Asian Growth Stocks With Strong Insider Ownership In December 2025

Reviewed by Simply Wall St

As of December 2025, Asian markets are witnessing a resurgence in investor enthusiasm, particularly in technology and artificial intelligence sectors, despite broader concerns over economic slowdowns. In this context, growth companies with high insider ownership often attract attention as they can indicate strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25.2% | 120.7% |

| SungEel HiTech (KOSDAQ:A365340) | 37.5% | 110.8% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 34.1% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

Let's review some notable picks from our screened stocks.

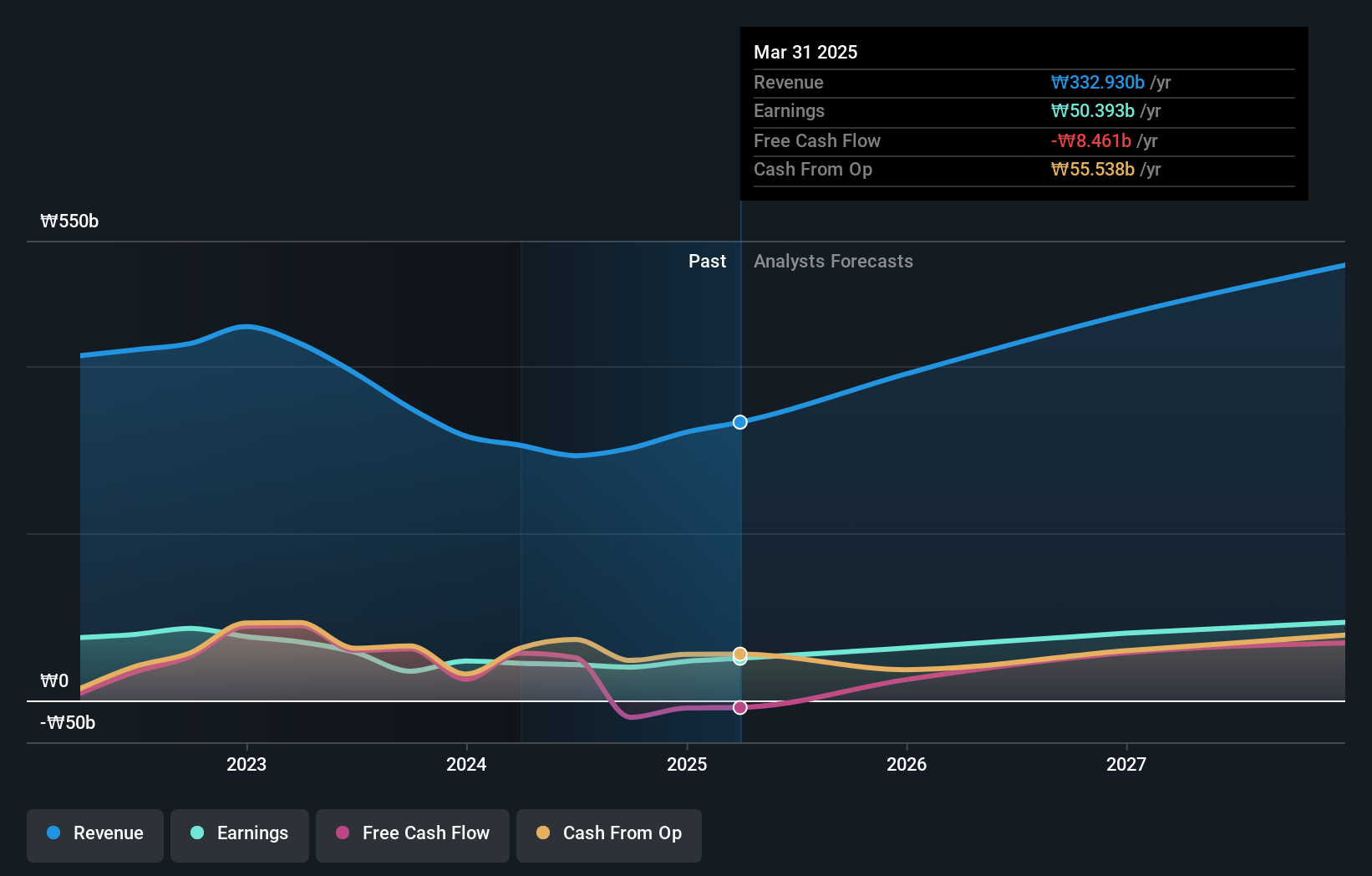

EO Technics (KOSDAQ:A039030)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: EO Technics Co., Ltd. manufactures and supplies laser processing equipment globally, with a market cap of ₩3.34 trillion.

Operations: Revenue Segments (in millions of ₩):

Insider Ownership: 30.7%

Revenue Growth Forecast: 18.8% p.a.

EO Technics is positioned for strong growth with forecasted annual revenue and earnings increases of 18.8% and 31.9%, respectively, outpacing the broader Korean market. Despite high share price volatility recently, the company maintains a substantial insider ownership, which often aligns management interests with shareholders. However, its return on equity is projected to remain modest at 14.3% in three years. Recent dividend affirmations signal confidence in ongoing financial stability.

- Dive into the specifics of EO Technics here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, EO Technics' share price might be too optimistic.

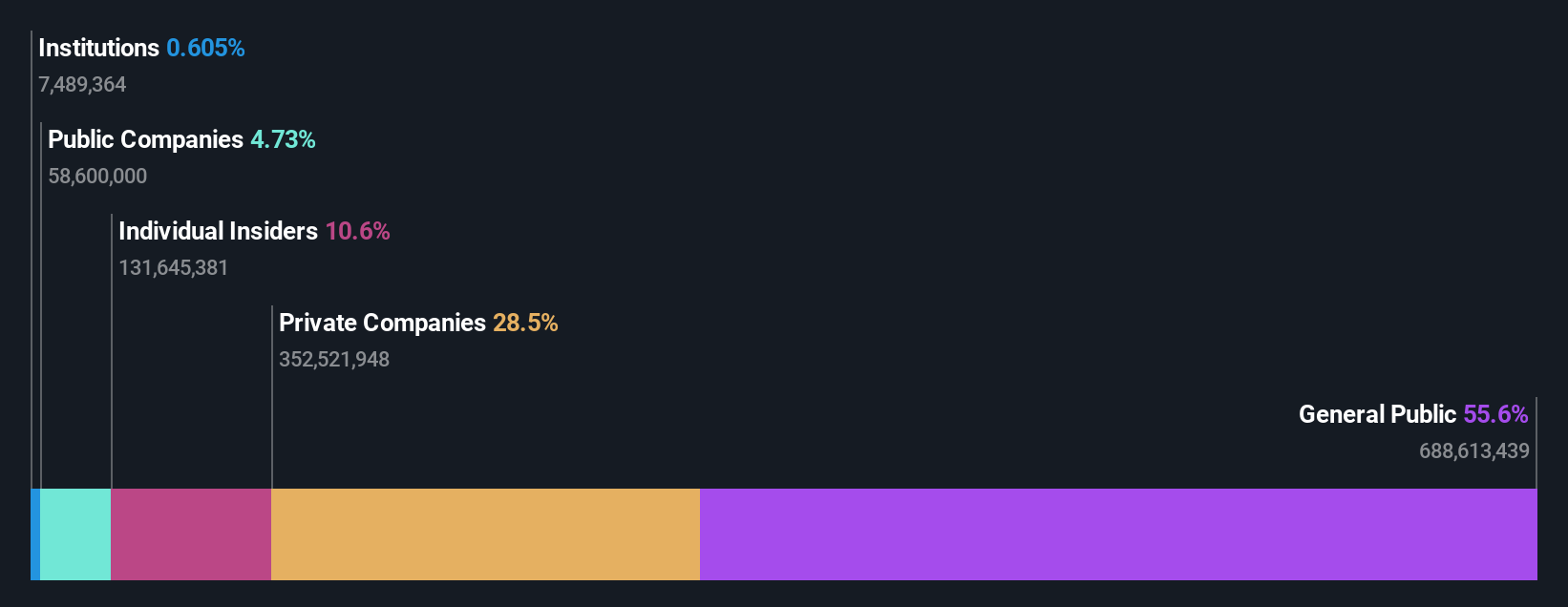

Global New Material International Holdings (SEHK:6616)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Global New Material International Holdings Limited is an investment holding company that produces and sells pearlescent pigment, functional mica filler, and related products in China and South Korea, with a market cap of HK$10.78 billion.

Operations: The company generates revenue from its operations in the People’s Republic of China, amounting to CN¥1.48 billion, and in South Korea, totaling CN¥308.71 million.

Insider Ownership: 10.6%

Revenue Growth Forecast: 41.7% p.a.

Global New Material International Holdings is projected to experience robust growth, with earnings and revenue expected to expand at approximately 41.9% and 41.7% annually, respectively, surpassing the Hong Kong market averages. Significant insider buying in recent months suggests strong internal confidence in the company's prospects. However, despite high growth expectations, its future return on equity remains modest at 10.9%. The company also reports a high level of non-cash earnings.

- Click here to discover the nuances of Global New Material International Holdings with our detailed analytical future growth report.

- Our valuation report unveils the possibility Global New Material International Holdings' shares may be trading at a premium.

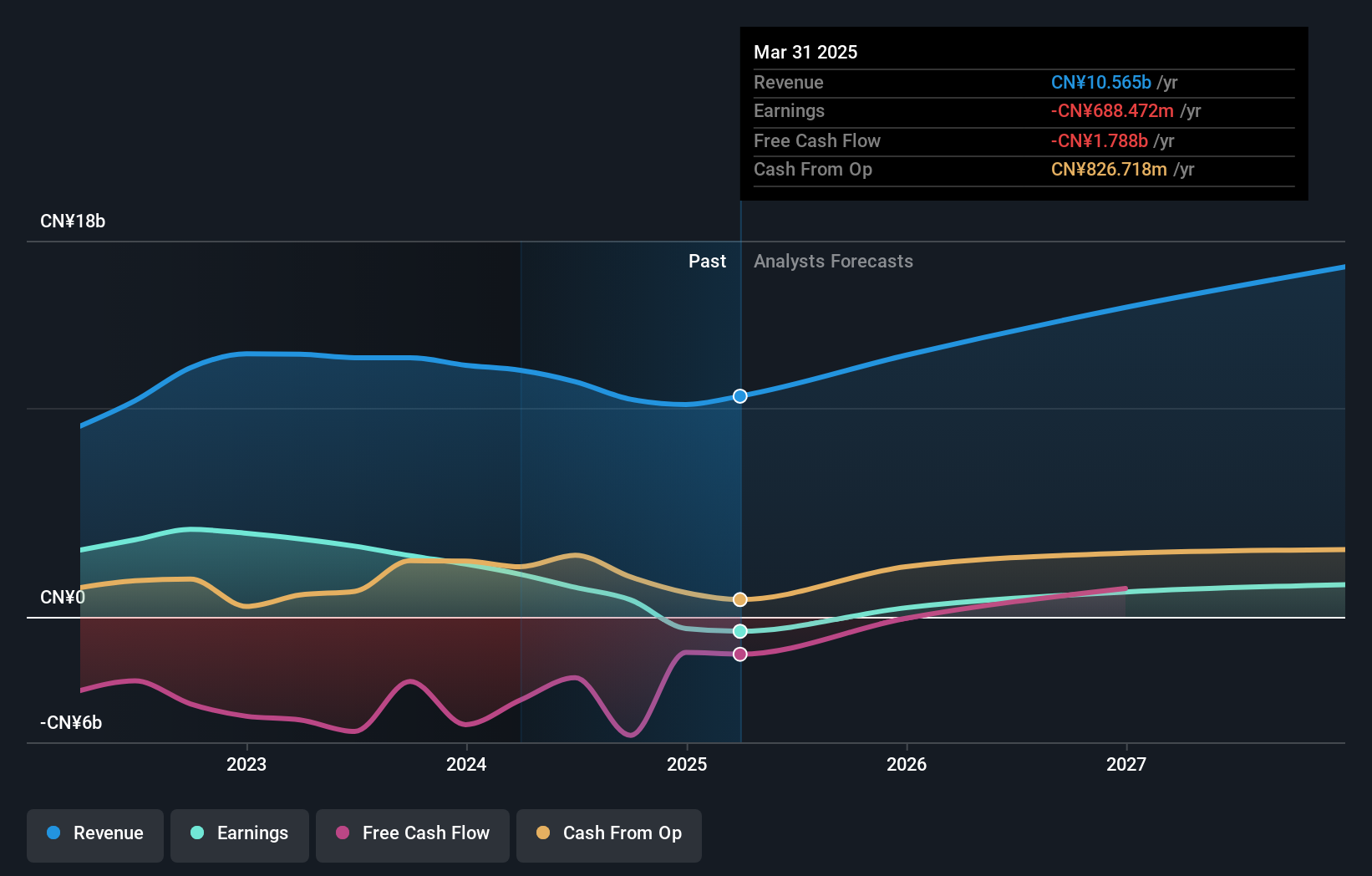

Yunnan Energy New Material (SZSE:002812)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Yunnan Energy New Material Co., Ltd., along with its subsidiaries, supplies film products both in China and internationally, with a market cap of CN¥54.04 billion.

Operations: Yunnan Energy New Material Co., Ltd. generates revenue through its provision of film products across domestic and international markets.

Insider Ownership: 30.9%

Revenue Growth Forecast: 19.8% p.a.

Yunnan Energy New Material's revenue is forecast to grow at 19.8% annually, outpacing the broader Chinese market. Despite this, the company's recent financials show a net loss of CNY 86.32 million for nine months ending September 2025, contrasting with prior profitability. The company trades significantly below its estimated fair value but faces challenges with debt coverage by operating cash flow. Recent changes in company bylaws may indicate strategic shifts amid volatile share price movements.

- Get an in-depth perspective on Yunnan Energy New Material's performance by reading our analyst estimates report here.

- The analysis detailed in our Yunnan Energy New Material valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Click through to start exploring the rest of the 635 Fast Growing Asian Companies With High Insider Ownership now.

- Want To Explore Some Alternatives? Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002812

Yunnan Energy New Material

Provides film products in China and internationally.

Reasonable growth potential and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026