- South Korea

- /

- Machinery

- /

- KOSE:A009540

3 KRX Stocks Estimated To Be Up To 39.9% Below Intrinsic Value

Reviewed by Simply Wall St

As the South Korean stock market experiences a slight downturn, with the KOSPI index hovering just below the 2,610-point mark after recent losses, investors are keenly observing potential opportunities amid mixed performances across various sectors. In such fluctuating conditions, identifying undervalued stocks can be crucial for investors looking to capitalize on discrepancies between market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| T'Way Air (KOSE:A091810) | ₩2840.00 | ₩5434.86 | 47.7% |

| PharmaResearch (KOSDAQ:A214450) | ₩227000.00 | ₩424055.57 | 46.5% |

| Cosmecca Korea (KOSDAQ:A241710) | ₩75300.00 | ₩149807.52 | 49.7% |

| TSE (KOSDAQ:A131290) | ₩50000.00 | ₩99407.06 | 49.7% |

| Sejin Heavy Industries (KOSE:A075580) | ₩7470.00 | ₩14830.96 | 49.6% |

| Lutronic (KOSDAQ:A085370) | ₩36700.00 | ₩63217.94 | 41.9% |

| Intellian Technologies (KOSDAQ:A189300) | ₩50000.00 | ₩90387.73 | 44.7% |

| Shinsung E&GLtd (KOSE:A011930) | ₩1532.00 | ₩2899.64 | 47.2% |

| Global Tax Free (KOSDAQ:A204620) | ₩3800.00 | ₩6413.54 | 40.8% |

| Hotel ShillaLtd (KOSE:A008770) | ₩45100.00 | ₩75434.51 | 40.2% |

Here's a peek at a few of the choices from the screener.

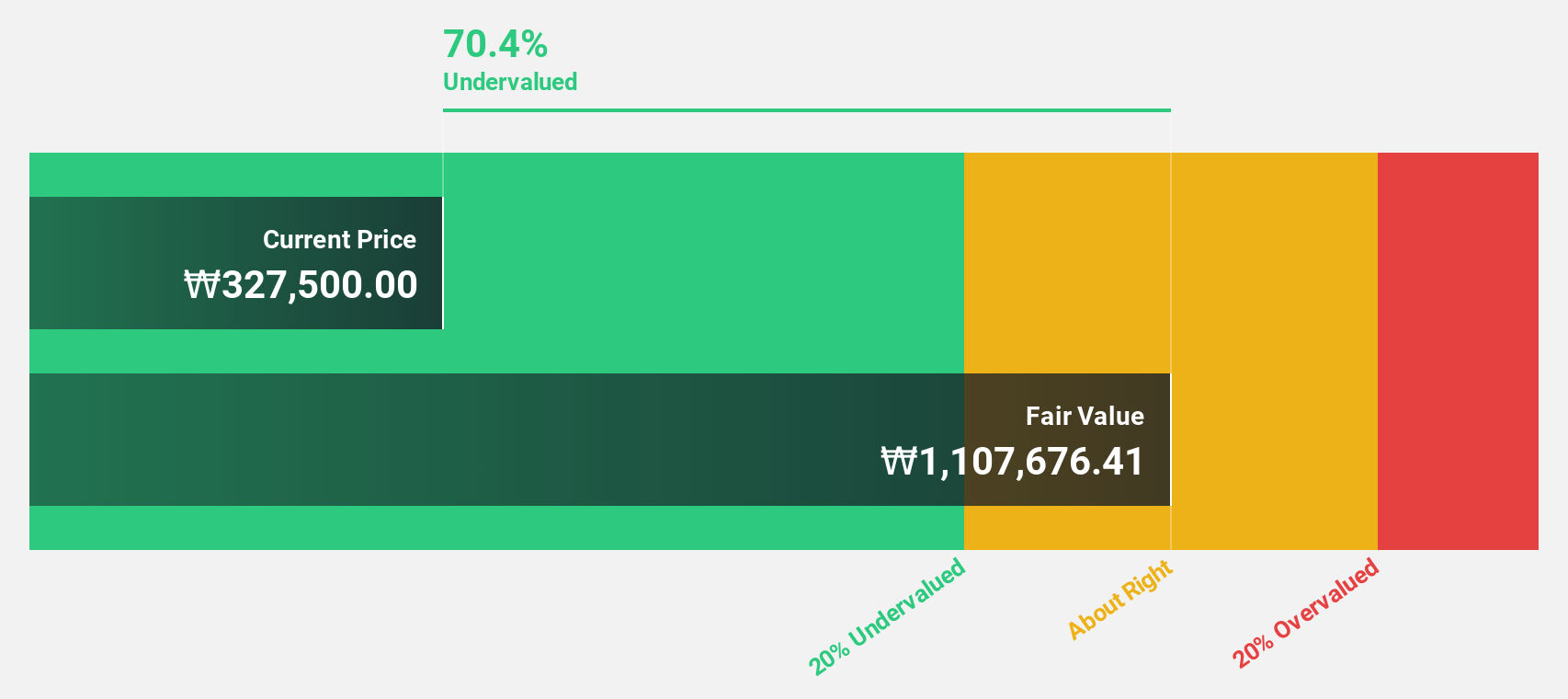

Wonik Ips (KOSDAQ:A240810)

Overview: Wonik IPS Co., Ltd is engaged in the research, development, manufacturing, and sale of semiconductor, display, and solar cell systems in South Korea with a market cap of ₩1.43 trillion.

Operations: The company's revenue primarily comes from its Semiconductor Equipment Division, which generated ₩687.21 billion.

Estimated Discount To Fair Value: 39.9%

Wonik Ips, trading at ₩29,300, is significantly undervalued based on discounted cash flow analysis with a fair value estimate of ₩48,731.07. Analysts expect the stock price to rise by 49.5%, supported by anticipated earnings growth of 90.12% annually and revenue growth surpassing market averages at 20.5% per year. Despite lower forecasted return on equity at 13.5%, the company is projected to become profitable within three years, indicating strong potential for investors focusing on cash flow valuation metrics in South Korea.

- In light of our recent growth report, it seems possible that Wonik Ips' financial performance will exceed current levels.

- Dive into the specifics of Wonik Ips here with our thorough financial health report.

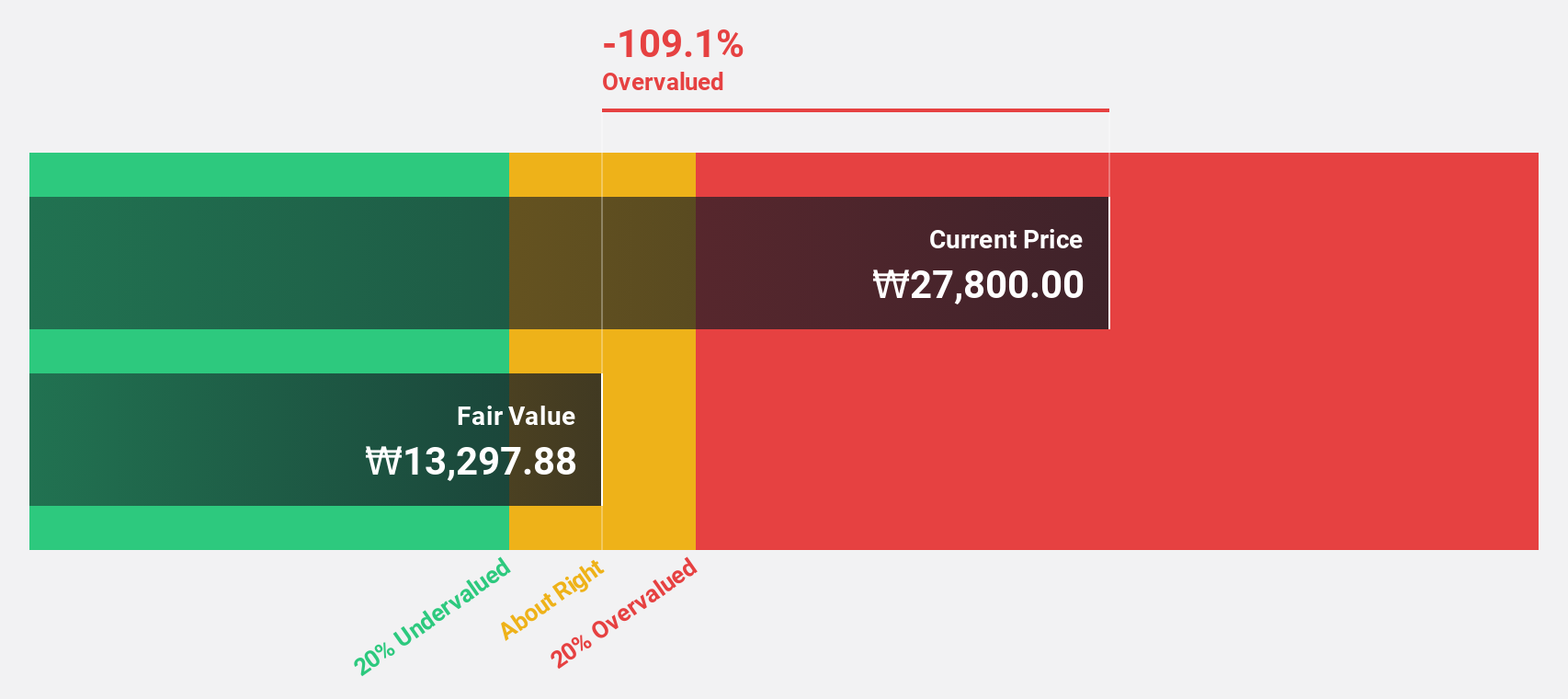

HD Korea Shipbuilding & Offshore Engineering (KOSE:A009540)

Overview: HD Korea Shipbuilding & Offshore Engineering Co., Ltd. operates in the shipbuilding and offshore engineering industry with a market cap of ₩13.79 trillion.

Operations: The company's revenue segments include Shipbuilding at ₩21.80 trillion, Engine at ₩4.21 trillion, Green Energy at ₩467.66 million, and Marine Plant at ₩802.72 million.

Estimated Discount To Fair Value: 17.7%

HD Korea Shipbuilding & Offshore Engineering is trading at ₩195,000, undervalued by 17.7% compared to its fair value of ₩237,060.38 based on discounted cash flow analysis. The company's earnings surged significantly over the past year and are forecast to grow 39.23% annually, outpacing the Korean market average of 29.2%. Recent strategic partnerships in ammonia technology could enhance future revenue streams despite a modest return on equity forecast of 14.3%.

- Our comprehensive growth report raises the possibility that HD Korea Shipbuilding & Offshore Engineering is poised for substantial financial growth.

- Get an in-depth perspective on HD Korea Shipbuilding & Offshore Engineering's balance sheet by reading our health report here.

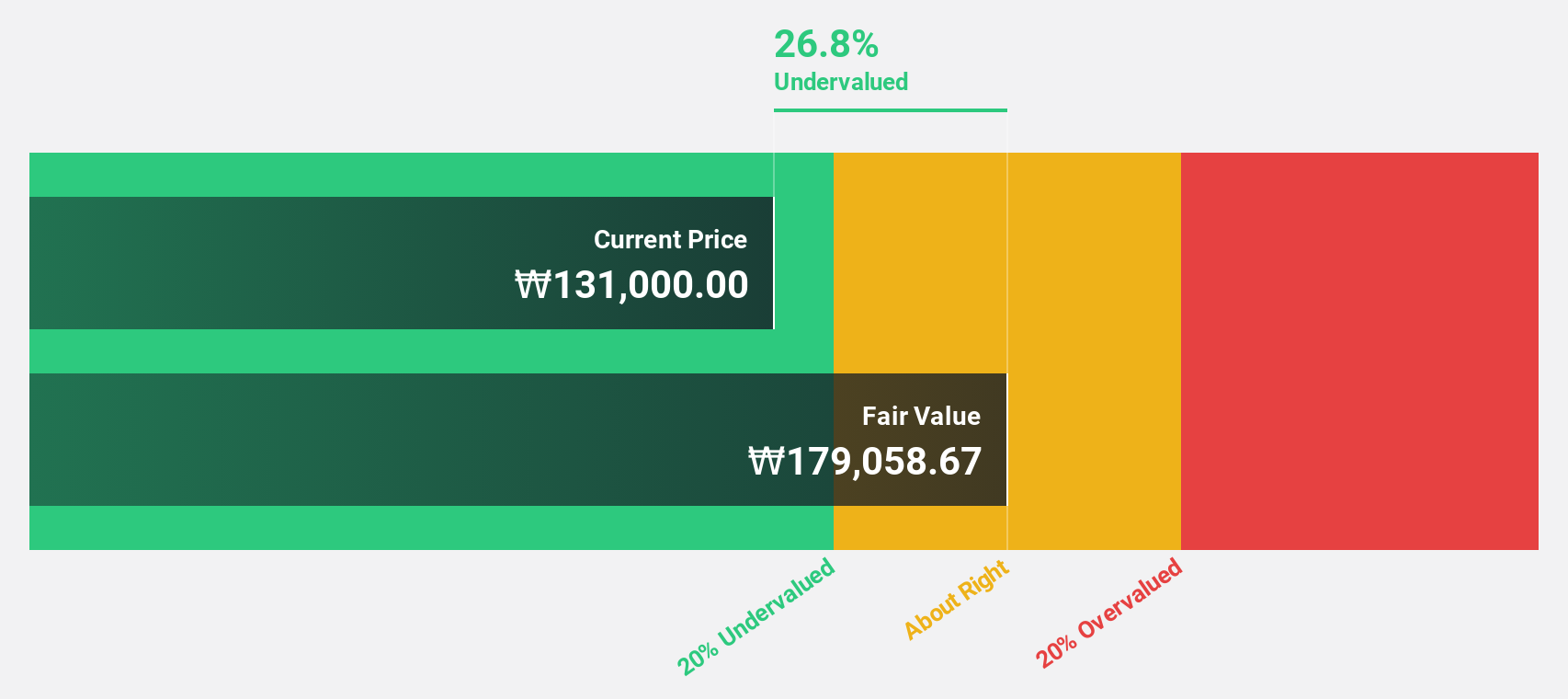

APR (KOSE:A278470)

Overview: APR Co., Ltd is a company that manufactures and sells cosmetic products for both men and women, with a market cap of ₩403.58 billion.

Operations: The company's revenue segments include ₩614.77 billion from cosmetics and ₩64.46 billion from apparel fashion.

Estimated Discount To Fair Value: 21.6%

APR Co., Ltd. is trading at ₩266,500, over 21% below its estimated fair value of ₩339,814.6 according to discounted cash flow analysis. Despite a volatile share price recently and slower forecasted earnings growth compared to the Korean market, APR's revenue is expected to grow faster than the market average at 19.6% annually. The recent stock split and inclusion in the S&P Global BMI Index could enhance investor interest and liquidity.

- According our earnings growth report, there's an indication that APR might be ready to expand.

- Unlock comprehensive insights into our analysis of APR stock in this financial health report.

Seize The Opportunity

- Click this link to deep-dive into the 33 companies within our Undervalued KRX Stocks Based On Cash Flows screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HD Korea Shipbuilding & Offshore Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A009540

HD Korea Shipbuilding & Offshore Engineering

HD Korea Shipbuilding & Offshore Engineering Co., Ltd.

Flawless balance sheet with solid track record.