- South Korea

- /

- Software

- /

- KOSDAQ:A100030

Investors Who Bought MobileleaderLtd (KOSDAQ:100030) Shares Three Years Ago Are Now Up 102%

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But when you pick a company that is really flourishing, you can make more than 100%. To wit, the Mobileleader Co.,Ltd. (KOSDAQ:100030) share price has flown 102% in the last three years. How nice for those who held the stock! On top of that, the share price is up 32% in about a quarter.

Check out our latest analysis for MobileleaderLtd

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the three years of share price growth, MobileleaderLtd actually saw its earnings per share (EPS) drop 45% per year. In this instance, recent extraordinary items impacted the earnings.

Thus, it seems unlikely that the market is focussed on EPS growth at the moment. Therefore, we think it's worth considering other metrics as well.

It could be that the revenue growth of 23% per year is viewed as evidence that MobileleaderLtd is growing. If the company is being managed for the long term good, today's shareholders might be right to hold on.

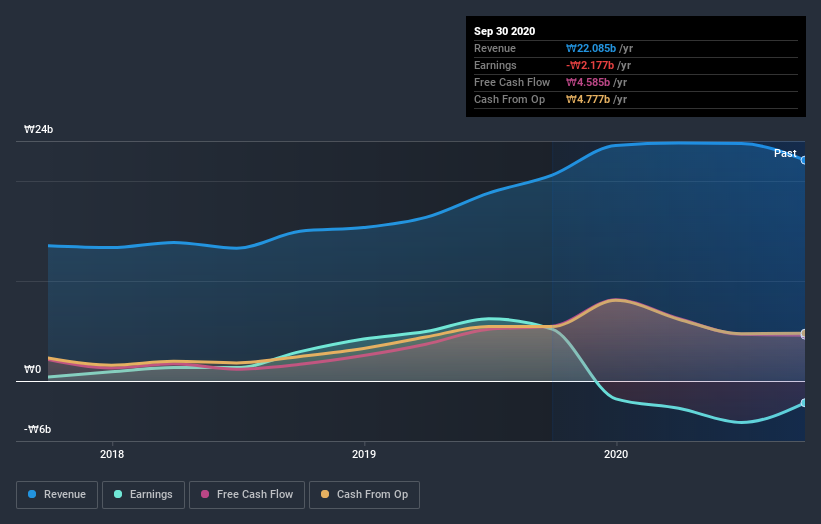

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on MobileleaderLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

MobileleaderLtd shareholders are up 47% for the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it's actually better than the average return of 14% over half a decade It is possible that returns will improve along with the business fundamentals. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 3 warning signs we've spotted with MobileleaderLtd (including 1 which is a bit concerning) .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading MobileleaderLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A100030

InzisoftLtd

Engages in the development and sale of software solutions for financial sector in South Korea.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026