- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A123010

Does iWIN PLUSLTD (KOSDAQ:123010) Have A Healthy Balance Sheet?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, iWIN PLUS CO.,LTD. (KOSDAQ:123010) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for iWIN PLUSLTD

What Is iWIN PLUSLTD's Net Debt?

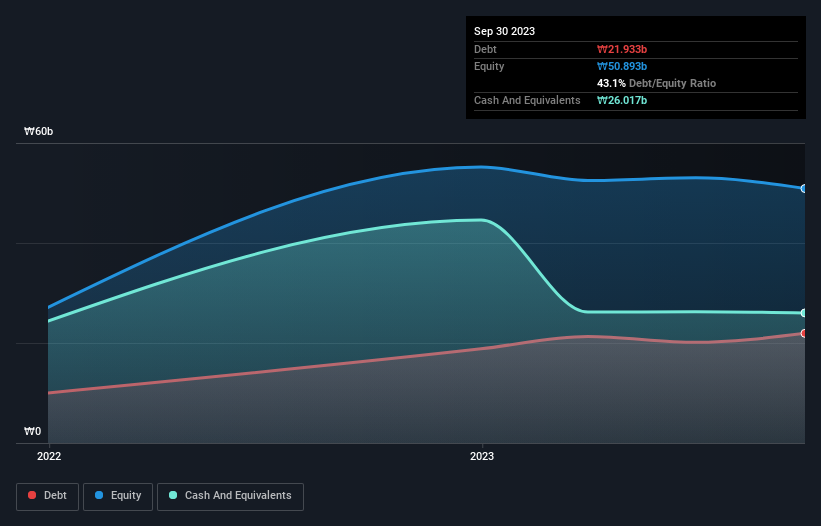

As you can see below, at the end of September 2023, iWIN PLUSLTD had ₩21.9b of debt, up from ₩18.8b a year ago. Click the image for more detail. However, its balance sheet shows it holds ₩26.0b in cash, so it actually has ₩4.08b net cash.

How Healthy Is iWIN PLUSLTD's Balance Sheet?

According to the last reported balance sheet, iWIN PLUSLTD had liabilities of ₩28.0b due within 12 months, and liabilities of ₩2.08b due beyond 12 months. Offsetting these obligations, it had cash of ₩26.0b as well as receivables valued at ₩8.16b due within 12 months. So it actually has ₩4.06b more liquid assets than total liabilities.

This short term liquidity is a sign that iWIN PLUSLTD could probably pay off its debt with ease, as its balance sheet is far from stretched. Succinctly put, iWIN PLUSLTD boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since iWIN PLUSLTD will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, iWIN PLUSLTD reported revenue of ₩31b, which is a gain of 111%, although it did not report any earnings before interest and tax. So its pretty obvious shareholders are hoping for more growth!

So How Risky Is iWIN PLUSLTD?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And we do note that iWIN PLUSLTD had an earnings before interest and tax (EBIT) loss, over the last year. Indeed, in that time it burnt through ₩6.7b of cash and made a loss of ₩7.5b. But the saving grace is the ₩4.08b on the balance sheet. That kitty means the company can keep spending for growth for at least two years, at current rates. The good news for shareholders is that iWIN PLUSLTD has dazzling revenue growth, so there's a very good chance it can boost its free cash flow in the years to come. While unprofitable companies can be risky, they can also grow hard and fast in those pre-profit years. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 2 warning signs we've spotted with iWIN PLUSLTD .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if iWIN PLUSLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A123010

iWIN PLUSLTD

Provides image sensor packaging and testing solutions in South Korea, Taiwan, China, Germany, and internationally.

Mediocre balance sheet low.

Market Insights

Community Narratives