- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A086390

We Think UniTest Incorporation's (KOSDAQ:086390) Profit Is Only A Baseline For What They Can Achieve

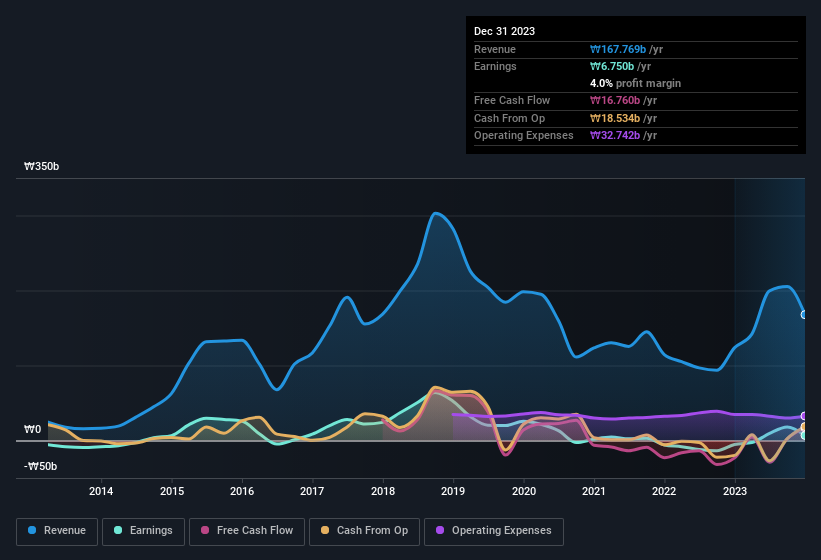

UniTest Incorporation's (KOSDAQ:086390) strong earnings report was rewarded with a positive stock price move. We have done some analysis, and we found several positive factors beyond the profit numbers.

View our latest analysis for UniTest Incorporation

The Impact Of Unusual Items On Profit

To properly understand UniTest Incorporation's profit results, we need to consider the ₩2.7b expense attributed to unusual items. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. If UniTest Incorporation doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of UniTest Incorporation.

An Unusual Tax Situation

Just as we noted the unusual items, we must inform you that UniTest Incorporation received a tax benefit which contributed ₩2.1b to the bottom line. It's always a bit noteworthy when a company is paid by the tax man, rather than paying the tax man. Of course, prima facie it's great to receive a tax benefit. And given that it lost money last year, it seems possible that the benefit is evidence that it now expects to find value in its past tax losses. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth.

Our Take On UniTest Incorporation's Profit Performance

In the last year UniTest Incorporation received a tax benefit, which boosted its profit in a way that might not be much more sustainable than turning prime farmland into gas fields. Having said that, it also had a unusual item reducing its profit. Considering the aforementioned, we think that UniTest Incorporation's profits are probably a reasonable reflection of its underlying profitability; although we'd be confident in that conclusion if we saw a cleaner set of results. If you want to do dive deeper into UniTest Incorporation, you'd also look into what risks it is currently facing. Every company has risks, and we've spotted 2 warning signs for UniTest Incorporation (of which 1 is significant!) you should know about.

Our examination of UniTest Incorporation has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A086390

UniTest Incorporation

Manufactures and sells semiconductor testing equipment in South Korea.

Mediocre balance sheet minimal.

Similar Companies

Market Insights

Community Narratives