- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A232140

Three Undiscovered Gems In South Korea With Strong Growth Potential

Reviewed by Simply Wall St

South Korea's market has been closely watched as it prepares to release August figures for import and export prices, following a notable increase in July. Amid these economic indicators, savvy investors are turning their attention to small-cap stocks with strong growth potential. In this article, we will explore three undiscovered gems in South Korea that stand out due to their promising fundamentals and favorable market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| Korea Cast Iron Pipe Ind | NA | 1.97% | 8.84% | ★★★★★★ |

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.74% | ★★★★★★ |

| Woori Technology Investment | NA | 25.66% | -1.45% | ★★★★★★ |

| Kyung Dong Navien | 22.40% | 11.19% | 18.84% | ★★★★★★ |

| Namuga | 14.47% | 0.88% | 38.25% | ★★★★★★ |

| SELVAS Healthcare | 13.50% | 9.36% | 71.59% | ★★★★★★ |

| Synergy Innovation | 12.39% | 12.87% | 28.82% | ★★★★★★ |

| iMarketKorea | 28.53% | 5.35% | 1.30% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Cheryong ElectricLtd (KOSDAQ:A033100)

Simply Wall St Value Rating: ★★★★★★

Overview: Cheryong Electric Co., Ltd. manufactures and sells power electric equipment in South Korea, with a market cap of ₩905.92 billion.

Operations: Cheryong Electric Co., Ltd. generates revenue primarily from the sale of power electric equipment in South Korea, with a market cap of ₩905.92 billion.

Cheryong Electric Ltd. has shown impressive earnings growth of 134% over the past year, significantly outpacing the Electrical industry’s 18.5%. Currently trading at 81% below its estimated fair value, it offers considerable upside potential. The company is debt-free, improving from a debt-to-equity ratio of 2.3% five years ago. Despite recent share price volatility, Cheryong's high-quality earnings and positive free cash flow position it well for future stability and growth in South Korea's electrical sector.

- Delve into the full analysis health report here for a deeper understanding of Cheryong ElectricLtd.

Evaluate Cheryong ElectricLtd's historical performance by accessing our past performance report.

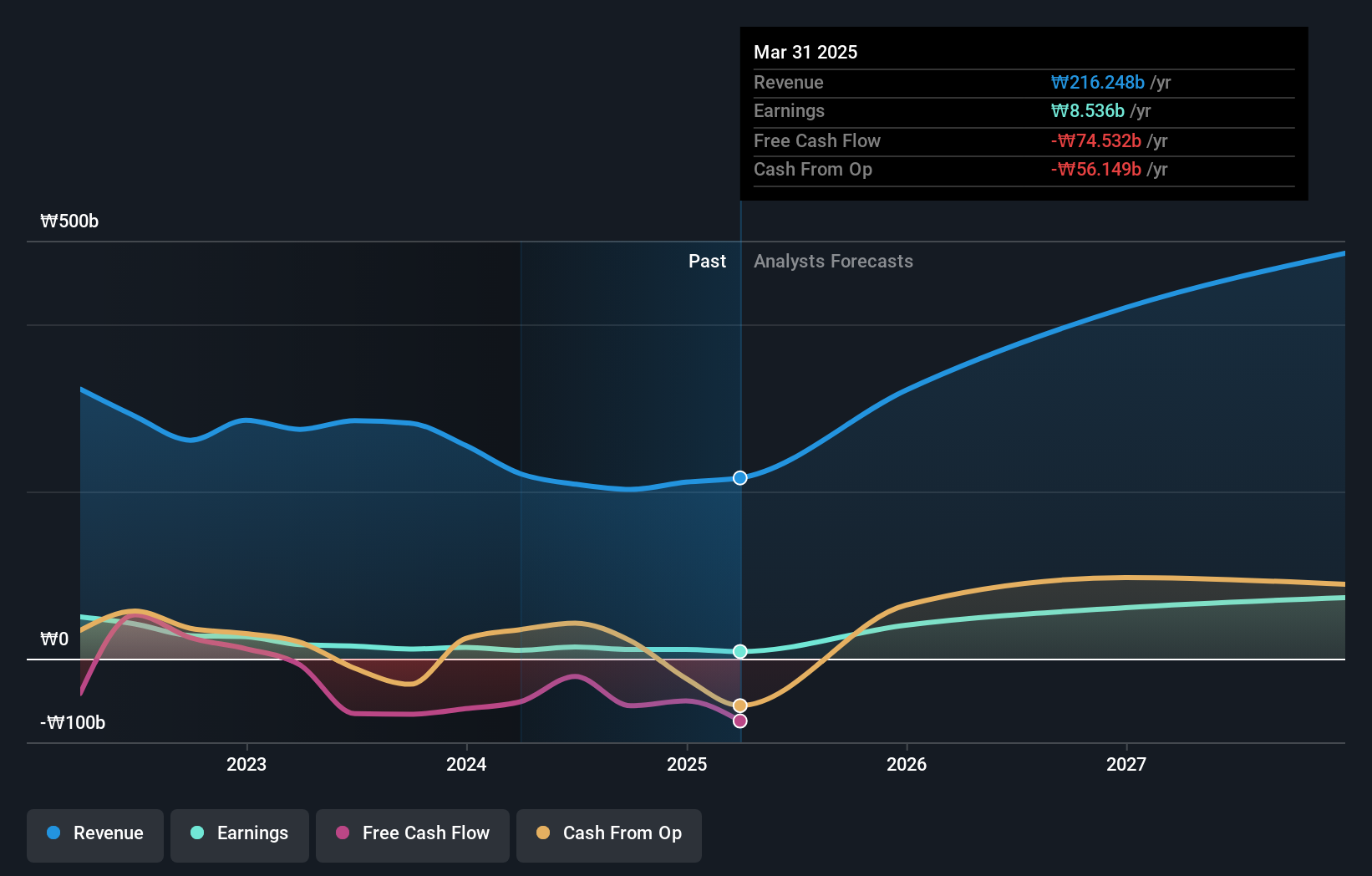

YC (KOSDAQ:A232140)

Simply Wall St Value Rating: ★★★★★★

Overview: YC Corporation develops, manufactures, and sells inspection equipment for semiconductor memories in South Korea and internationally, with a market cap of ₩1.07 billion.

Operations: YC Corporation generates revenue primarily from its Semiconductor Division (₩161.99 billion), followed by Electrical and Electronic Accessories (₩42.12 billion) and Wholesale/Retail (₩4.71 billion).

YC, a small yet promising player in South Korea's tech sector, has seen its debt to equity ratio improve significantly from 43.6% to 18% over the past five years. Despite a negative earnings growth of -7.1% last year, it still outperformed the semiconductor industry average of -10%. The company is profitable and its interest coverage is solid, indicating financial stability. Earnings are projected to grow by almost 50% annually, showcasing strong future potential.

- Dive into the specifics of YC here with our thorough health report.

Gain insights into YC's past trends and performance with our Past report.

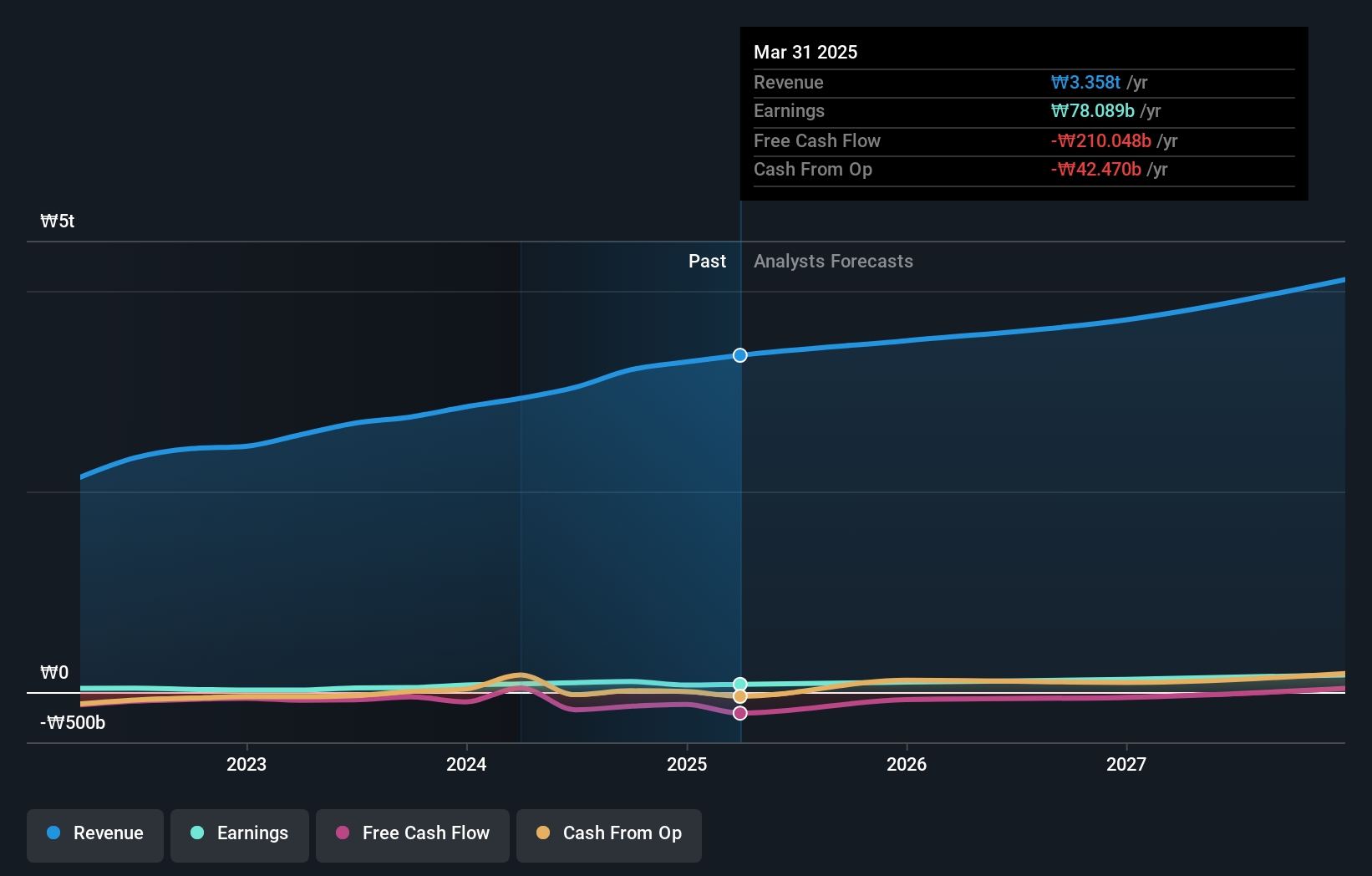

Taihan Cable & Solution (KOSE:A001440)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taihan Cable & Solution Co., Ltd. manufactures, processes, and sells electric wires, cables, and related products worldwide with a market cap of ₩2.09 trillion.

Operations: Taihan Cable & Solution generates revenue primarily from its wire segment, which reported ₩3.42 billion in sales. The company also accounts for internal sales between divisions amounting to -₩380.13 million.

Taihan Cable & Solution has shown significant financial improvement, with net income for the second quarter at KRW 24.88 million, up from KRW 12.82 million the previous year. Earnings per share increased to KRW 134 from KRW 104. Over the past five years, its debt-to-equity ratio dropped from 203.6% to 30.2%. Despite a decrease in sales to KRW 8,822.92 million for Q2, earnings growth of 127% last year outpaced the industry’s average of 18.5%.

Summing It All Up

- Investigate our full lineup of 190 KRX Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A232140

YC

Engages in the development, manufacture, and sale of inspection equipment for semiconductor memories in South Korea and internationally.

Flawless balance sheet with high growth potential.