- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A101490

Exploring S&S Tech And 2 Other Promising Small Caps with Strong Financials

Reviewed by Simply Wall St

As global markets continue to show resilience with U.S. indexes approaching record highs and smaller-cap indexes outperforming large-caps, investors are increasingly focusing on small-cap stocks that demonstrate strong financial health amid broad-based gains. In this dynamic environment, identifying stocks with solid fundamentals becomes crucial, as they can offer potential opportunities for growth while navigating market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| All E Technologies | NA | 34.23% | 31.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| PBA Holdings Bhd | 1.86% | 7.41% | 40.17% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| PAN Group | 143.29% | 15.75% | 23.10% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

S&S Tech (KOSDAQ:A101490)

Simply Wall St Value Rating: ★★★★★★

Overview: S&S Tech Corporation manufactures and sells blank masks worldwide with a market cap of ₩473.20 billion.

Operations: The company generates revenue primarily from the sale of blank masks. It has a market cap of ₩473.20 billion.

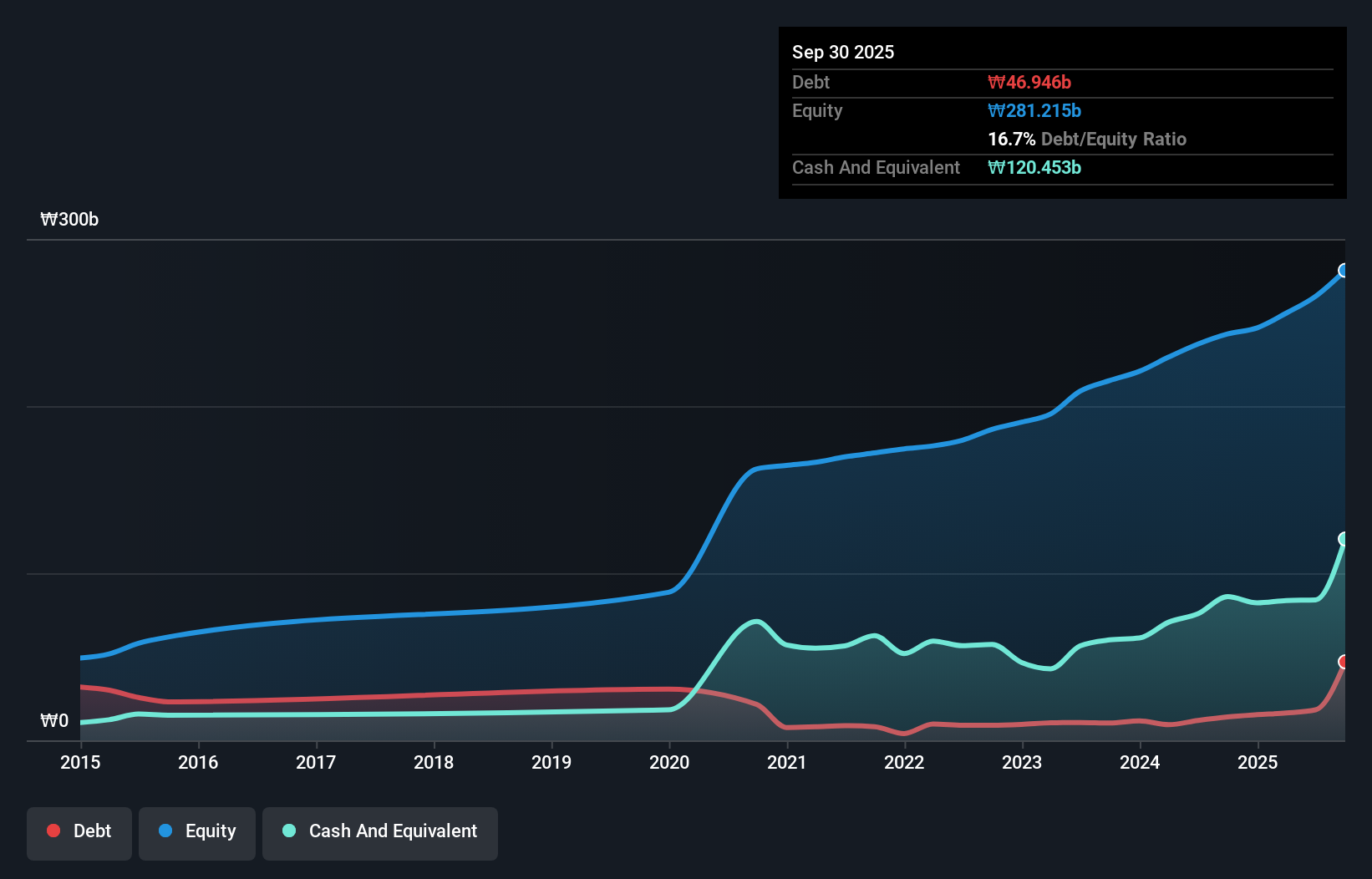

S&S Tech appears to be a promising player in its field, with earnings growing by 23.6% over the past year, outpacing the semiconductor industry's -3.3%. The company's debt-to-equity ratio has impressively decreased from 34.7% to 5.8% over five years, indicating effective financial management. Recent buybacks saw them repurchasing 81,084 shares for KRW 2,124 million, reflecting confidence in their stock's value. In Q3 of this year, net income rose to KRW 8,208 million from KRW 6,287 million last year and basic earnings per share increased to KRW 391 from KRW 299 previously reported.

- Take a closer look at S&S Tech's potential here in our health report.

Explore historical data to track S&S Tech's performance over time in our Past section.

SIGMAXYZ Holdings (TSE:6088)

Simply Wall St Value Rating: ★★★★★★

Overview: SIGMAXYZ Holdings Inc. operates in Japan through its consulting, investment, and M&A advisory businesses and has a market capitalization of approximately ¥156.74 billion.

Operations: The primary revenue stream for SIGMAXYZ Holdings comes from its consulting business, generating approximately ¥24.30 billion, while its investment business contributes around ¥184.92 million.

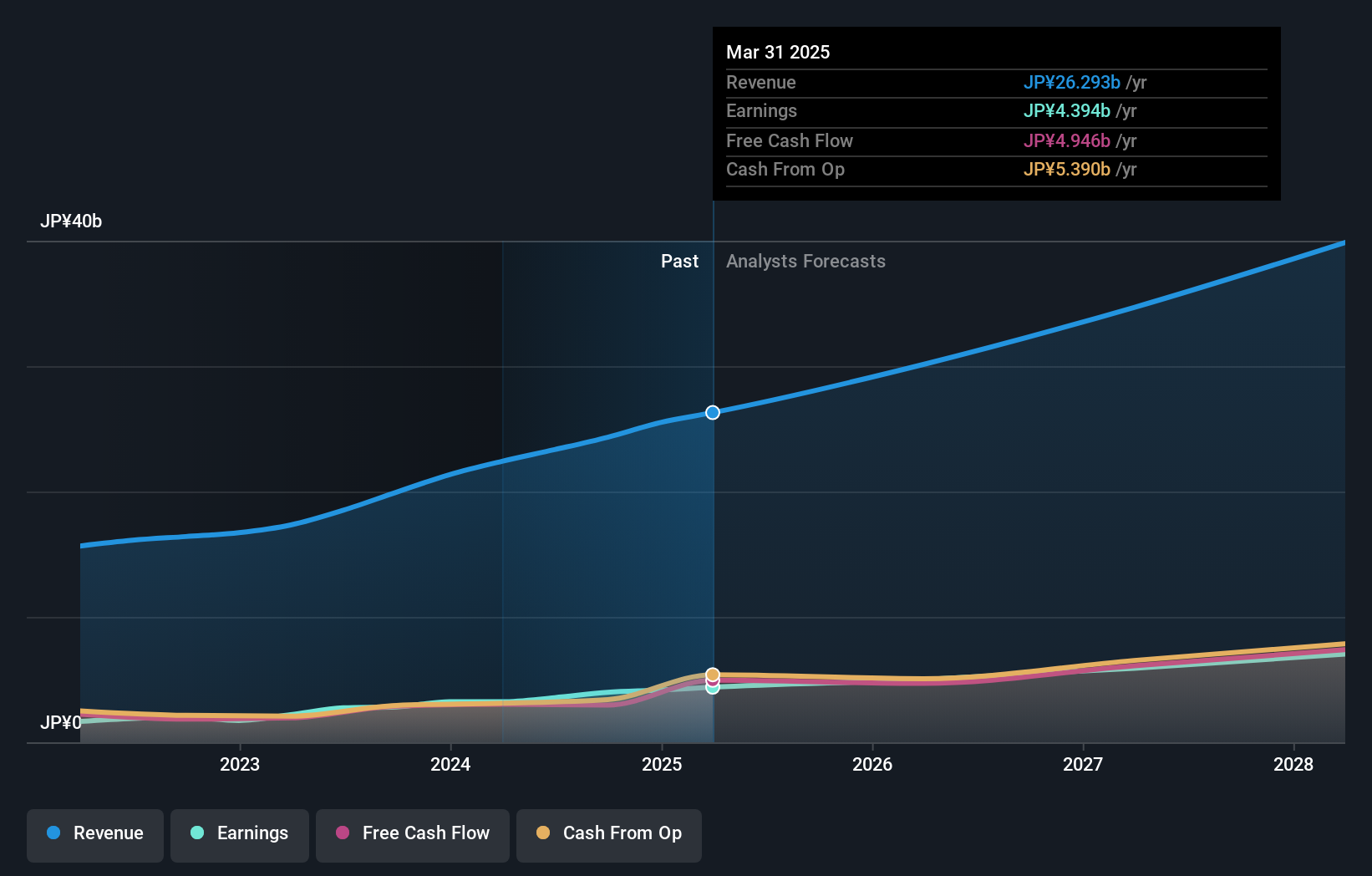

SIGMAXYZ Holdings, a promising player in its sector, showcases robust financial health with high-quality earnings and no debt, marking a significant improvement from five years ago when the debt-to-equity ratio stood at 6.4%. The company reported an impressive 41.2% earnings growth over the past year, outpacing industry averages. Recent activities include repurchasing 442,300 shares for ¥637 million between August and September 2024. However, dividend guidance indicates a reduction to ¥19 per share from last year's ¥27. With projected revenue of ¥26 billion and operating profit of ¥5.45 billion for fiscal year ending March 2025, SIGMAXYZ seems poised for steady growth despite market volatility.

San Fu Chemical (TWSE:4755)

Simply Wall St Value Rating: ★★★★★☆

Overview: San Fu Chemical Co., Ltd. is a Taiwanese company that manufactures and sells various chemical products, with a market capitalization of NT$12.44 billion.

Operations: San Fu Chemical generates revenue primarily from its Basic Chemicals Department and Precision Special Chemicals Department, with the latter contributing NT$3.94 billion. The company's gross profit margin is not specified in the data provided.

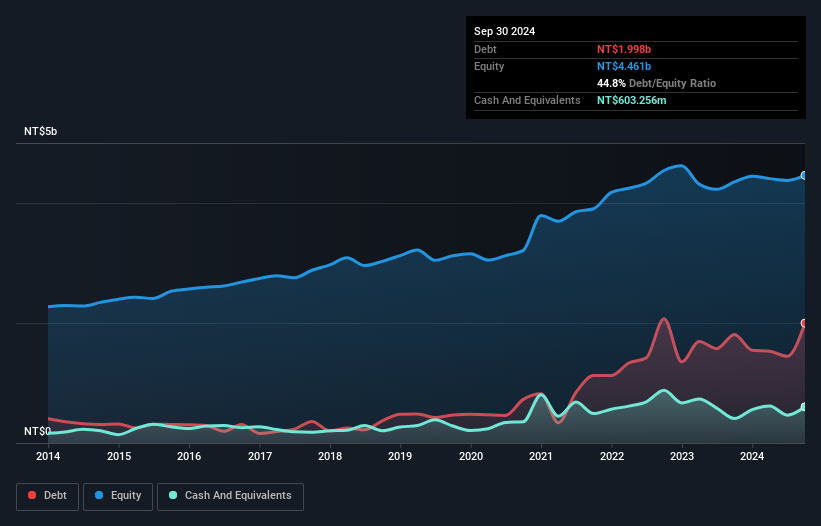

San Fu Chemical, a nimble player in the chemical industry, has shown resilience with earnings growing 7.6% annually over the past five years. Despite a rise in debt to equity from 15% to 44.8%, its net debt to equity remains satisfactory at 31.3%, and interest payments are well covered by EBIT at 24 times coverage. Recent results reveal third-quarter sales of TWD 1,233 million and net income of TWD 94 million, slightly lower than last year’s figures but indicating stable performance overall. The company’s profitability suggests a strong foundation for future growth prospects within its sector.

- Navigate through the intricacies of San Fu Chemical with our comprehensive health report here.

Evaluate San Fu Chemical's historical performance by accessing our past performance report.

Next Steps

- Gain an insight into the universe of 4636 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A101490

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives