- South Korea

- /

- Software

- /

- KOSDAQ:A057680

Investors Appear Satisfied With T Scientific Co.,Ltd.'s (KOSDAQ:057680) Prospects As Shares Rocket 36%

Despite an already strong run, T Scientific Co.,Ltd. (KOSDAQ:057680) shares have been powering on, with a gain of 36% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 26% over that time.

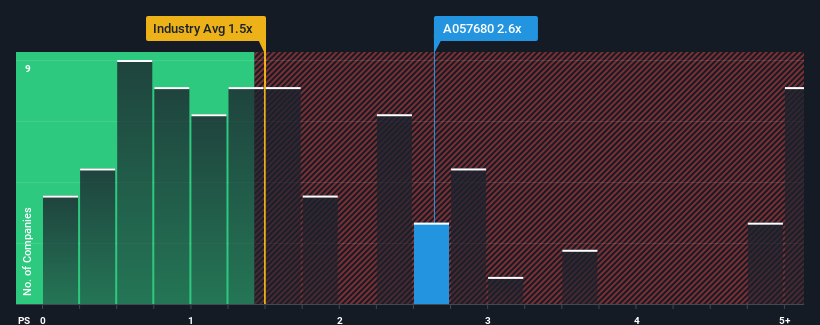

Since its price has surged higher, when almost half of the companies in Korea's Software industry have price-to-sales ratios (or "P/S") below 1.5x, you may consider T ScientificLtd as a stock probably not worth researching with its 2.6x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for T ScientificLtd

What Does T ScientificLtd's Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, T ScientificLtd has been doing very well. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on T ScientificLtd's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like T ScientificLtd's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 113% last year. Pleasingly, revenue has also lifted 273% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is only predicted to deliver 18% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in consideration, it's not hard to understand why T ScientificLtd's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

The large bounce in T ScientificLtd's shares has lifted the company's P/S handsomely. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that T ScientificLtd maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 4 warning signs for T ScientificLtd (2 are significant!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if T ScientificLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A057680

T ScientificLtd

Engages in the IT and mobile commerce businesses in South Korea.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026