- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A218410

Introducing RFHIC (KOSDAQ:218410), The Stock That Zoomed 120% In The Last Three Years

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But if you buy shares in a really great company, you can more than double your money. For instance the RFHIC Corporation (KOSDAQ:218410) share price is 120% higher than it was three years ago. How nice for those who held the stock! It's also good to see the share price up 19% over the last quarter. But this move may well have been assisted by the reasonably buoyant market (up 22% in 90 days).

View our latest analysis for RFHIC

We don't think that RFHIC's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last 3 years RFHIC saw its revenue grow at 7.3% per year. Considering the company is losing money, we think that rate of revenue growth is uninspiring. In comparison, the share price rise of 30% per year over the last three years is pretty impressive. Shareholders should be pretty happy with that, although interested investors might want to examine the financial data more closely to see if the gains are really justified. It may be that the market is pretty optimistic about RFHIC if you look to the bottom line.

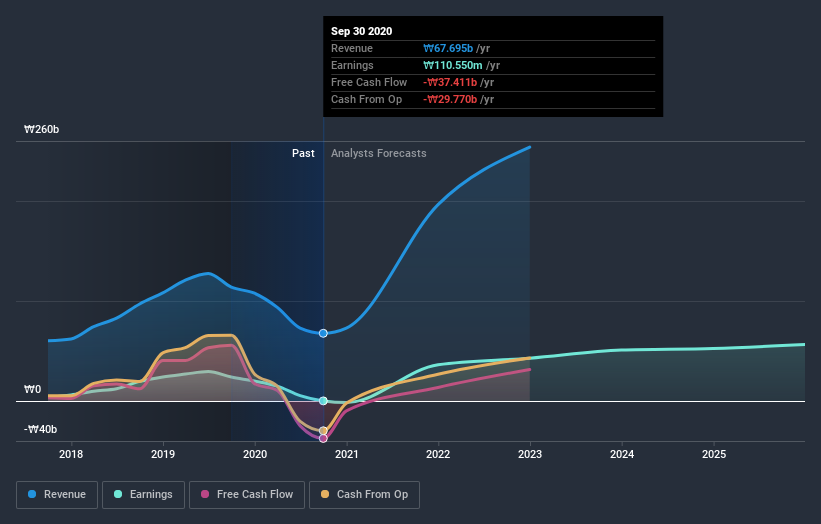

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling RFHIC stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of RFHIC, it has a TSR of 124% for the last 3 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

RFHIC shareholders are up 33% for the year (even including dividends). While you don't go broke making a profit, this return was actually lower than the average market return of about 47%. On the bright side that gain is actually better than the average return of 31% over the last three years, implying that the company is doing better recently. If the share price is up as a result of improved business performance, then this kind of improvement may be sustained. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for RFHIC (of which 1 is potentially serious!) you should know about.

But note: RFHIC may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade RFHIC, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A218410

RFHIC

Designs and manufactures radio frequency (RF) and microwave components for wireless infrastructure, commercial and military radar, and RF energy applications in South Korea and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives