- South Korea

- /

- Semiconductors

- /

- KOSE:A000660

Can SK hynix’s 232% Rally Continue or Is the Stock Priced for Perfection in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if SK hynix might still be a smart buy after its incredible run, or if you are jumping in at the peak? Let’s break down what is driving the buzz and where the company’s value really stands today.

- SK hynix’s stock has captured investor attention with a 232.9% gain year-to-date, and it is up 237.4% over the past year, though it did dip 7.9% in the last week.

- Much of this momentum comes on the heels of a surge in global demand for memory chips, as excitement about artificial intelligence and data center growth continues to propel semiconductor stocks. Headlines have also focused on SK hynix investing aggressively in next-generation technologies, fueling optimism that recent gains might have staying power and also hinting at volatility ahead.

- When it comes to value, SK hynix scores a strong 5 out of 6 on our under-valuation checks. Next, we will walk through how this score reflects different valuation approaches, and we will wrap up with an even more insightful way to judge the company's fair price, so stick with us.

Approach 1: SK hynix Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to today’s value. This helps investors gauge what the business is truly worth based on how much cash it is expected to generate.

For SK hynix, the latest reported Free Cash Flow (FCF) stands at ₩21.0 billion. Looking ahead, analysts project aggressive growth with FCF predicted to rise to ₩45.2 billion by 2027. After that point, future cash flow projections as estimated by Simply Wall St beyond analyst coverage continue to climb, reaching ₩84.6 billion in 2035. All of these values are naturally expressed in Korean won (₩).

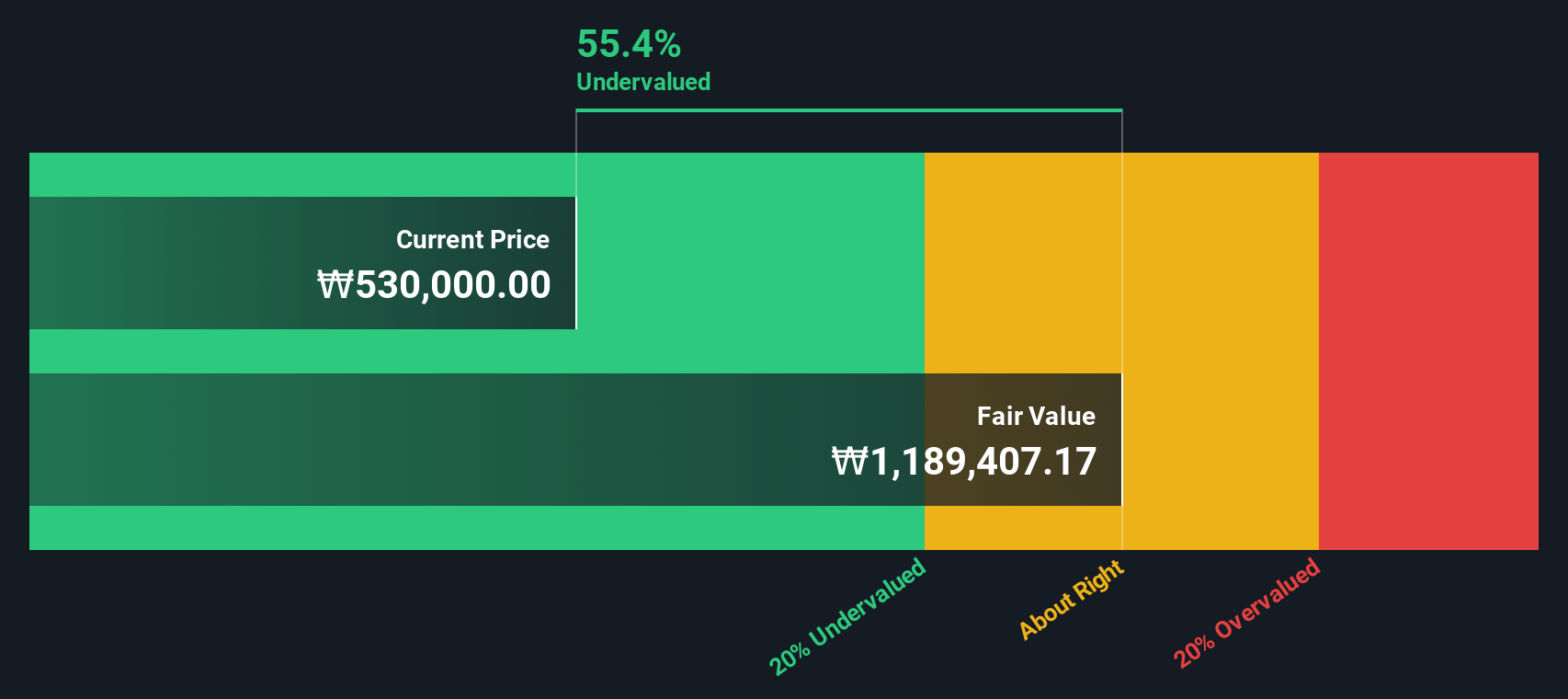

Based on this two-stage FCF approach, the intrinsic value of SK hynix is estimated at ₩1,068,239 per share. With the DCF model indicating that SK hynix’s stock is trading at a 46.6% discount to this calculated intrinsic value, the shares currently appear significantly undervalued relative to what the future cash flows suggest.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests SK hynix is undervalued by 46.6%. Track this in your watchlist or portfolio, or discover 894 more undervalued stocks based on cash flows.

Approach 2: SK hynix Price vs Earnings

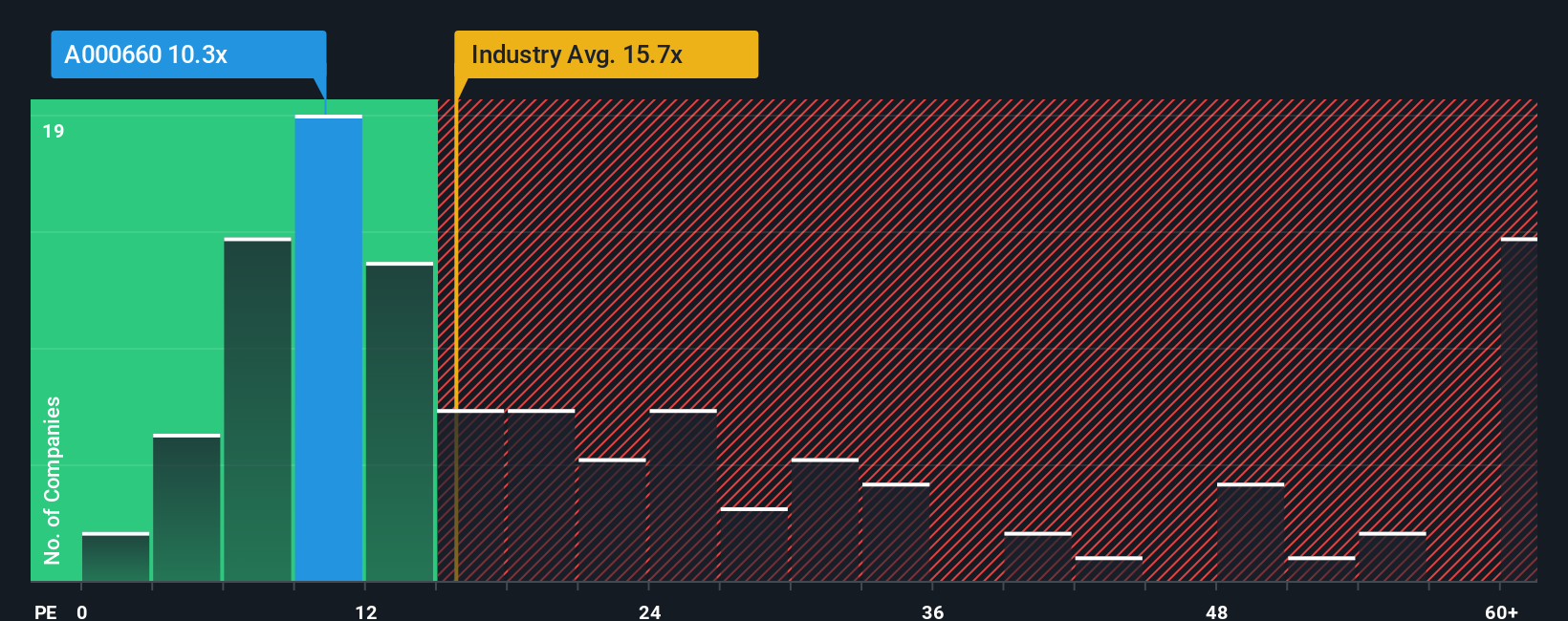

For profitable companies like SK hynix, the Price-to-Earnings (PE) ratio is a widely trusted valuation metric. That is because it compares the company’s current share price to its per-share earnings, offering a straightforward way to gauge whether the stock is expensive or cheap relative to how much profit the business is actually generating.

Growth expectations and company-specific risks play a pivotal role in determining what a “normal” or “fair” PE ratio should be. Companies with strong anticipated growth or lower risk can command higher PE ratios, while those with uncertain outlooks generally trade lower.

Currently, SK hynix trades at a PE ratio of 11.0x. For context, the average PE ratio across the semiconductor industry is 19.8x, and the typical peer commands an even higher multiple of 31.6x. This paints SK hynix as notably cheaper than much of its sector, at least at face value.

However, Simply Wall St’s “Fair Ratio” goes a step further. This proprietary metric calculates what SK hynix’s PE ratio should be, taking into account not just industry trends or competitor averages, but also the company’s earnings growth, margins, market cap, and risk factors. This gives a fuller and more accurate picture of fair value compared to simple industry or peer benchmarking.

Simply Wall St’s calculated fair PE ratio for SK hynix is 38.9x, more than three times its current multiple. This suggests that the market is significantly undervaluing SK hynix based on its underlying fundamentals and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1417 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SK hynix Narrative

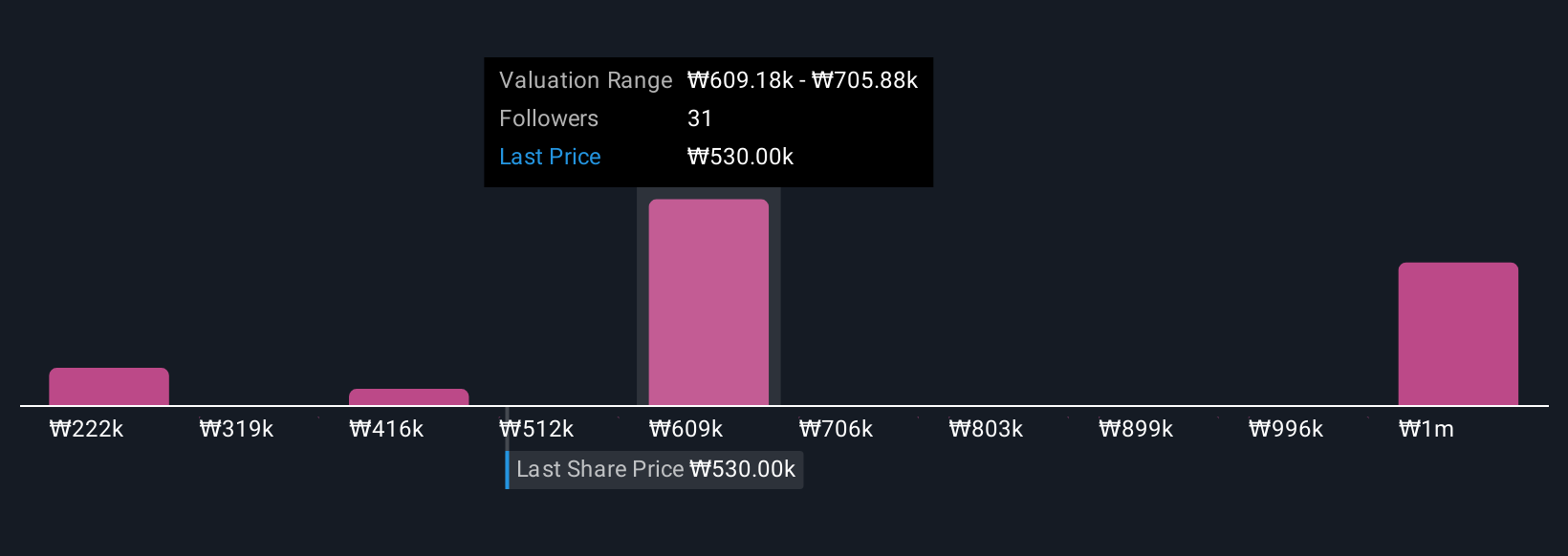

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a tool that moves beyond the numbers by connecting your view of a company's story to a real financial forecast and then to a fair value.

A Narrative is simply your perspective about where a company like SK hynix is headed and why, paired with your own assumptions about future revenue, profits, and margins. It transforms typical data and ratios into a dynamic, story-driven valuation.

This approach makes investing more accessible, because Narratives are available to everyone on Simply Wall St's Community page, and millions already use them to track their evolving views alongside the numbers.

With Narratives, you can instantly see how your story and fair value estimate compare to the current SK hynix price and to other investors' views. This helps you decide if now is a buying opportunity or a time to wait.

Narratives continuously update when new events such as earnings releases or major news happen, so your valuation outlook stays current and relevant.

For example, one investor might believe SK hynix's breakthroughs in next-gen memory for artificial intelligence will drive earnings toward ₩52,777.0 billion and set a fair value near ₩400,000 per share. A more cautious investor, worried about competition and geopolitical risks, might estimate future earnings at ₩22,912.0 billion and a fair value of ₩255,245. This allows you to see both optimism and caution reflected in real time.

Do you think there's more to the story for SK hynix? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000660

SK hynix

Manufactures, distributes, and sells semiconductor products in Korea, China, rest of Asia, the United States, and Europe.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.