RFHIC Corporation's (KOSDAQ:218410) stock rose after it released a robust earnings report. However, we think that shareholders should be aware of some other factors beyond the profit numbers.

See our latest analysis for RFHIC

Zooming In On RFHIC's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

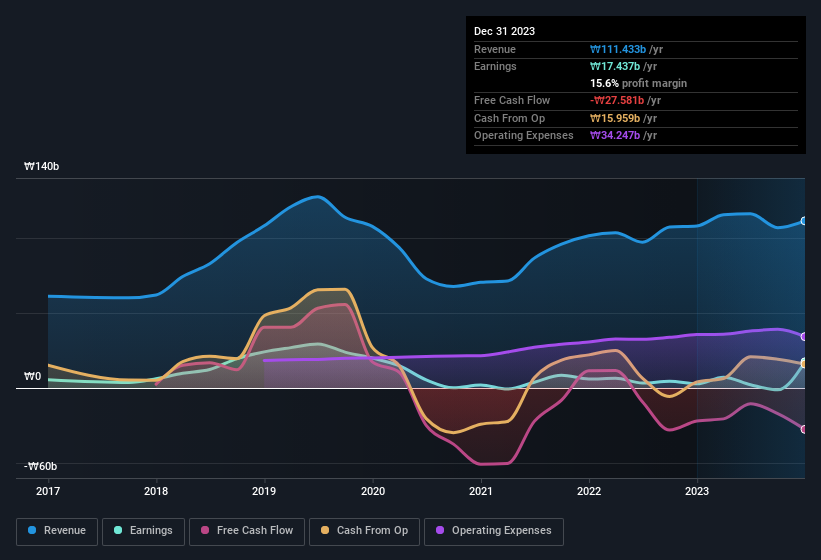

RFHIC has an accrual ratio of 0.22 for the year to December 2023. Therefore, we know that it's free cashflow was significantly lower than its statutory profit, which is hardly a good thing. In the last twelve months it actually had negative free cash flow, with an outflow of ₩28b despite its profit of ₩17.4b, mentioned above. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of ₩28b, this year, indicates high risk. Having said that it seems that a recent tax benefit and some unusual items have impacted its profit (and this its accrual ratio).

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

How Do Unusual Items Influence Profit?

Given the accrual ratio, it's not overly surprising that RFHIC's profit was boosted by unusual items worth ₩5.6b in the last twelve months. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. Which is hardly surprising, given the name. We can see that RFHIC's positive unusual items were quite significant relative to its profit in the year to December 2023. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

An Unusual Tax Situation

Moving on from the accrual ratio, we note that RFHIC profited from a tax benefit which contributed ₩10b to profit. It's always a bit noteworthy when a company is paid by the tax man, rather than paying the tax man. We're sure the company was pleased with its tax benefit. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal.

Our Take On RFHIC's Profit Performance

In conclusion, RFHIC's weak accrual ratio suggests its statutory earnings have been inflated by the non-cash tax benefit and the boost it received from unusual items. For all the reasons mentioned above, we think that, at a glance, RFHIC's statutory profits could be considered to be low quality, because they are likely to give investors an overly positive impression of the company. So while earnings quality is important, it's equally important to consider the risks facing RFHIC at this point in time. At Simply Wall St, we found 1 warning sign for RFHIC and we think they deserve your attention.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A218410

RFHIC

Designs and manufactures radio frequency (RF) and microwave components for wireless infrastructure, commercial and military radar, and RF energy applications in South Korea and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.