- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3533

High Growth Tech Stocks in Asia with Promising Potential

Reviewed by Simply Wall St

As global markets experience fluctuations, with notable movements in interest rates and concerns about technology stock valuations impacting indices like the Nasdaq Composite, investors are closely watching the Asian tech sector for high-growth opportunities. In this environment, a good stock often exhibits strong fundamentals and adaptability to evolving market conditions, particularly as technological advancements continue to reshape industries across Asia.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 36.73% | 38.14% | ★★★★★★ |

| Fositek | 37.83% | 51.54% | ★★★★★★ |

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.48% | 32.83% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Zhongji Innolight | 35.08% | 35.94% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Knowmerce | 42.51% | 33.23% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Cafe24 (KOSDAQ:A042000)

Simply Wall St Growth Rating: ★★★★☆☆

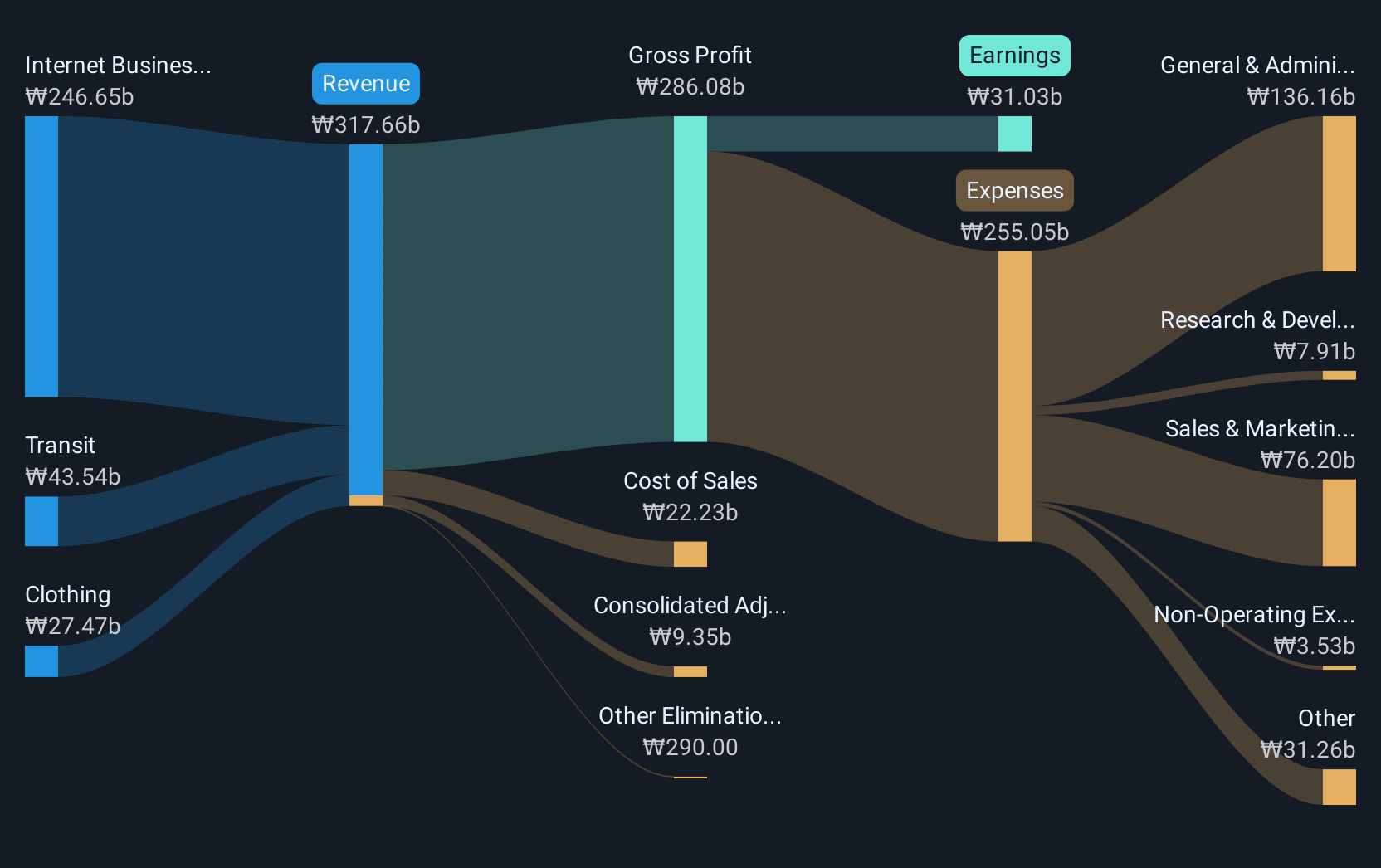

Overview: Cafe24 Corp. operates a global e-commerce platform and has a market capitalization of approximately ₩749.52 billion.

Operations: Cafe24 Corp. generates revenue primarily from its Internet Business Solution segment, which contributes ₩252.57 billion, followed by Transit and Clothes segments at ₩40.35 billion and ₩30.70 billion respectively.

Cafe24, a player in the bustling tech scene of Asia, is navigating an interesting trajectory with its earnings forecast to surge by 30.8% annually, outpacing the Korean market's growth of 30.4%. Despite this robust earnings outlook, its revenue growth at 11.2% annually slightly lags behind the high-growth benchmark of 20%, yet it still surpasses Korea's market average of 10.6%. The firm recently announced expectations to unveil its Q3 results on November 7, highlighting a period marked by strategic maneuvers aimed at bolstering their market stance amidst competitive pressures and evolving industry dynamics. This blend of financial vigor and strategic positioning underscores Cafe24’s potential to adapt and thrive in the dynamic tech landscape.

- Click to explore a detailed breakdown of our findings in Cafe24's health report.

Evaluate Cafe24's historical performance by accessing our past performance report.

Linklogis (SEHK:9959)

Simply Wall St Growth Rating: ★★★★☆☆

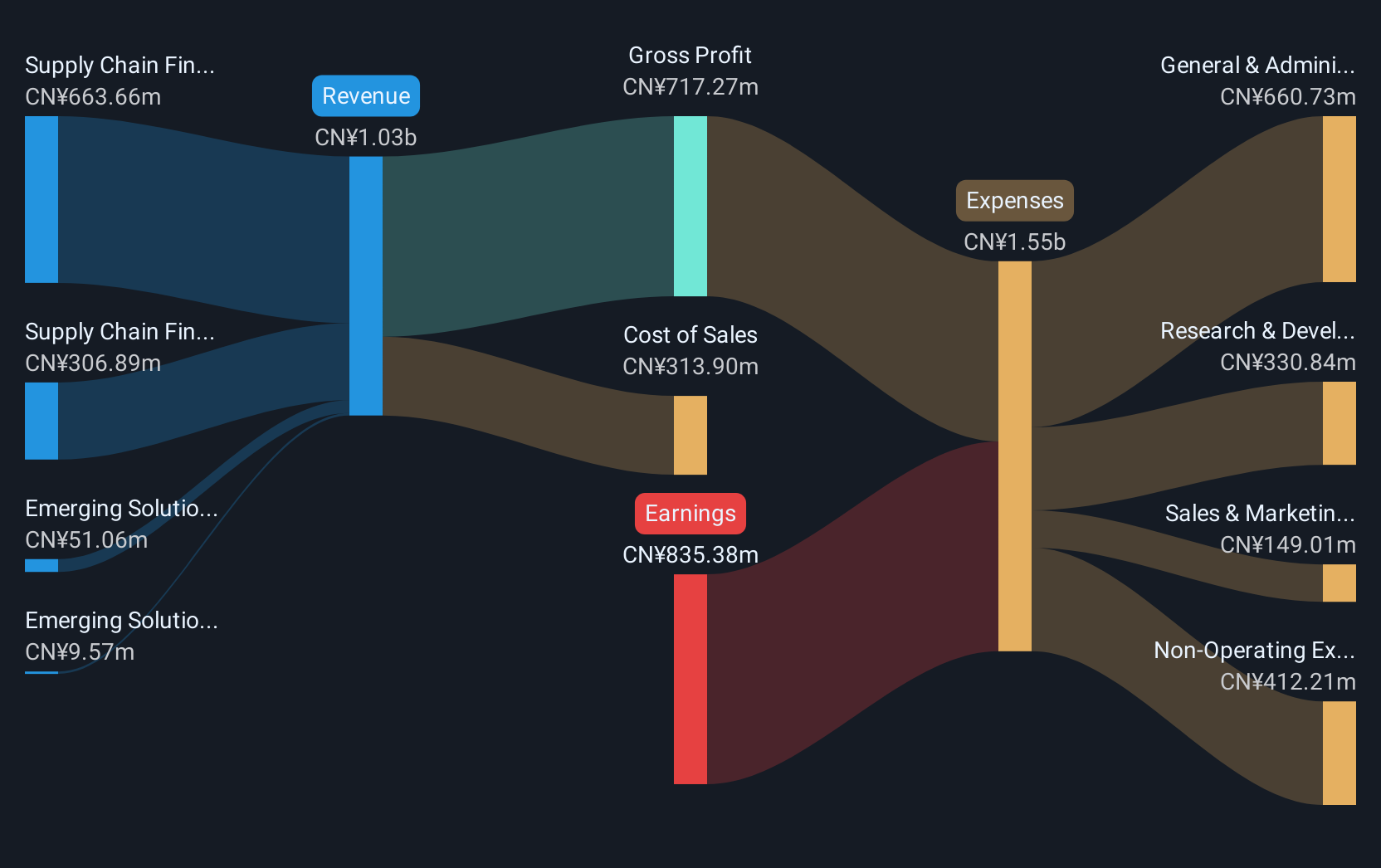

Overview: Linklogis Inc. is an investment holding company that offers supply chain finance technology and data-driven emerging solutions both in the People’s Republic of China and internationally, with a market capitalization of HK$4.26 billion.

Operations: Linklogis generates revenue primarily from its Supply Chain Finance Technology Solutions, with Anchor Cloud contributing CN¥614.55 million and FI Cloud adding CN¥318.76 million. Emerging Solutions through Cross-Border Cloud account for CN¥55.48 million in revenue.

Linklogis stands out in the Asian tech landscape, not just for its robust annual revenue growth at 15.3%, but also for its remarkable forecasted earnings increase of 124.4% per year. This growth trajectory is complemented by a strategic focus on R&D, with significant investments amounting to $200 million last year alone, representing about 15% of their total revenue. These financial commitments to innovation are critical as they navigate the competitive and fast-evolving fintech sector in Asia, where technological advancements rapidly transform market dynamics. Moreover, becoming profitable within the next three years sets Linklogis apart in a region where many tech firms struggle to hit profitability milestones quickly.

- Click here and access our complete health analysis report to understand the dynamics of Linklogis.

Gain insights into Linklogis' past trends and performance with our Past report.

Lotes (TWSE:3533)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lotes Co., Ltd. is engaged in the design, manufacturing, and sale of electronic interconnect and hardware components across Taiwan, Mainland China, and international markets, with a market cap of NT$147.19 billion.

Operations: Lotes generates revenue primarily from its electronic components and parts segment, amounting to NT$32.82 billion. The company operates in Taiwan, Mainland China, and international markets.

Lotes Co. has demonstrated a robust performance with its third-quarter sales rising to TWD 8,421.59 million from TWD 8,066.74 million year-over-year, and net income increasing to TWD 2,318.22 million from TWD 2,061.6 million in the same period. This growth is underpinned by an impressive annual earnings growth forecast of 21.3%, outpacing the Taiwan market's expectation of 20.3%. Additionally, Lotes' strategic emphasis on R&D is evident as it continues to innovate within the competitive electronics sector in Asia, aiming for a high Return on Equity of 25.3% in three years' time which could potentially reshape its market standing and fuel future expansions.

- Take a closer look at Lotes' potential here in our health report.

Assess Lotes' past performance with our detailed historical performance reports.

Key Takeaways

- Click through to start exploring the rest of the 187 Asian High Growth Tech and AI Stocks now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3533

Lotes

Designs, manufactures, and sells electronic interconnect and hardware components in Taiwan, Mainland China, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)