- South Korea

- /

- IT

- /

- KOSDAQ:A042500

Concerns Surrounding RingNet's (KOSDAQ:042500) Performance

Following the solid earnings report from RingNet Co., Ltd. (KOSDAQ:042500), the market responded by bidding up the stock price. However, we think that shareholders should be cautious as we found some worrying factors underlying the profit.

Check out our latest analysis for RingNet

A Closer Look At RingNet's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. This ratio tells us how much of a company's profit is not backed by free cashflow.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

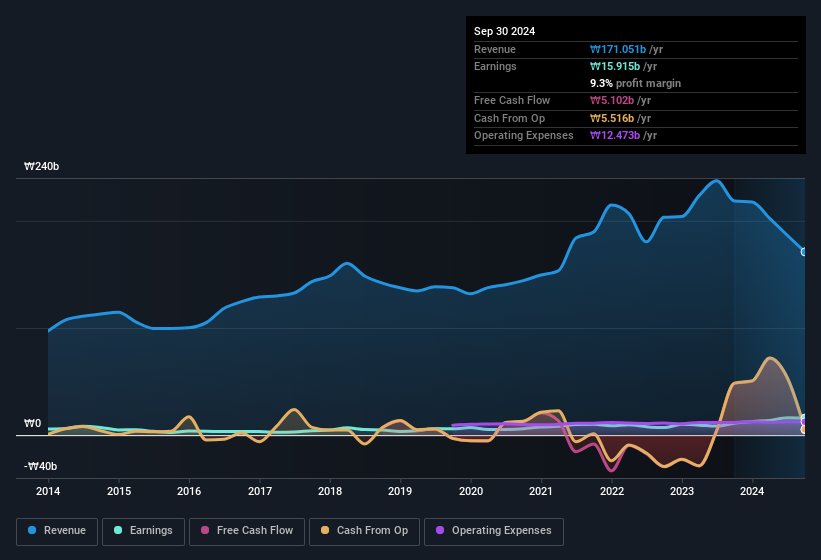

RingNet has an accrual ratio of 0.22 for the year to September 2024. Therefore, we know that it's free cashflow was significantly lower than its statutory profit, which is hardly a good thing. Indeed, in the last twelve months it reported free cash flow of ₩5.1b, which is significantly less than its profit of ₩15.9b. RingNet shareholders will no doubt be hoping that its free cash flow bounces back next year, since it was down over the last twelve months. One positive for RingNet shareholders is that it's accrual ratio was significantly better last year, providing reason to believe that it may return to stronger cash conversion in the future. As a result, some shareholders may be looking for stronger cash conversion in the current year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of RingNet.

Our Take On RingNet's Profit Performance

RingNet didn't convert much of its profit to free cash flow in the last year, which some investors may consider rather suboptimal. Therefore, it seems possible to us that RingNet's true underlying earnings power is actually less than its statutory profit. But at least holders can take some solace from the 49% per annum growth in EPS for the last three. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. If you want to do dive deeper into RingNet, you'd also look into what risks it is currently facing. When we did our research, we found 2 warning signs for RingNet (1 is concerning!) that we believe deserve your full attention.

This note has only looked at a single factor that sheds light on the nature of RingNet's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A042500

RingNet

Engages in the implementation of information and communication technology (ICT) services and solutions in South Korea.

Adequate balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Hims & Hers Health - Valuation

Tesla will achieve a 392% PE ratio increase according to recent forecasts

Lynas Rare Earths: Owning the Policy-Backed Growth Regime, Not Just the Ore Body.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026