- Japan

- /

- Semiconductors

- /

- TSE:8035

3 Stocks Estimated To Be Trading At Discounts Up To 33.7%

Reviewed by Simply Wall St

As global markets experience broad-based gains, with U.S. indexes approaching record highs and positive sentiment buoyed by strong labor market reports, investors are keenly observing opportunities to capitalize on undervalued stocks. In this environment of cautious optimism amid geopolitical tensions and economic uncertainties, identifying stocks trading at significant discounts can offer potential value for those looking to strengthen their portfolios.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gaming Realms (AIM:GMR) | £0.3665 | £0.73 | 49.6% |

| BMC Medical (SZSE:301367) | CN¥68.90 | CN¥137.12 | 49.8% |

| Tongqinglou Catering (SHSE:605108) | CN¥21.87 | CN¥43.43 | 49.6% |

| Winking Studios (Catalist:WKS) | SGD0.27 | SGD0.54 | 49.6% |

| EnomotoLtd (TSE:6928) | ¥1479.00 | ¥2934.35 | 49.6% |

| Equity Bancshares (NYSE:EQBK) | US$49.21 | US$98.42 | 50% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.94 | THB9.86 | 49.9% |

| Atlas Arteria (ASX:ALX) | A$4.88 | A$9.67 | 49.5% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €7.88 | €15.63 | 49.6% |

| Chengdu Olymvax Biopharmaceuticals (SHSE:688319) | CN¥10.91 | CN¥21.64 | 49.6% |

Underneath we present a selection of stocks filtered out by our screen.

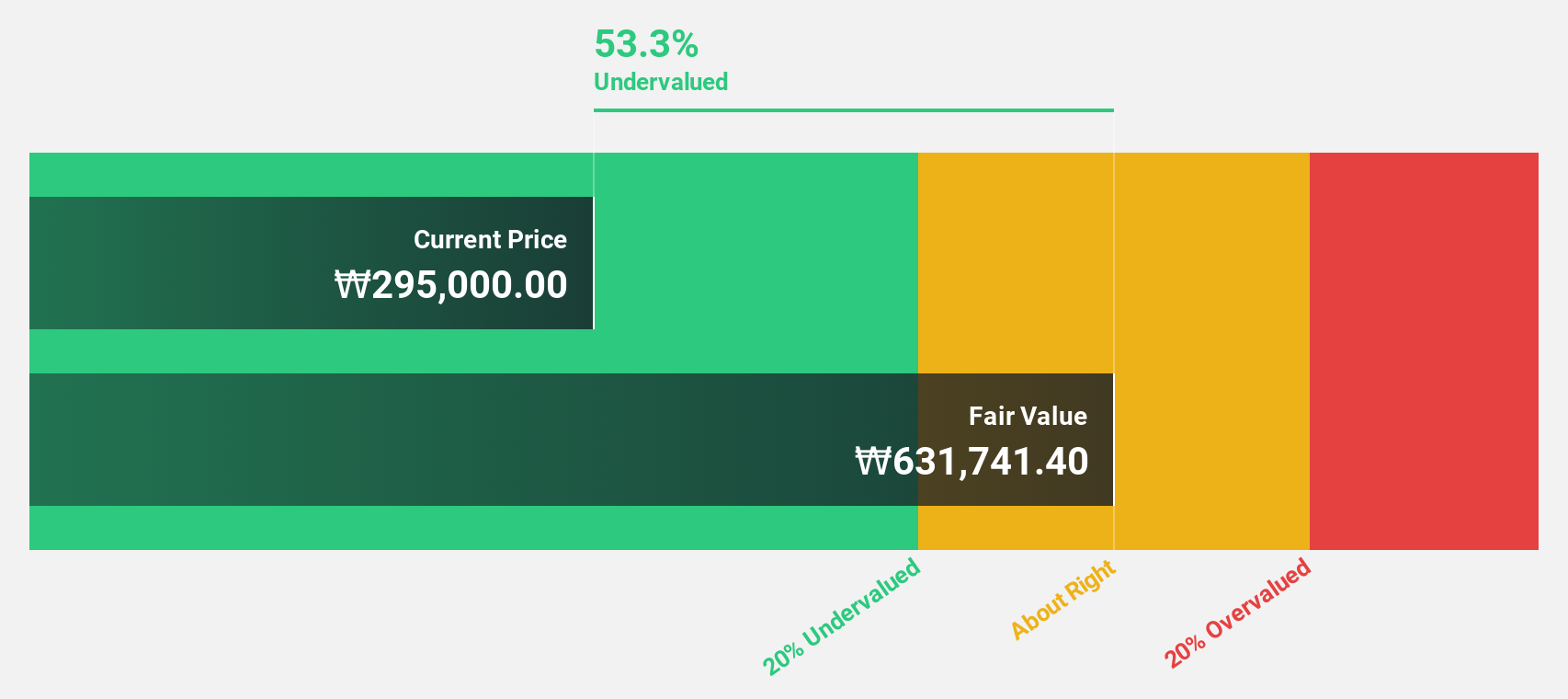

SK hynix (KOSE:A000660)

Overview: SK hynix Inc., along with its subsidiaries, is involved in the manufacturing, distribution, and sale of semiconductor products across Korea, China, the rest of Asia, the United States, and Europe with a market cap of ₩121.80 trillion.

Operations: Revenue Segments (in millions of ₩): Semiconductor products: ₩35,200,000; Memory solutions: ₩18,500,000; System ICs: ₩7,400,000. SK hynix generates revenue primarily from semiconductor products (₩35.20 billion), memory solutions (₩18.50 billion), and system ICs (₩7.40 billion).

Estimated Discount To Fair Value: 15.4%

SK hynix is trading 15.4% below its estimated fair value of ₩209,335.71, suggesting it may be undervalued based on cash flows. The company recently reported a significant turnaround in earnings with a net income of ₩5.75 trillion for Q3 2024, compared to a loss the previous year. With advancements in NAND technology and strategic alliances for AI applications, SK hynix shows potential for enhanced revenue growth above market expectations at 20% annually.

- According our earnings growth report, there's an indication that SK hynix might be ready to expand.

- Take a closer look at SK hynix's balance sheet health here in our report.

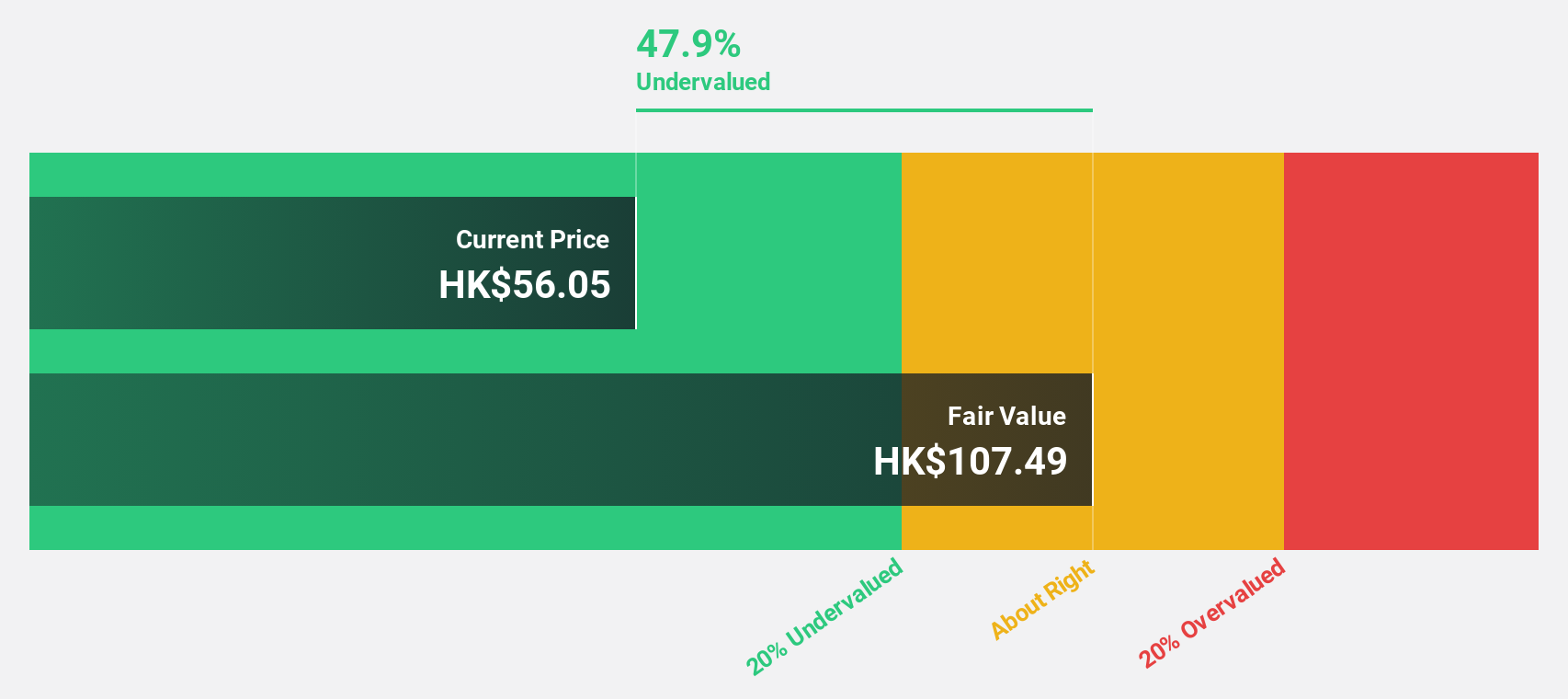

Shenzhou International Group Holdings (SEHK:2313)

Overview: Shenzhou International Group Holdings Limited is an investment holding company involved in the manufacture, printing, and sale of knitwear products across Mainland China, the European Union, the United States, Japan, and other international markets with a market cap of HK$92.60 billion.

Operations: The company's revenue from the manufacture and sale of knitwear products amounts to CN¥26.38 billion.

Estimated Discount To Fair Value: 33.7%

Shenzhou International Group Holdings is trading 33.7% below its estimated fair value of HK$92.95, highlighting potential undervaluation based on cash flows. The company reported a net income increase to CNY 2,931.03 million for H1 2024, with revenue growth outpacing the Hong Kong market at 10.6% annually. Despite an unstable dividend track record, earnings are forecast to grow at 12.8% per year, surpassing market expectations and supporting a positive outlook for profitability expansion.

- The analysis detailed in our Shenzhou International Group Holdings growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Shenzhou International Group Holdings.

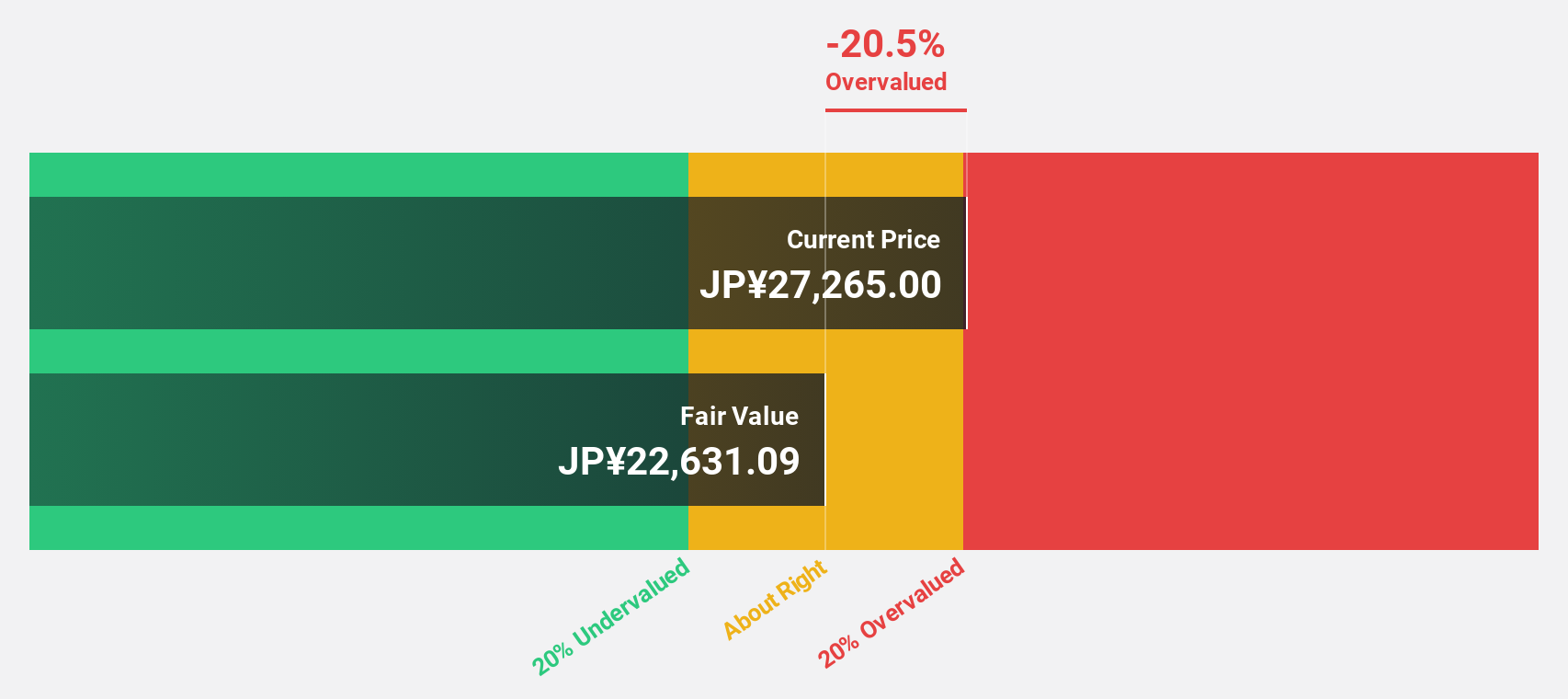

Tokyo Electron (TSE:8035)

Overview: Tokyo Electron Limited, with a market cap of approximately ¥10.66 trillion, develops, manufactures, and sells semiconductor and flat panel display production equipment across Japan and various international markets including Europe, North America, Taiwan, China, South Korea, and Southeast Asia.

Operations: The company's revenue segments include the development, manufacturing, and sale of equipment for semiconductor and flat panel display production across Japan and international markets such as Europe, North America, Taiwan, China, South Korea, and Southeast Asia.

Estimated Discount To Fair Value: 12.3%

Tokyo Electron is trading 12.3% below its estimated fair value of ¥26,374.03, suggesting potential undervaluation based on cash flows. Recent announcements include a share repurchase program worth ¥70 billion and an increased interim dividend to ¥265 per share, reflecting improved business performance. Earnings grew by 37.6% last year and are forecast to grow at 13% annually, exceeding the Japanese market's growth rate of 7.9%. However, the stock has shown high volatility recently.

- The growth report we've compiled suggests that Tokyo Electron's future prospects could be on the up.

- Get an in-depth perspective on Tokyo Electron's balance sheet by reading our health report here.

Where To Now?

- Access the full spectrum of 923 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokyo Electron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8035

Tokyo Electron

Develops, manufactures, and sells semiconductor and flat panel display (FPD) production equipment in Japan, Europe, North America, Taiwan, China, South Korea, Southeast Asia, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.