- South Korea

- /

- Software

- /

- KOSDAQ:A049470

SGA Co's (KOSDAQ:049470) Solid Earnings Have Been Accounted For Conservatively

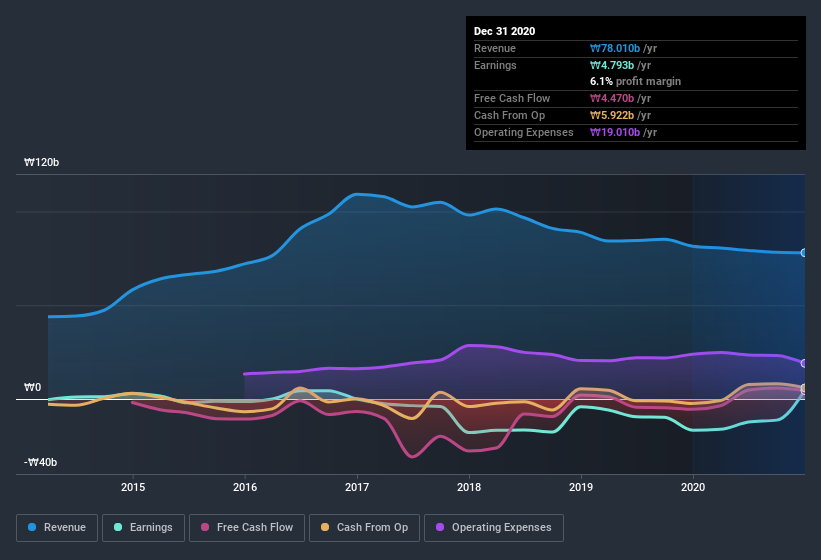

SGA Co,. Ltd's (KOSDAQ:049470) solid earnings announcement recently didn't do much to the stock price. We did some analysis to find out why and believe that investors might be missing some encouraging factors contained in the earnings.

View our latest analysis for SGA Co

The Impact Of Unusual Items On Profit

Importantly, our data indicates that SGA Co's profit was reduced by ₩4.5b, due to unusual items, over the last year. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. SGA Co took a rather significant hit from unusual items in the year to December 2020. As a result, we can surmise that the unusual items made its statutory profit significantly weaker than it would otherwise be.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of SGA Co.

An Unusual Tax Situation

Having already discussed the impact of the unusual items, we should also note that SGA Co received a tax benefit of ₩939m. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! Of course, prima facie it's great to receive a tax benefit. And since it previously lost money, it may well simply indicate the realisation of past tax losses. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal.

Our Take On SGA Co's Profit Performance

In its last report SGA Co received a tax benefit which might make its profit look better than it really is on a underlying level. But on the other hand, it also saw an unusual item depress its profit. Based on these factors, we think that SGA Co's profits are a reasonably conservative guide to its underlying profitability. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. To help with this, we've discovered 3 warning signs (1 is potentially serious!) that you ought to be aware of before buying any shares in SGA Co.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade SGA Co, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BITPLANETLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A049470

BITPLANETLtd

Operates as an IT, cryptocurrency, and blockchain company in South Korea.

Slight risk with weak fundamentals.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026