- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A095340

3 Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As global markets navigate the complexities of shifting political landscapes and economic indicators, investors are closely watching sectors influenced by policy changes and interest rate expectations. Amidst this environment, identifying stocks that may be trading below their estimated value becomes crucial for those seeking opportunities in a market marked by volatility and sector-specific fluctuations. A good stock in such conditions often exhibits strong fundamentals, resilience to external pressures, and potential for growth despite broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Giant Biogene Holding (SEHK:2367) | HK$48.90 | HK$97.69 | 49.9% |

| Wistron (TWSE:3231) | NT$114.00 | NT$227.48 | 49.9% |

| SISB (SET:SISB) | THB31.75 | THB63.41 | 49.9% |

| Shoei (TSE:7839) | ¥2398.00 | ¥4723.94 | 49.2% |

| A.L.A. società per azioni (BIT:ALA) | €24.80 | €49.51 | 49.9% |

| EnomotoLtd (TSE:6928) | ¥1481.00 | ¥2941.30 | 49.6% |

| Enento Group Oyj (HLSE:ENENTO) | €18.06 | €36.11 | 50% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.94 | THB9.87 | 50% |

| Saipem (BIT:SPM) | €2.327 | €4.65 | 50% |

| Credit Clear (ASX:CCR) | A$0.35 | A$0.71 | 50.5% |

Here we highlight a subset of our preferred stocks from the screener.

ISC (KOSDAQ:A095340)

Overview: ISC Co., Ltd. develops, manufactures, and sells semiconductor test sockets worldwide with a market cap of approximately ₩930.10 billion.

Operations: Revenue Segments (in millions of ₩): Semiconductor test sockets - ₩null

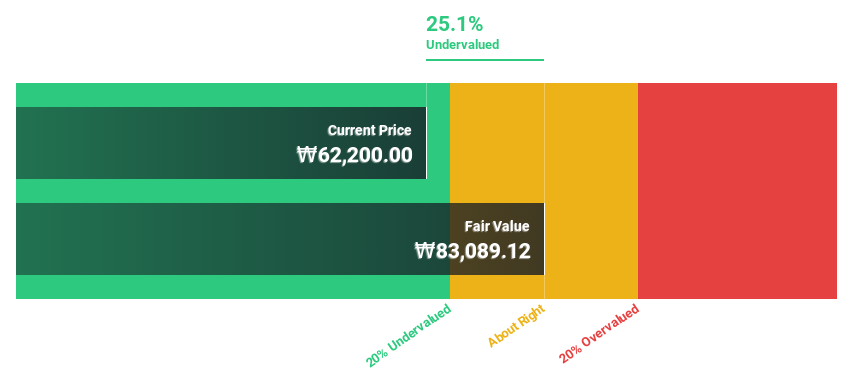

Estimated Discount To Fair Value: 23.1%

ISC Co., Ltd. appears undervalued with its stock trading 23.1% below the estimated fair value of ₩65,047.26, and analysts expect a price rise of 57.6%. The company reported significant earnings growth for Q3 2024, turning a net loss into a net income of ₩11,130.25 million compared to the previous year. Despite forecasted revenue growth outpacing the market at 21.9% annually, its future return on equity remains low at an expected 11.7%.

- Our growth report here indicates ISC may be poised for an improving outlook.

- Get an in-depth perspective on ISC's balance sheet by reading our health report here.

Kakao Games (KOSDAQ:A293490)

Overview: Kakao Games Corporation operates a mobile and PC online game service platform for gamers worldwide, with a market cap of ₩1.31 trillion.

Operations: Revenue Segments (in millions of ₩):

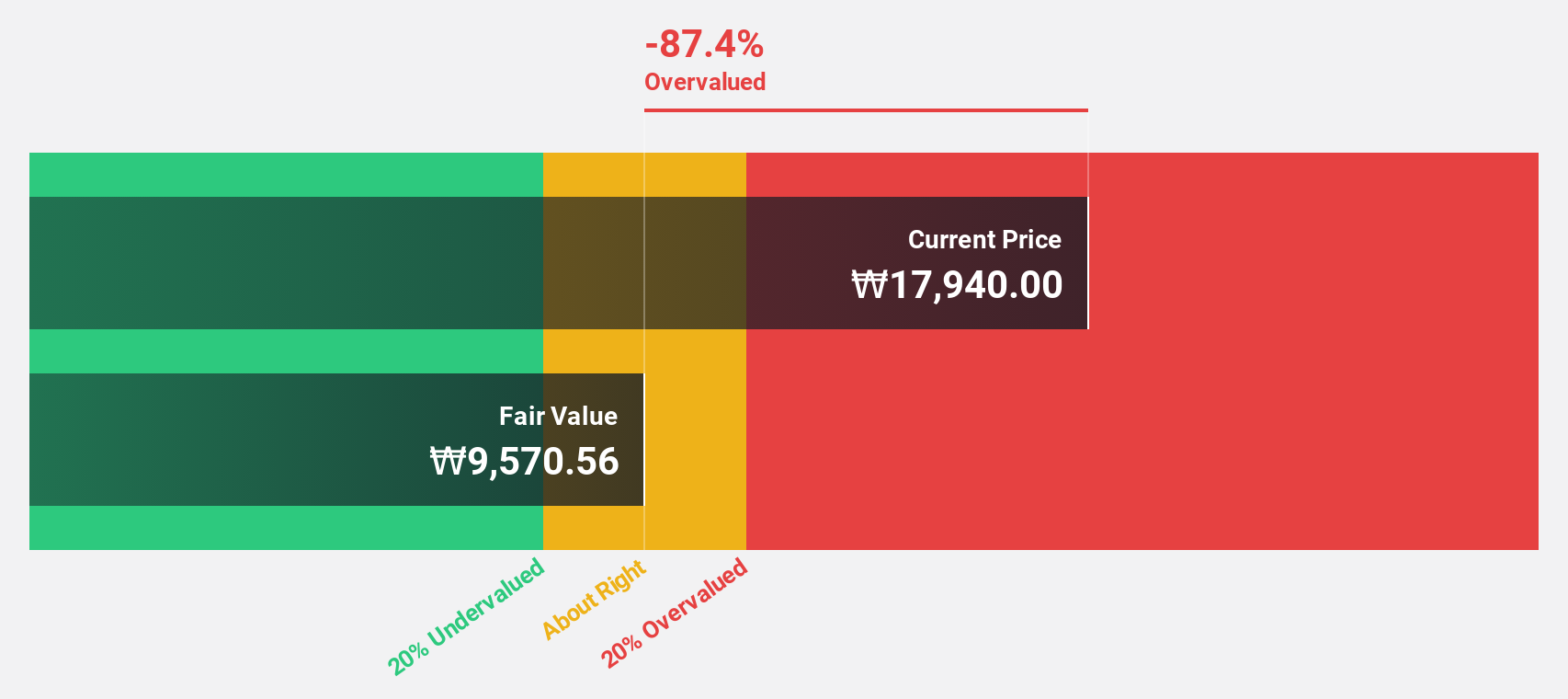

Estimated Discount To Fair Value: 34.2%

Kakao Games is trading 34.2% below its estimated fair value of ₩24,405.29, highlighting potential undervaluation based on cash flows. The company's revenue is forecast to grow at 10.4% annually, outpacing the Korean market's average growth rate of 9.3%. While it is expected to become profitable within three years with earnings projected to increase significantly each year, its return on equity remains low at a forecasted 5.7%.

- Our expertly prepared growth report on Kakao Games implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Kakao Games.

EIH (NSEI:EIHOTEL)

Overview: EIH Limited, along with its subsidiaries, owns and manages hotels and cruisers under the Oberoi and Resorts brand names both in India and internationally, with a market cap of ₹223.79 billion.

Operations: The company's revenue from its hotel operations amounts to ₹26.74 billion.

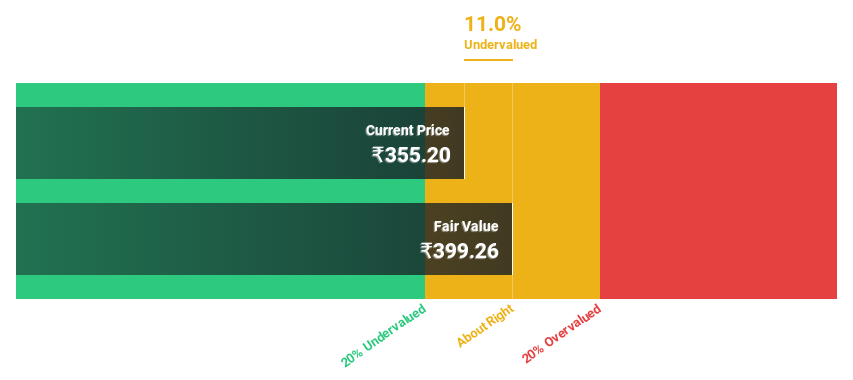

Estimated Discount To Fair Value: 10.4%

EIH is trading at ₹357.85, slightly below its estimated fair value of ₹399.18, suggesting a potential undervaluation based on cash flows. The company's earnings grew by 55.8% over the past year and are expected to grow significantly at 30.7% annually, outpacing the Indian market's growth rate of 18.1%. Despite an unstable dividend track record, EIH's revenue is projected to grow faster than the Indian market at 19.4% per year.

- The analysis detailed in our EIH growth report hints at robust future financial performance.

- Take a closer look at EIH's balance sheet health here in our report.

Taking Advantage

- Access the full spectrum of 921 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A095340

ISC

Develops, manufactures, and sells semiconductor test sockets worldwide.

Flawless balance sheet with solid track record.