- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A160980

CYMECHS Inc.'s (KOSDAQ:160980) 26% Share Price Plunge Could Signal Some Risk

The CYMECHS Inc. (KOSDAQ:160980) share price has fared very poorly over the last month, falling by a substantial 26%. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 18%.

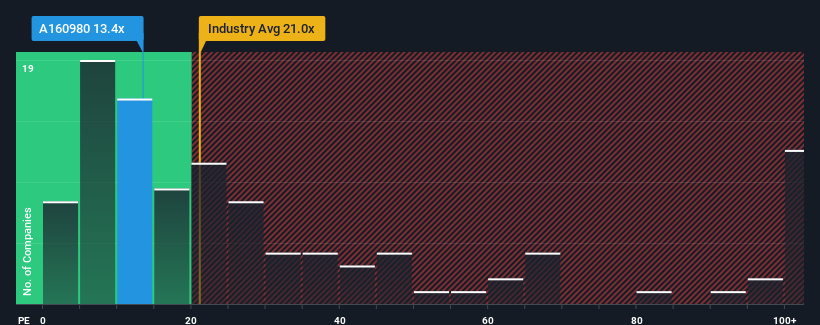

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about CYMECHS' P/E ratio of 13.4x, since the median price-to-earnings (or "P/E") ratio in Korea is also close to 12x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been quite advantageous for CYMECHS as its earnings have been rising very briskly. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for CYMECHS

Is There Some Growth For CYMECHS?

CYMECHS' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 99% last year. However, this wasn't enough as the latest three year period has seen a very unpleasant 58% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 33% shows it's an unpleasant look.

In light of this, it's somewhat alarming that CYMECHS' P/E sits in line with the majority of other companies. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Bottom Line On CYMECHS' P/E

With its share price falling into a hole, the P/E for CYMECHS looks quite average now. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of CYMECHS revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 1 warning sign for CYMECHS that you should be aware of.

If these risks are making you reconsider your opinion on CYMECHS, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A160980

CYMECHS

A tool automation company, engages in the provision of core system components for semiconductor manufacturing in South Korea.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives