- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A131290

TSE Co., Ltd's (KOSDAQ:131290) 28% Share Price Surge Not Quite Adding Up

Despite an already strong run, TSE Co., Ltd (KOSDAQ:131290) shares have been powering on, with a gain of 28% in the last thirty days. The last month tops off a massive increase of 115% in the last year.

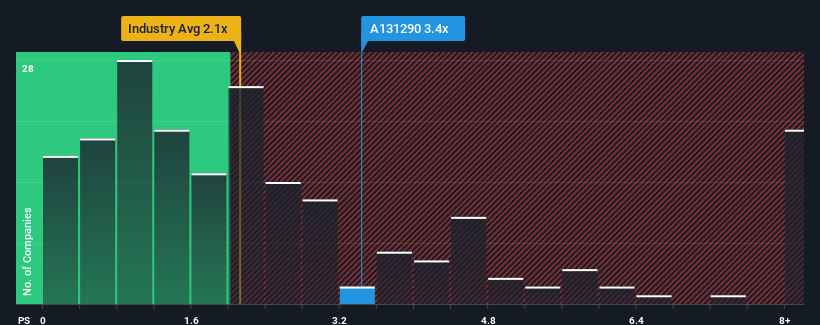

After such a large jump in price, you could be forgiven for thinking TSE is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.4x, considering almost half the companies in Korea's Semiconductor industry have P/S ratios below 2.1x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for TSE

What Does TSE's P/S Mean For Shareholders?

TSE has been struggling lately as its revenue has declined faster than most other companies. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on TSE.How Is TSE's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as TSE's is when the company's growth is on track to outshine the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 27%. This means it has also seen a slide in revenue over the longer-term as revenue is down 13% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 16% each year as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 44% per annum, which is noticeably more attractive.

With this information, we find it concerning that TSE is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does TSE's P/S Mean For Investors?

The large bounce in TSE's shares has lifted the company's P/S handsomely. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've concluded that TSE currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for TSE (1 is concerning) you should be aware of.

If you're unsure about the strength of TSE's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if TSE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A131290

TSE

Provides semiconductor test solutions in South Korea and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026