- South Korea

- /

- Semiconductors

- /

- KOSE:A003160

D.I Corporation (KRX:003160) Stock Rockets 26% But Many Are Still Ignoring The Company

D.I Corporation (KRX:003160) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Looking further back, the 13% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

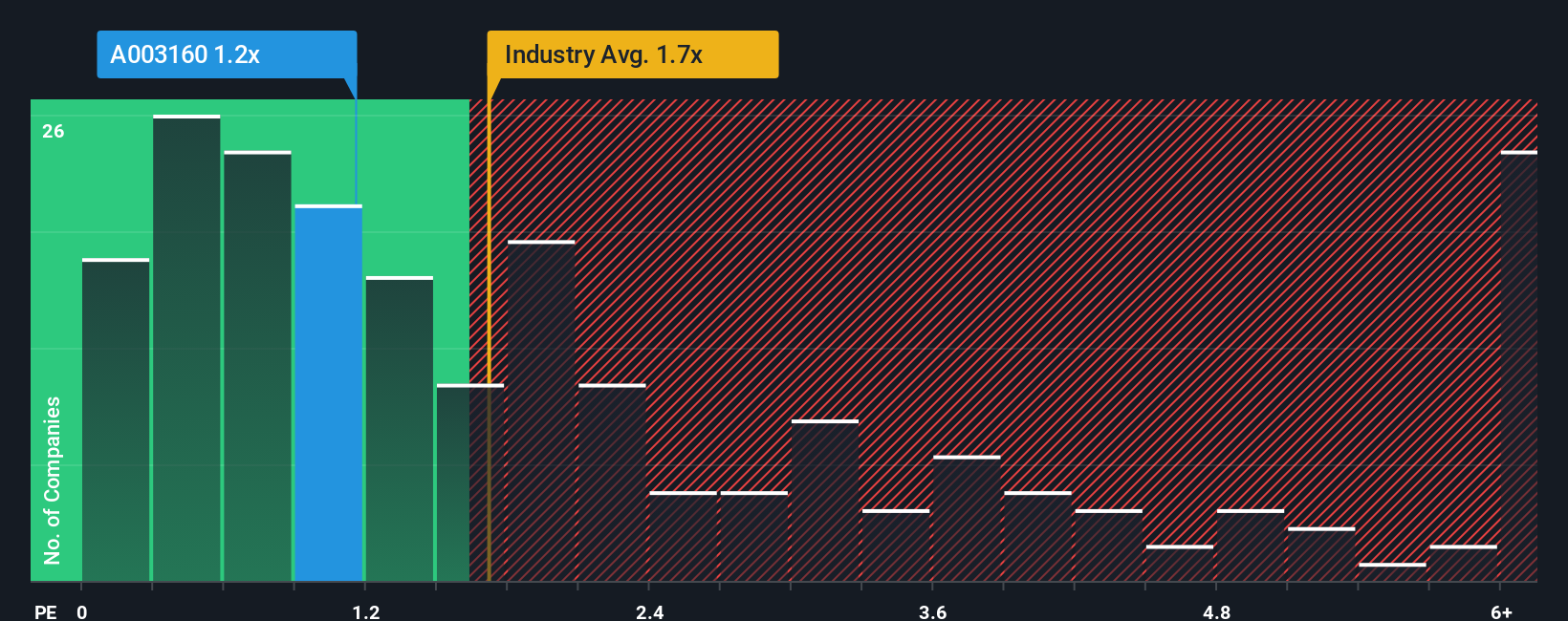

Even after such a large jump in price, D.I may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.2x, since almost half of all companies in the Semiconductor industry in Korea have P/S ratios greater than 1.7x and even P/S higher than 4x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for D.I

How Has D.I Performed Recently?

D.I certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on D.I.How Is D.I's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as D.I's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 89%. Pleasingly, revenue has also lifted 73% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 33% during the coming year according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 27%, which is noticeably less attractive.

With this in consideration, we find it intriguing that D.I's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does D.I's P/S Mean For Investors?

D.I's stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

D.I's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for D.I with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of D.I's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A003160

D.I

Manufactures and supplies semiconductor inspection equipment in South Korea and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026