- South Korea

- /

- Telecom Services and Carriers

- /

- KOSE:A030200

Top Three Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump 2.0 administration's policies and fluctuating interest rate expectations, investors are keenly observing sectoral shifts influenced by potential deregulation and geopolitical dynamics. Amidst this backdrop, dividend stocks remain an attractive option for those seeking steady income streams; these stocks often belong to companies with robust financial health and a commitment to returning value to shareholders, making them a compelling consideration in today's volatile market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.60% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.16% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.79% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.82% | ★★★★★★ |

| Petrol d.d (LJSE:PETG) | 5.84% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.49% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.65% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.51% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 1968 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

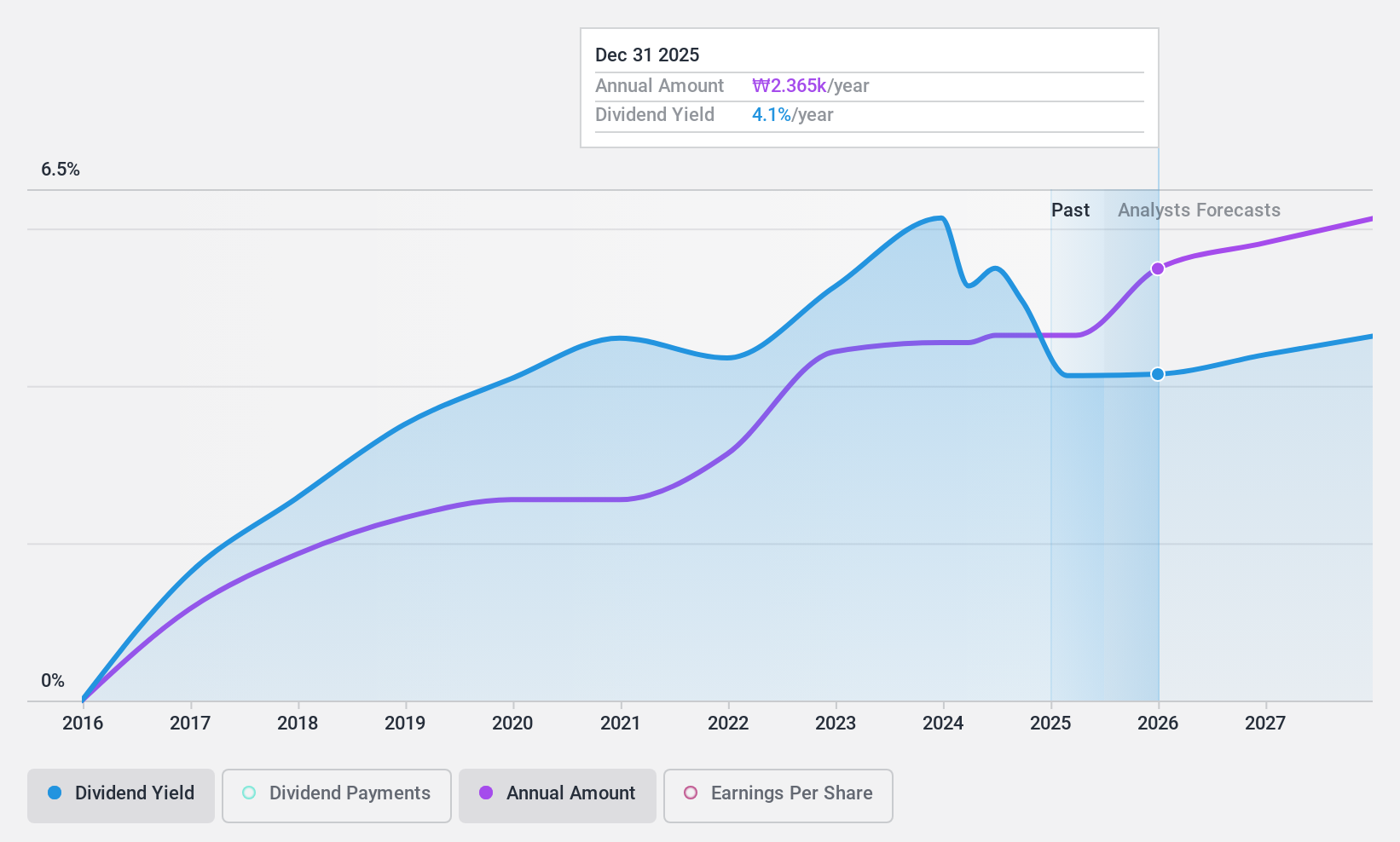

KT (KOSE:A030200)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: KT Corporation provides integrated telecommunications and platform services in Korea and internationally, with a market cap of ₩10.64 trillion.

Operations: KT Corporation generates revenue from its integrated telecommunications and platform services, with specific segment figures not provided in the available text.

Dividend Yield: 4.6%

KT Corporation recently affirmed a quarterly cash dividend of KRW 500 per share, amounting to approximately KRW 122.91 billion, highlighting its commitment to returning value to shareholders. The dividend is well-covered by both earnings (73.1% payout ratio) and cash flows (19.6% cash payout ratio), though the track record has been unstable over the past decade. Trading at good relative value compared to peers, KT's yield is among the top 25% in Korea's market.

- Click to explore a detailed breakdown of our findings in KT's dividend report.

- According our valuation report, there's an indication that KT's share price might be on the cheaper side.

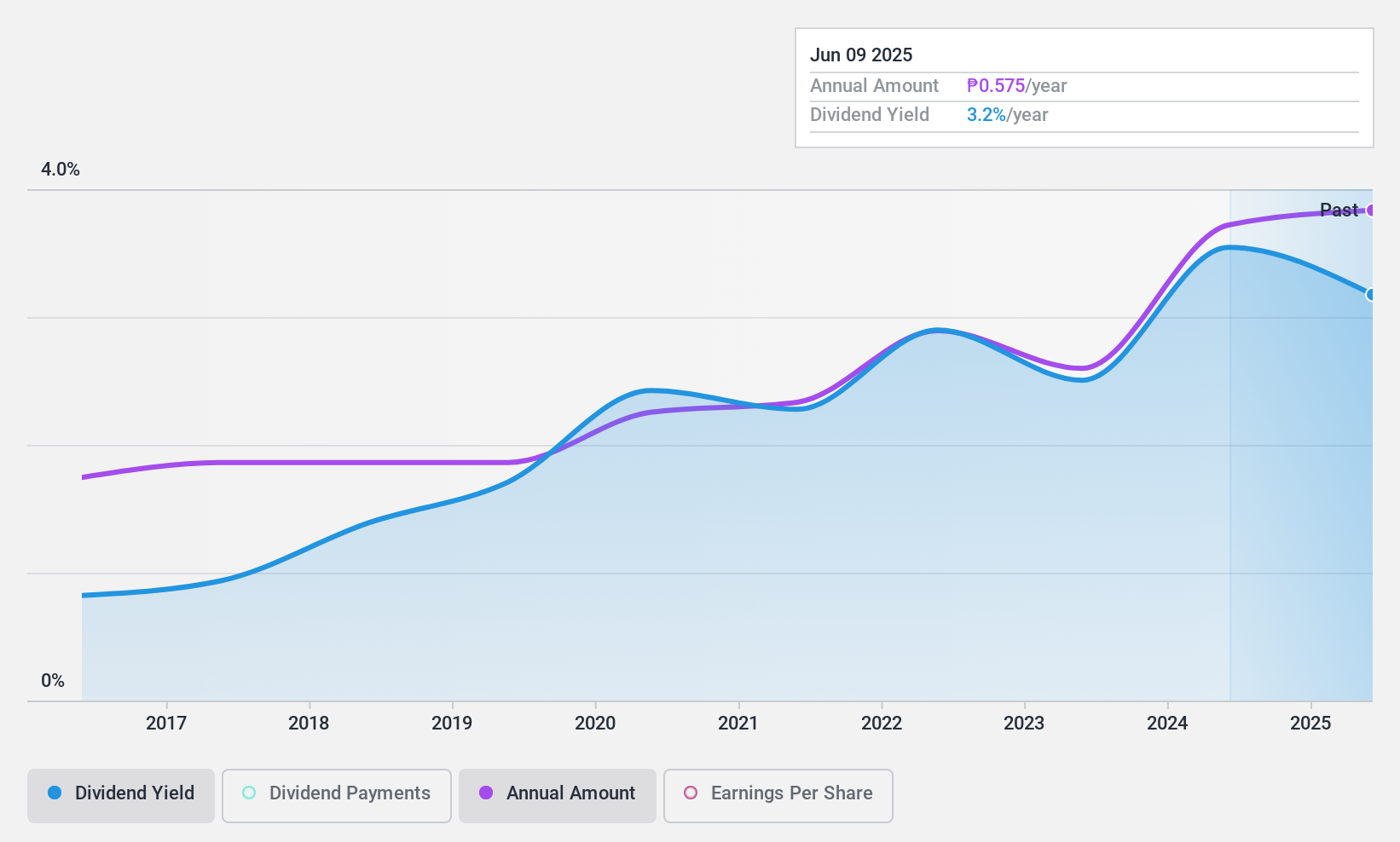

Vivant (PSE:VVT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vivant Corporation, with a market cap of ₱17.40 billion, operates in the Philippines through its subsidiaries by generating, distributing, and retailing electric power.

Operations: Vivant Corporation's revenue is derived from its activities in generating, distributing, and retailing electric power within the Philippines.

Dividend Yield: 3.3%

Vivant Corporation's recent earnings report showed significant revenue growth, yet net income for nine months decreased to PHP 1.67 billion. While dividends have grown steadily over the past decade and are well-covered by a low payout ratio of 30%, they aren't supported by free cash flow, raising sustainability concerns. The dividend yield is relatively low at 3.28% compared to top payers in the Philippines market, with high share price volatility noted recently.

- Dive into the specifics of Vivant here with our thorough dividend report.

- Our valuation report here indicates Vivant may be overvalued.

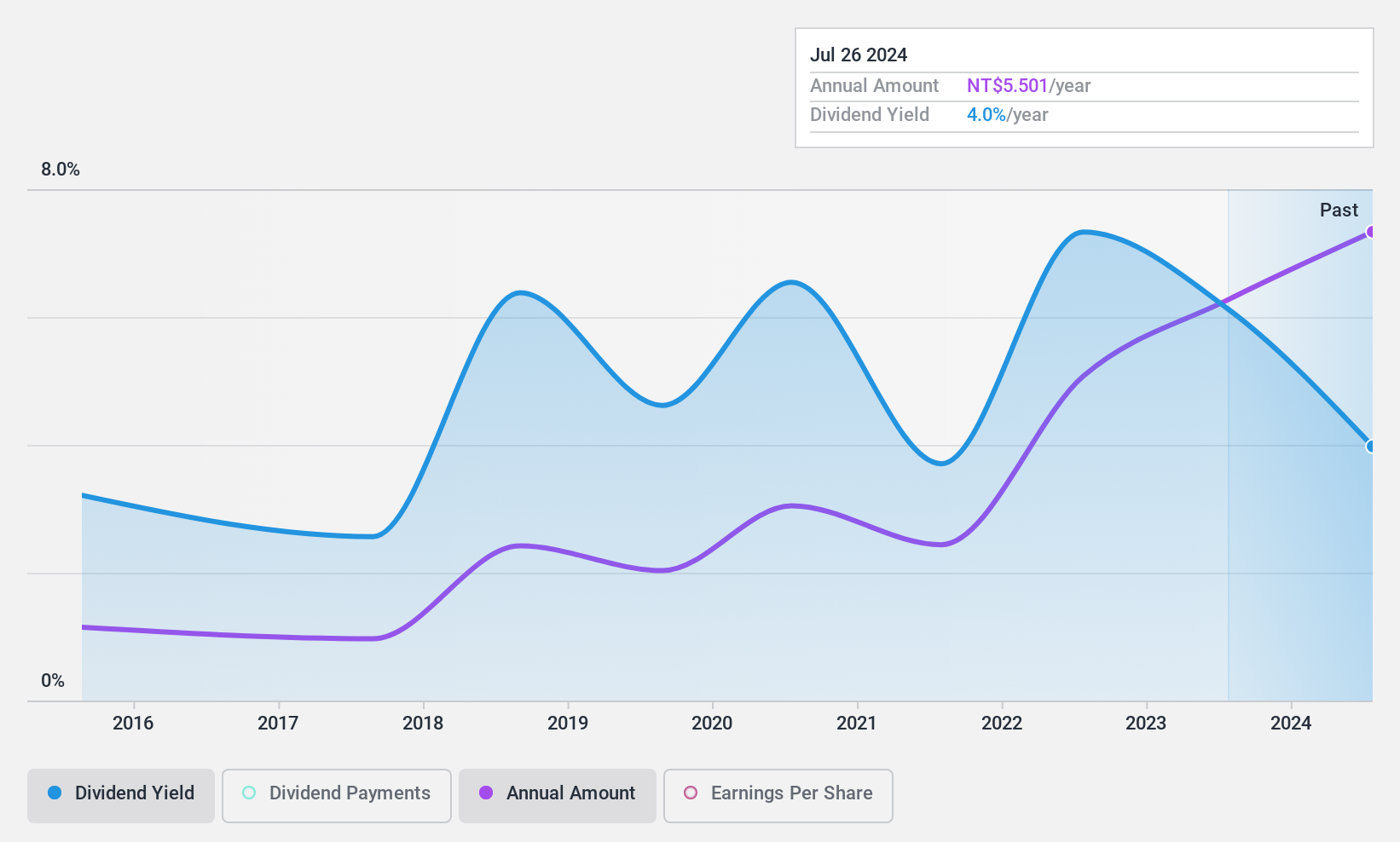

Hua Yu Lien Development (TWSE:1436)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hua Yu Lien Development Co., Ltd. is involved in the development, leasing, and sale of residential projects and buildings in Taiwan, with a market cap of NT$13.90 billion.

Operations: Hua Yu Lien Development Co., Ltd. generates its revenue primarily from the Construction Sector with NT$7.46 billion and the Engineering Department contributing NT$643.99 million.

Dividend Yield: 4.5%

Hua Yu Lien Development's recent earnings reveal substantial growth, with net income reaching TWD 2.08 billion for the first nine months of 2024. Despite a low payout ratio of 20.2%, indicating dividends are well-covered by earnings, cash flow coverage is tighter at an 88.5% cash payout ratio. The dividend yield is slightly below top-tier levels in Taiwan at 4.45%, and historical volatility in dividend payments raises concerns about reliability and sustainability amidst high share price fluctuations.

- Delve into the full analysis dividend report here for a deeper understanding of Hua Yu Lien Development.

- Insights from our recent valuation report point to the potential overvaluation of Hua Yu Lien Development shares in the market.

Turning Ideas Into Actions

- Access the full spectrum of 1968 Top Dividend Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if KT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A030200

KT

Provides integrated telecommunications and platform services in South Korea, rest of Asia, and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)