- South Korea

- /

- Software

- /

- KOSDAQ:A051160

GaeaSoft (KOSDAQ:051160) shareholder returns have been favorable, earning 49% in 5 years

When we invest, we're generally looking for stocks that outperform the market average. And the truth is, you can make significant gains if you buy good quality businesses at the right price. To wit, the GaeaSoft share price has climbed 49% in five years, easily topping the market return of 13% (ignoring dividends).

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for GaeaSoft

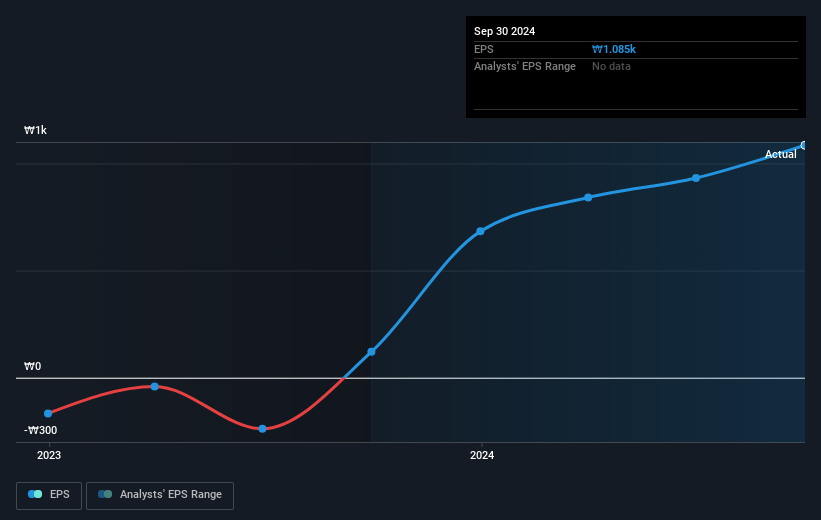

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last half decade, GaeaSoft became profitable. That's generally thought to be a genuine positive, so investors may expect to see an increasing share price.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

While it's never nice to take a loss, GaeaSoft shareholders can take comfort that their trailing twelve month loss of 2.3% wasn't as bad as the market loss of around 4.0%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 8% for each year. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. It's always interesting to track share price performance over the longer term. But to understand GaeaSoft better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for GaeaSoft you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A051160

GaeaSoft

Operates as an IT service and digital marketing company in South Korea.

Flawless balance sheet with solid track record.