Investors were disappointed with Green Resource Co., Ltd.'s (KOSDAQ:402490) recent earnings. We think that they may have more to worry about than just soft profit numbers.

Zooming In On Green Resource's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

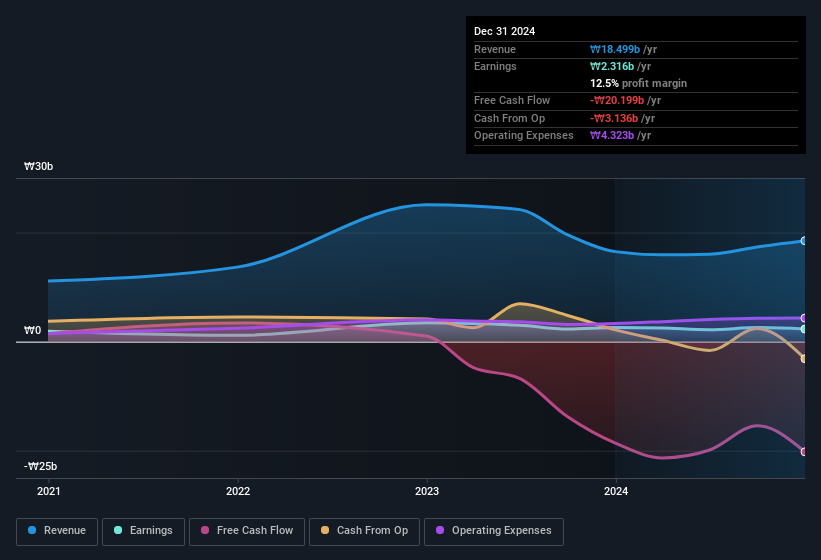

Green Resource has an accrual ratio of 0.30 for the year to December 2024. Therefore, we know that it's free cashflow was significantly lower than its statutory profit, raising questions about how useful that profit figure really is. In the last twelve months it actually had negative free cash flow, with an outflow of ₩20b despite its profit of ₩2.32b, mentioned above. We also note that Green Resource's free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of ₩20b. Having said that it seems that a recent tax benefit and some unusual items have impacted its profit (and this its accrual ratio).

View our latest analysis for Green Resource

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Green Resource.

The Impact Of Unusual Items On Profit

The fact that the company had unusual items boosting profit by ₩1.0b, in the last year, probably goes some way to explain why its accrual ratio was so weak. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. Which is hardly surprising, given the name. Green Resource had a rather significant contribution from unusual items relative to its profit to December 2024. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

An Unusual Tax Situation

In addition to the notable accrual ratio, we can see that Green Resource received a tax benefit of ₩799m. This is meaningful because companies usually pay tax rather than receive tax benefits. We're sure the company was pleased with its tax benefit. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Our Take On Green Resource's Profit Performance

In conclusion, Green Resource's weak accrual ratio suggests its statutory earnings have been inflated by the non-cash tax benefit and the boost it received from unusual items. On reflection, the above-mentioned factors give us the strong impression that Green Resource'sunderlying earnings power is not as good as it might seem, based on the statutory profit numbers. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. To that end, you should learn about the 4 warning signs we've spotted with Green Resource (including 2 which are a bit unpleasant).

Our examination of Green Resource has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A402490

Green Resource

Manufactures and supplies engineered and advances materials worldwide.

Proven track record with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026