- South Korea

- /

- Semiconductors

- /

- KOSE:A322000

HD Hyundai Energy Solutions Co.,Ltd. (KRX:322000) Stock Catapults 30% Though Its Price And Business Still Lag The Industry

The HD Hyundai Energy Solutions Co.,Ltd. (KRX:322000) share price has done very well over the last month, posting an excellent gain of 30%. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 21% over that time.

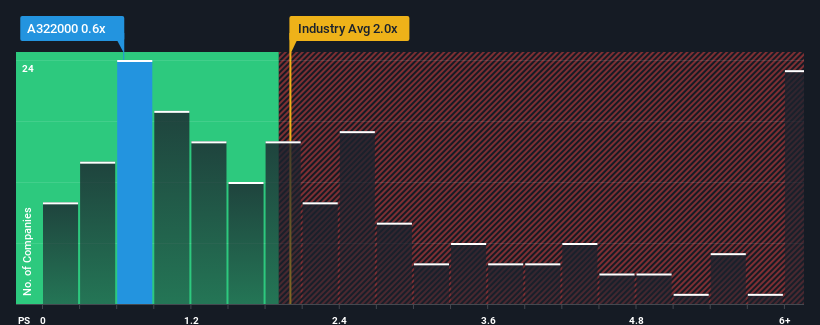

Even after such a large jump in price, HD Hyundai Energy SolutionsLtd's price-to-sales (or "P/S") ratio of 0.6x might still make it look like a buy right now compared to the Semiconductor industry in Korea, where around half of the companies have P/S ratios above 2x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for HD Hyundai Energy SolutionsLtd

How HD Hyundai Energy SolutionsLtd Has Been Performing

Recent times haven't been great for HD Hyundai Energy SolutionsLtd as its revenue has been falling quicker than most other companies. The P/S ratio is probably low because investors think this poor revenue performance isn't going to improve at all. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on HD Hyundai Energy SolutionsLtd.How Is HD Hyundai Energy SolutionsLtd's Revenue Growth Trending?

In order to justify its P/S ratio, HD Hyundai Energy SolutionsLtd would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 45%. Still, the latest three year period has seen an excellent 38% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 17% per year as estimated by the lone analyst watching the company. With the industry predicted to deliver 41% growth per annum, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why HD Hyundai Energy SolutionsLtd's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

HD Hyundai Energy SolutionsLtd's stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that HD Hyundai Energy SolutionsLtd maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for HD Hyundai Energy SolutionsLtd that you should be aware of.

If you're unsure about the strength of HD Hyundai Energy SolutionsLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if HD Hyundai Energy SolutionsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A322000

Undervalued with excellent balance sheet.

Market Insights

Community Narratives