- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A241770

The past five-year earnings decline for Mecaro (KOSDAQ:241770) likely explains shareholders long-term losses

While it may not be enough for some shareholders, we think it is good to see the Mecaro Co., Ltd. (KOSDAQ:241770) share price up 15% in a single quarter. But if you look at the last five years the returns have not been good. In fact, the share price is down 38%, which falls well short of the return you could get by buying an index fund.

The recent uptick of 12% could be a positive sign of things to come, so let's take a look at historical fundamentals.

View our latest analysis for Mecaro

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Mecaro became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics might give us a better handle on how its value is changing over time.

It could be that the revenue decline of 12% per year is viewed as evidence that Mecaro is shrinking. That could explain the weak share price.

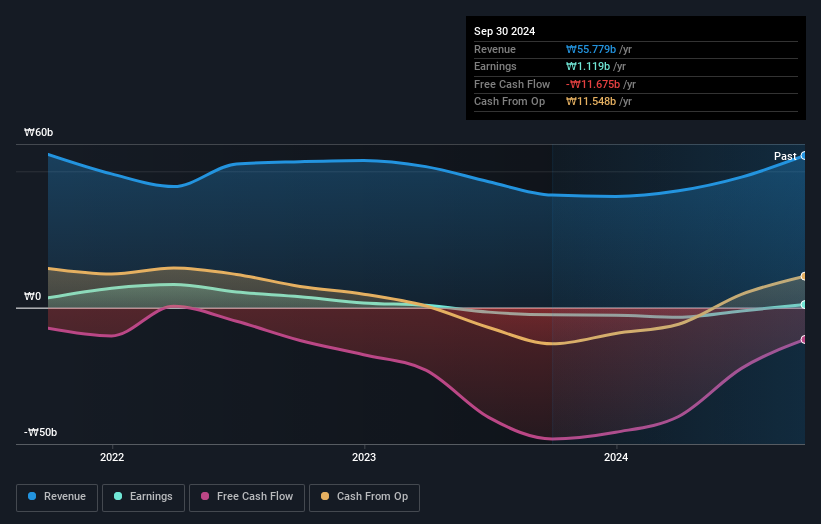

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Mecaro stock, you should check out this FREE detailed report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Mecaro's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Mecaro shareholders, and that cash payout explains why its total shareholder loss of 33%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

While it's certainly disappointing to see that Mecaro shares lost 2.0% throughout the year, that wasn't as bad as the market loss of 4.3%. What is more upsetting is the 6% per annum loss investors have suffered over the last half decade. While the losses are slowing we doubt many shareholders are happy with the stock. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Mecaro (at least 1 which is potentially serious) , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A241770

Mecaro

Researches, develops, produces, and supplies semiconductor components in South Korea.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives