- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A144960

We're Not Counting On New Power PlasmaLtd (KOSDAQ:144960) To Sustain Its Statutory Profitability

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. That said, the current statutory profit is not always a good guide to a company's underlying profitability. This article will consider whether New Power PlasmaLtd's (KOSDAQ:144960) statutory profits are a good guide to its underlying earnings.

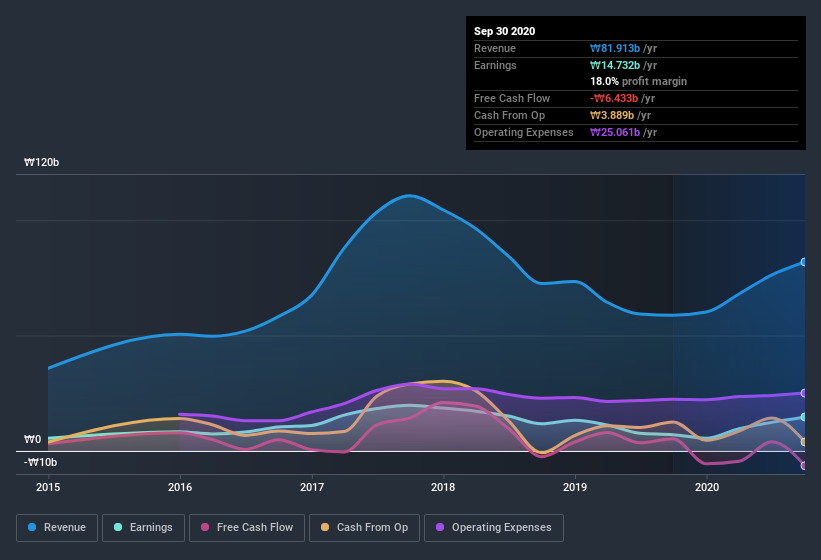

It's good to see that over the last twelve months New Power PlasmaLtd made a profit of ₩14.7b on revenue of ₩81.9b. The chart below shows that both revenue and profit have declined over the last three years.

Check out our latest analysis for New Power PlasmaLtd

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. This article will discuss how unusual items have impacted New Power PlasmaLtd's most recent profit results. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Impact Of Unusual Items On Profit

Importantly, our data indicates that New Power PlasmaLtd's profit received a boost of ₩5.1b in unusual items, over the last year. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. Which is hardly surprising, given the name. New Power PlasmaLtd had a rather significant contribution from unusual items relative to its profit to September 2020. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Our Take On New Power PlasmaLtd's Profit Performance

As we discussed above, we think the significant positive unusual item makes New Power PlasmaLtd'searnings a poor guide to its underlying profitability. For this reason, we think that New Power PlasmaLtd's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. But the happy news is that, while acknowledging we have to look beyond the statutory numbers, those numbers are still improving, with EPS growing at a very high rate over the last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. To help with this, we've discovered 2 warning signs (1 is a bit concerning!) that you ought to be aware of before buying any shares in New Power PlasmaLtd.

Today we've zoomed in on a single data point to better understand the nature of New Power PlasmaLtd's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade New Power PlasmaLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if New Power Plasma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A144960

New Power Plasma

New Power Plasma Co.,Ltd engages in development and sale of plasma components for wafer and LCD processing in the semiconductor/LDC/OLED industry in South Korea and internationally.

Slightly overvalued with questionable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026