- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A083500

Shareholders Can Be Confident That FNS TECH's (KOSDAQ:083500) Earnings Are High Quality

Even though FNS TECH. Co., Ltd's (KOSDAQ:083500) recent earnings release was robust, the market didn't seem to notice. Our analysis suggests that investors might be missing some promising details.

Check out our latest analysis for FNS TECH

A Closer Look At FNS TECH's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

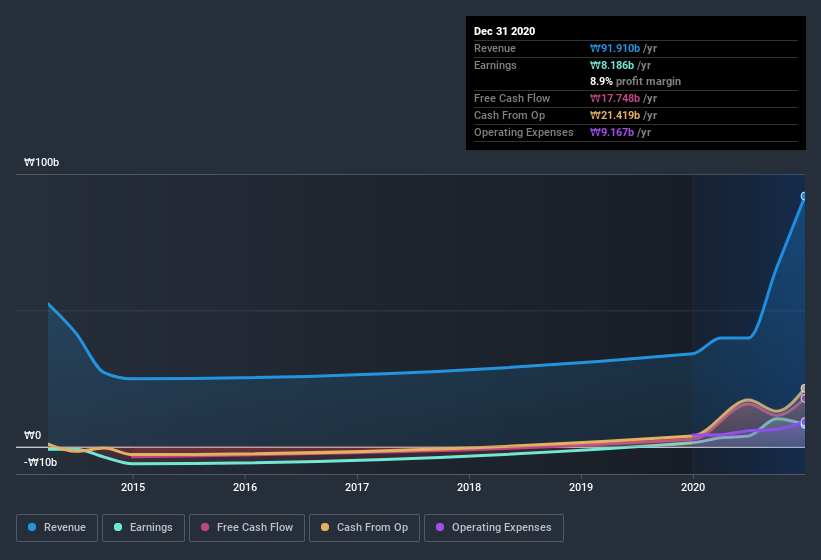

For the year to December 2020, FNS TECH had an accrual ratio of -0.23. That indicates that its free cash flow quite significantly exceeded its statutory profit. Indeed, in the last twelve months it reported free cash flow of ₩18b, well over the ₩8.19b it reported in profit. FNS TECH shareholders are no doubt pleased that free cash flow improved over the last twelve months. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of FNS TECH.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, FNS TECH issued 13% more new shares over the last year. That means its earnings are split among a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of FNS TECH's EPS by clicking here.

A Look At The Impact Of FNS TECH's Dilution on Its Earnings Per Share (EPS).

FNS TECH was losing money three years ago. The good news is that profit was up 460% in the last twelve months. But EPS was less impressive, up only 419% in that time. Therefore, the dilution is having a noteworthy influence on shareholder returns.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So FNS TECH shareholders will want to see that EPS figure continue to increase. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Our Take On FNS TECH's Profit Performance

At the end of the day, FNS TECH is diluting shareholders which will dampen earnings per share growth, but its accrual ratio showed it can back up its profits with free cash flow. Based on these factors, we think that FNS TECH's profits are a reasonably conservative guide to its underlying profitability. If you'd like to know more about FNS TECH as a business, it's important to be aware of any risks it's facing. At Simply Wall St, we found 2 warning signs for FNS TECH and we think they deserve your attention.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade FNS TECH, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A083500

FNS TECH

Manufactures and sells process equipment for OLED products worldwide.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion