- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A089980

High Growth Tech Stocks To Watch In South Korea This September 2024

Reviewed by Simply Wall St

The South Korean market is up 2.5% in the last 7 days, with all sectors gaining ground, although performance was flat over the past year. With earnings forecast to grow by 29% annually, identifying high-growth tech stocks can be key to capitalizing on this upward trend.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Revu | 20.22% | 39.40% | ★★★★★★ |

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| Park Systems | 23.64% | 35.66% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

Click here to see the full list of 43 stocks from our KRX High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

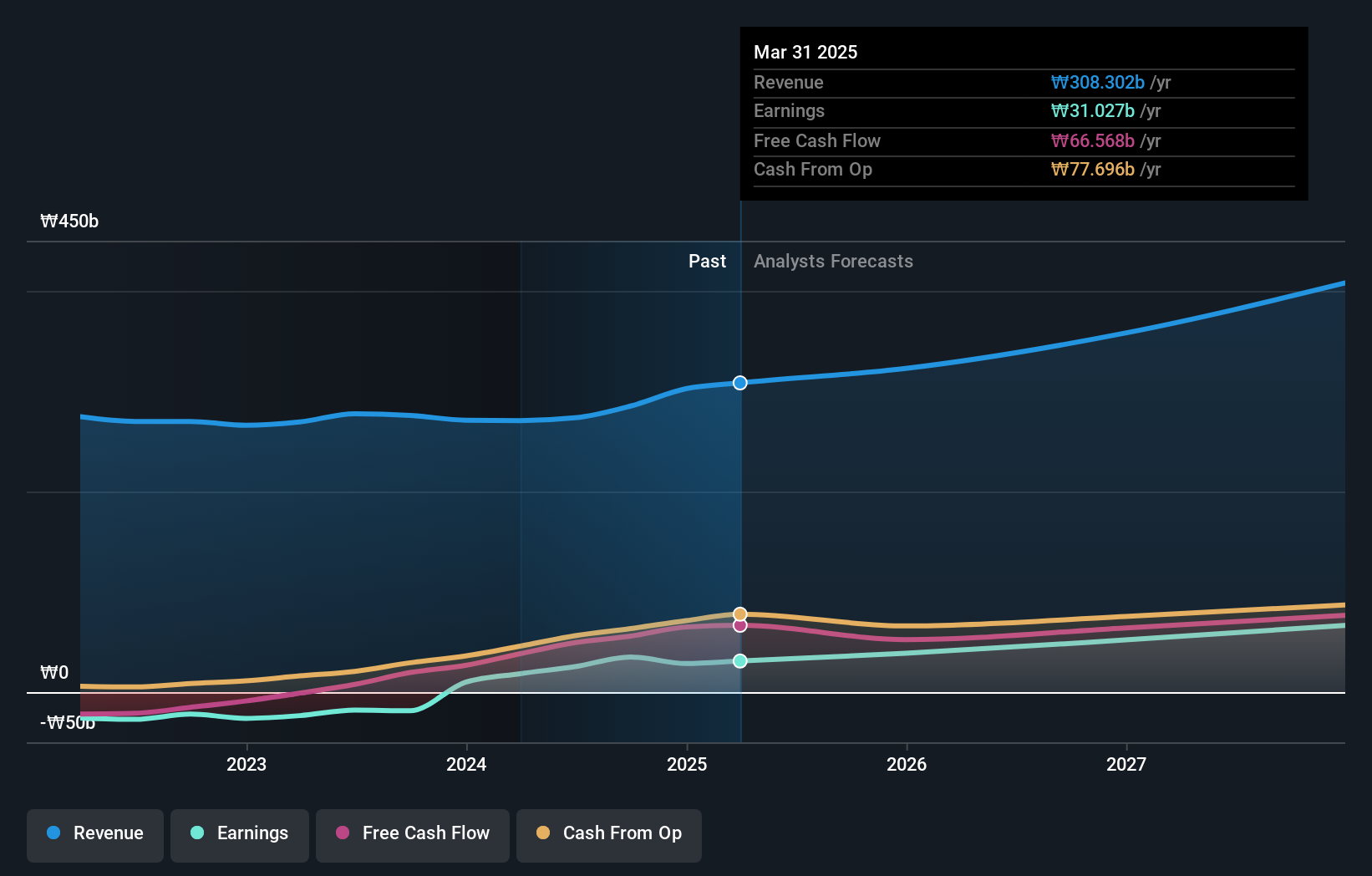

Cafe24 (KOSDAQ:A042000)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cafe24 Corp. operates an e-commerce platform worldwide with a market cap of ₩727.76 billion.

Operations: Cafe24 Corp. generates revenue primarily through its Internet Business Solution segment, which accounts for ₩230.51 billion, followed by Transit at ₩42.97 billion and Clothing at ₩21.03 billion. The company also has consolidated adjustments amounting to -₩12.59 billion.

Cafe24, a notable player in South Korea's tech sector, has seen its earnings grow by 42.47% annually, outpacing the IT industry's 1.2% growth rate. The company forecasts revenue growth of 11.1% per year, surpassing the KR market's average of 10.1%. With significant R&D investments amounting to ₩13.1B last year, Cafe24 is focusing on innovative e-commerce solutions that cater to a diverse clientele including SMEs and large enterprises alike.

- Click here to discover the nuances of Cafe24 with our detailed analytical health report.

Gain insights into Cafe24's past trends and performance with our Past report.

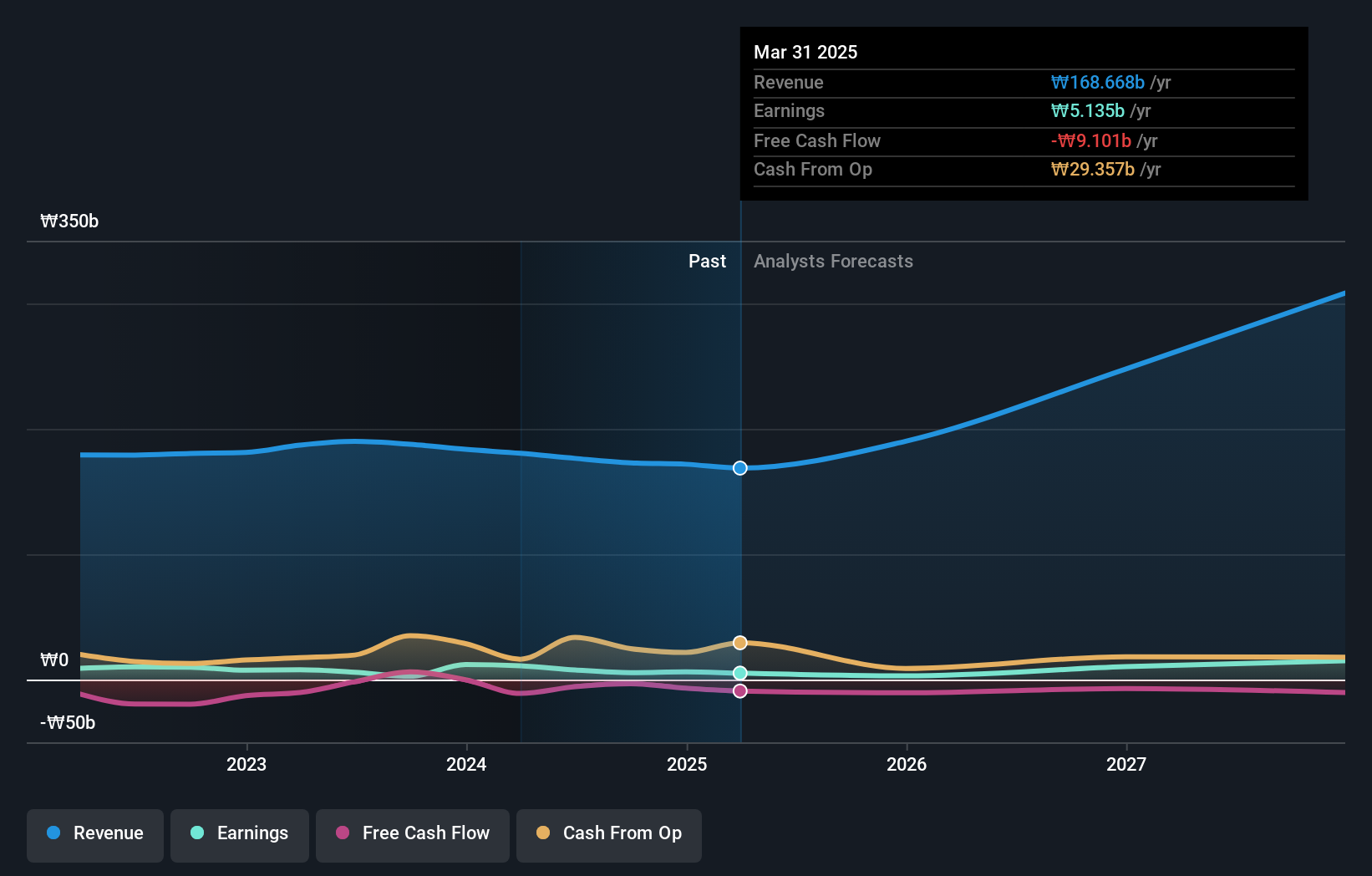

Sang-A FrontecLtd (KOSDAQ:A089980)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sang-A Frontec Co.,Ltd. engages in the research and development, production, and sale of materials/parts based on engineering plastics in South Korea and internationally, with a market cap of ₩349.23 billion.

Operations: Sang-A Frontec Co.,Ltd. generates revenue primarily from its Plastics & Rubber segment, amounting to ₩176.42 billion. The company focuses on engineering plastics for various applications both domestically and internationally.

Sang-A FrontecLtd has demonstrated robust growth, with earnings increasing by 30.3% over the past year, outpacing the electronic industry’s -13.4% decline. The company's revenue is projected to grow at an impressive rate of 20.3% per year, significantly higher than the Korean market's average of 10.1%. Furthermore, Sang-A FrontecLtd is expected to see its earnings surge by 39.4% annually over the next three years, driven by substantial R&D investments and innovative product developments in their core segments.

- Get an in-depth perspective on Sang-A FrontecLtd's performance by reading our health report here.

Evaluate Sang-A FrontecLtd's historical performance by accessing our past performance report.

Seojin SystemLtd (KOSDAQ:A178320)

Simply Wall St Growth Rating: ★★★★★★

Overview: Seojin System Co., Ltd. specializes in providing telecom equipment, repeaters, mechanical products, and LED and other equipment, with a market cap of ₩1.42 trillion.

Operations: The company generates revenue primarily from its EMS Division, contributing ₩1.52 billion, and the Semiconductor segment, adding ₩169.98 million. The telecom equipment and mechanical products segments are also significant contributors to its overall business operations.

Seojin SystemLtd is projected to see revenue growth of 33.6% annually, significantly outpacing the Korean market's average of 10.1%. Their earnings are expected to grow at an impressive rate of 52.1% per year over the next three years, driven by substantial R&D investments and innovative product developments in their core segments. Recent private placements raised KRW 100 billion, indicating strong investor confidence and providing capital for future expansion and technological advancements.

- Take a closer look at Seojin SystemLtd's potential here in our health report.

Understand Seojin SystemLtd's track record by examining our Past report.

Next Steps

- Investigate our full lineup of 43 KRX High Growth Tech and AI Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A089980

Sang-A FrontecLtd

Engages in the research and development, production, and sale of materials/parts based on engineering plastics in South Korea and internationally.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives