3 Growth Companies Insiders Own With Up To 30% Earnings Growth

Reviewed by Simply Wall St

In a week marked by cautious commentary from the Federal Reserve and political uncertainty surrounding a potential government shutdown, global markets experienced notable volatility. Despite these challenges, robust economic data such as stronger-than-expected GDP growth and retail sales figures provided some optimism amidst the turmoil. In this environment, identifying growth companies with high insider ownership can be particularly appealing, as insiders' confidence in their own companies often signals strong potential for earnings growth even amid broader market fluctuations.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 23.9% | 37.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Underneath we present a selection of stocks filtered out by our screen.

Genomma Lab Internacional. de (BMV:LAB B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genomma Lab Internacional, S.A.B. de C.V. is a company that, along with its subsidiaries, offers pharmaceutical and personal care products mainly in Latin America and has a market cap of MX$24.14 billion.

Operations: The company generates revenue of MX$17.47 billion from its pharmaceutical and personal care products segment.

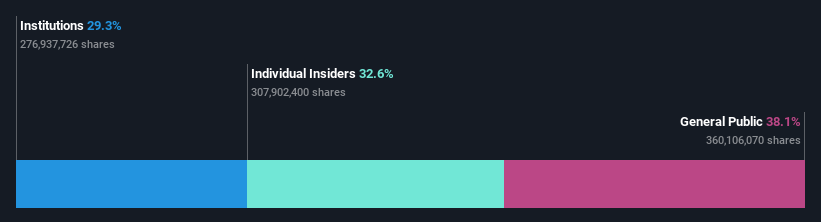

Insider Ownership: 32.6%

Earnings Growth Forecast: 19.4% p.a.

Genomma Lab Internacional has demonstrated strong growth, with earnings increasing by 15.1% over the past year and a forecasted annual profit growth of 19.4%, outpacing the MX market's 12.6%. Despite its high debt level, it trades at a discount to its estimated fair value and boasts a high return on equity forecast of 22.2% in three years. Recent third-quarter results showed significant sales and net income increases, supported by GMP certification for manufacturing compliance.

- Click to explore a detailed breakdown of our findings in Genomma Lab Internacional. de's earnings growth report.

- The valuation report we've compiled suggests that Genomma Lab Internacional. de's current price could be quite moderate.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA offers industrial intelligence solutions for the fashion, automotive, and furniture markets across Northern Europe, Southern Europe, the Americas, and the Asia Pacific with a market cap of €985.97 million.

Operations: The company's revenue segments include €172.19 million from the Americas and €124.33 million from the Asia-Pacific region.

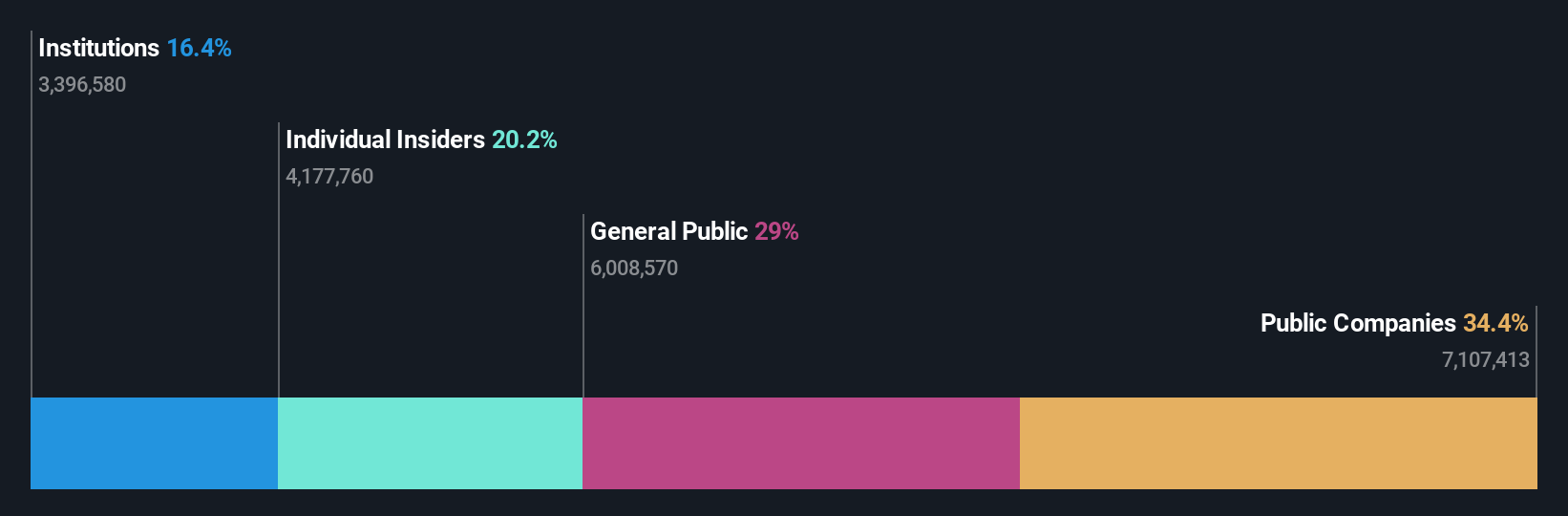

Insider Ownership: 19.6%

Earnings Growth Forecast: 25.6% p.a.

Lectra shows promising growth potential, with earnings forecasted to grow significantly at 25.6% annually, outpacing the French market's 12.3%. Despite a slight decline in net income for the first nine months of 2024, sales increased to €394.22 million from €358.26 million year-on-year. The stock trades below its estimated fair value and analysts anticipate a price rise of 26.1%. However, return on equity is expected to remain low at 12.1% in three years.

- Click here and access our complete growth analysis report to understand the dynamics of Lectra.

- The analysis detailed in our Lectra valuation report hints at an deflated share price compared to its estimated value.

KCTech (KOSE:A281820)

Simply Wall St Growth Rating: ★★★★★☆

Overview: KCTech Co., Ltd. operates in South Korea, focusing on the manufacture and distribution of semiconductor systems, display systems, and electronic materials, with a market cap of approximately ₩536.14 billion.

Operations: The company's revenue is derived from the manufacture and distribution of semiconductor systems, display systems, and electronic materials.

Insider Ownership: 20%

Earnings Growth Forecast: 31% p.a.

KCTech's earnings are projected to grow significantly at 31% annually, surpassing the KR market's 29%. Revenue is also expected to rise by 20.9% per year, outpacing the market's 8.8%. The stock trades slightly below its fair value and analysts predict an 82.8% price increase. Despite these positives, return on equity is forecasted to be low at 12.3%. Recent buyback efforts have seen no shares repurchased as of late December.

- Navigate through the intricacies of KCTech with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that KCTech is priced lower than what may be justified by its financials.

Seize The Opportunity

- Click through to start exploring the rest of the 1509 Fast Growing Companies With High Insider Ownership now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:LSS

Lectra

Provides industrial intelligence solutions for fashion, automotive, and furniture markets in Northern Europe, Southern Europe, the Americas, and the Asia Pacific.

Good value with reasonable growth potential.