As global markets experience a rebound, driven by easing core inflation and strong earnings in the financial sector, attention has turned to small-cap stocks, which have shown notable gains as evidenced by the S&P MidCap 400's impressive rise. In this environment of cautious optimism and economic recalibration, identifying undiscovered gems—stocks with solid fundamentals and growth potential—can offer intriguing opportunities for investors seeking diversification beyond large-cap technology shares.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| All E Technologies | NA | 27.05% | 31.58% | ★★★★★★ |

| Etihad Atheeb Telecommunication | NA | 30.82% | 63.88% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

Hyundai Home Shopping Network (KOSE:A057050)

Simply Wall St Value Rating: ★★★★★★

Overview: Hyundai Home Shopping Network Corporation, along with its subsidiaries, operates an online shopping company in South Korea and has a market capitalization of approximately ₩535.75 billion.

Operations: The company generates revenue primarily from its Home Shopping and Construction Material segments, with Home Shopping contributing approximately ₩1.12 trillion and Construction Material adding around ₩1.08 trillion. The net profit margin reflects the company's profitability after accounting for all expenses, taxes, and costs associated with these revenue streams.

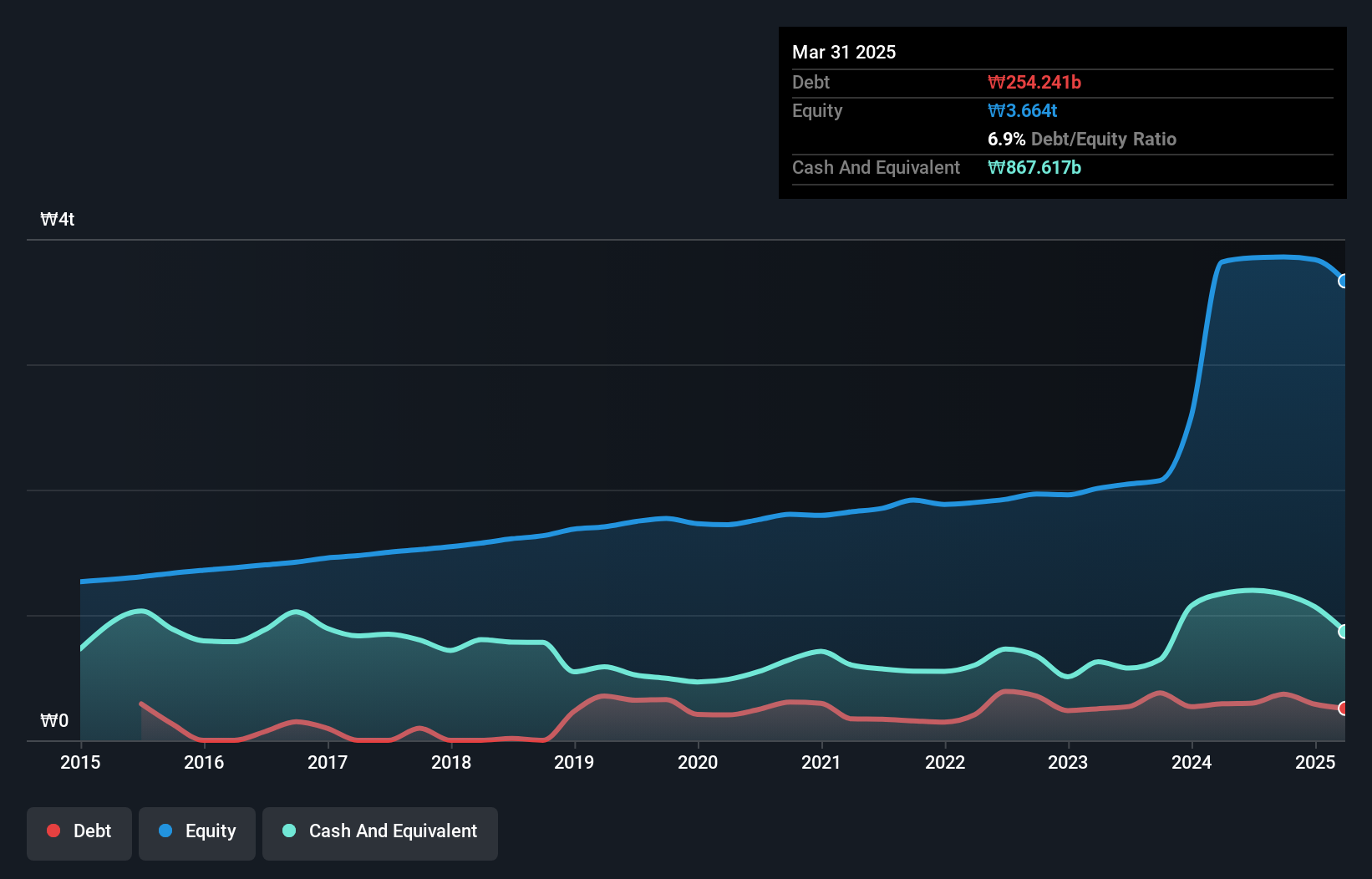

Hyundai Home Shopping Network, a relatively small player in the retail sector, has shown remarkable earnings growth of 231.5% over the past year, significantly outpacing the Multiline Retail industry's -19.9%. The company is trading at an appealing price-to-earnings ratio of 3.6x compared to the KR market average of 11.7x, indicating good relative value. Despite a large one-off loss impacting recent financial results by ₩789.6 billion, Hyundai's debt-to-equity ratio has improved from 18.4% to 9.6% over five years, suggesting better financial health and positioning for future opportunities in its industry landscape.

ISE Chemicals (TSE:4107)

Simply Wall St Value Rating: ★★★★★★

Overview: ISE Chemicals Corporation is involved in the production, processing, and trade of iodine and iodine derivatives, as well as nickel and cobalt compounds in Japan, with a market capitalization of approximately ¥144.74 billion.

Operations: ISE Chemicals generates revenue primarily through the production and trade of iodine derivatives and nickel-cobalt compounds. The company's market capitalization stands at approximately ¥144.74 billion, indicating its significant presence in the chemical industry within Japan.

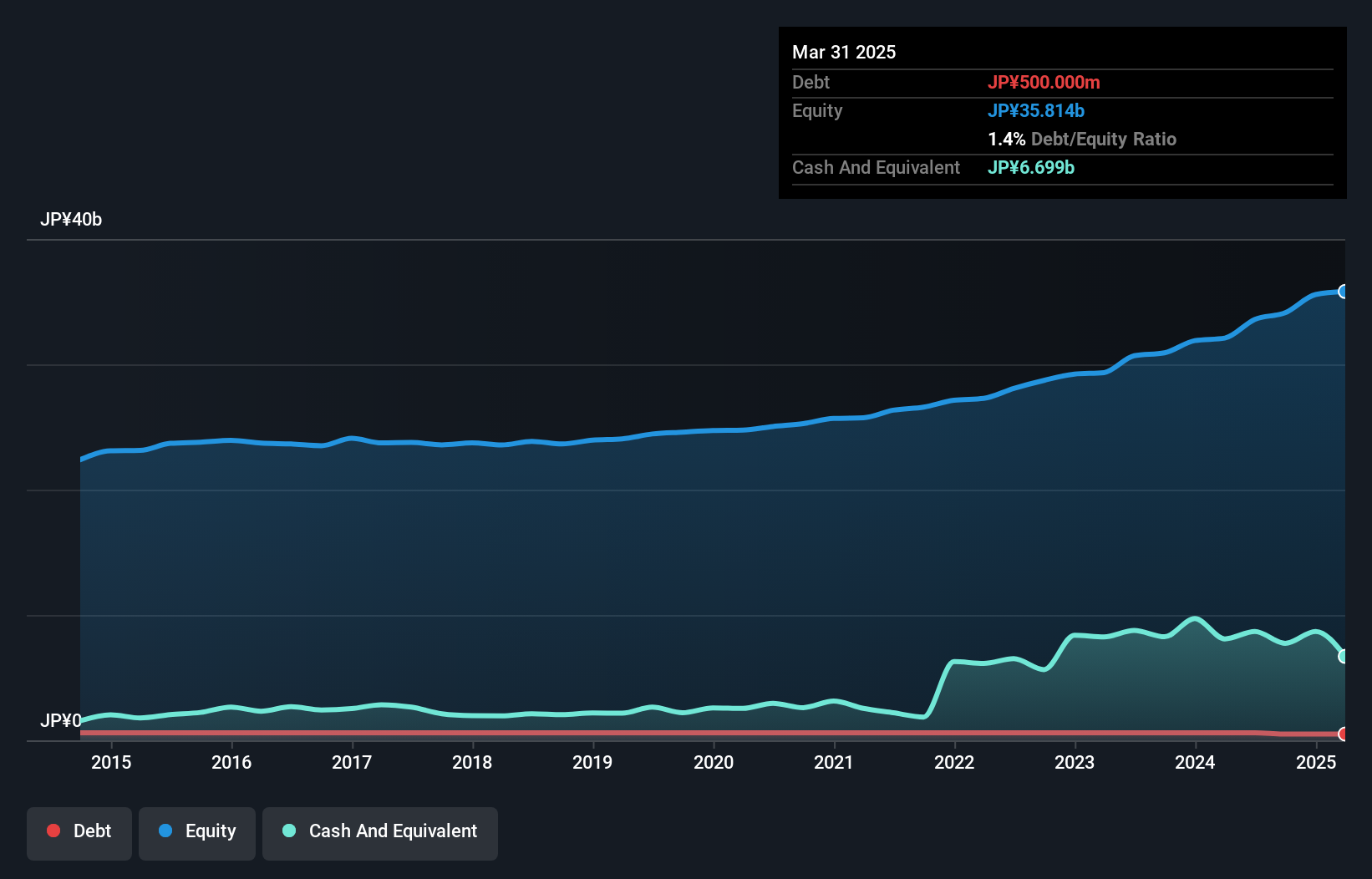

ISE Chemicals shines with a 53% earnings growth over the past year, outpacing the broader chemicals industry. This small-cap entity boasts high-quality earnings and positive free cash flow, reflecting solid operational efficiency. The debt-to-equity ratio has improved from 2.4 to 1.5 over five years, indicating prudent financial management. Despite a highly volatile share price recently, ISE's profitability suggests that its cash runway isn't worrisome for now. However, future prospects appear tempered by an expected annual earnings decline of 0.6% over the next three years, presenting both opportunities and challenges for potential investors in this dynamic sector.

- Click here to discover the nuances of ISE Chemicals with our detailed analytical health report.

Explore historical data to track ISE Chemicals' performance over time in our Past section.

Mars Group Holdings (TSE:6419)

Simply Wall St Value Rating: ★★★★★★

Overview: Mars Group Holdings Corporation, with a market cap of approximately ¥62.99 billion, operates in Japan through its subsidiaries in the amusement sector, automatic recognition systems, and hotel and restaurant related businesses.

Operations: Mars Group Holdings generates revenue primarily from its amusement segment, contributing approximately ¥37.59 billion, followed by the smart solution related business at around ¥5.34 billion, and hotel/restaurant related business at about ¥2.48 billion. The company's financial performance is impacted by a gross profit margin trend that has shown variation over recent periods.

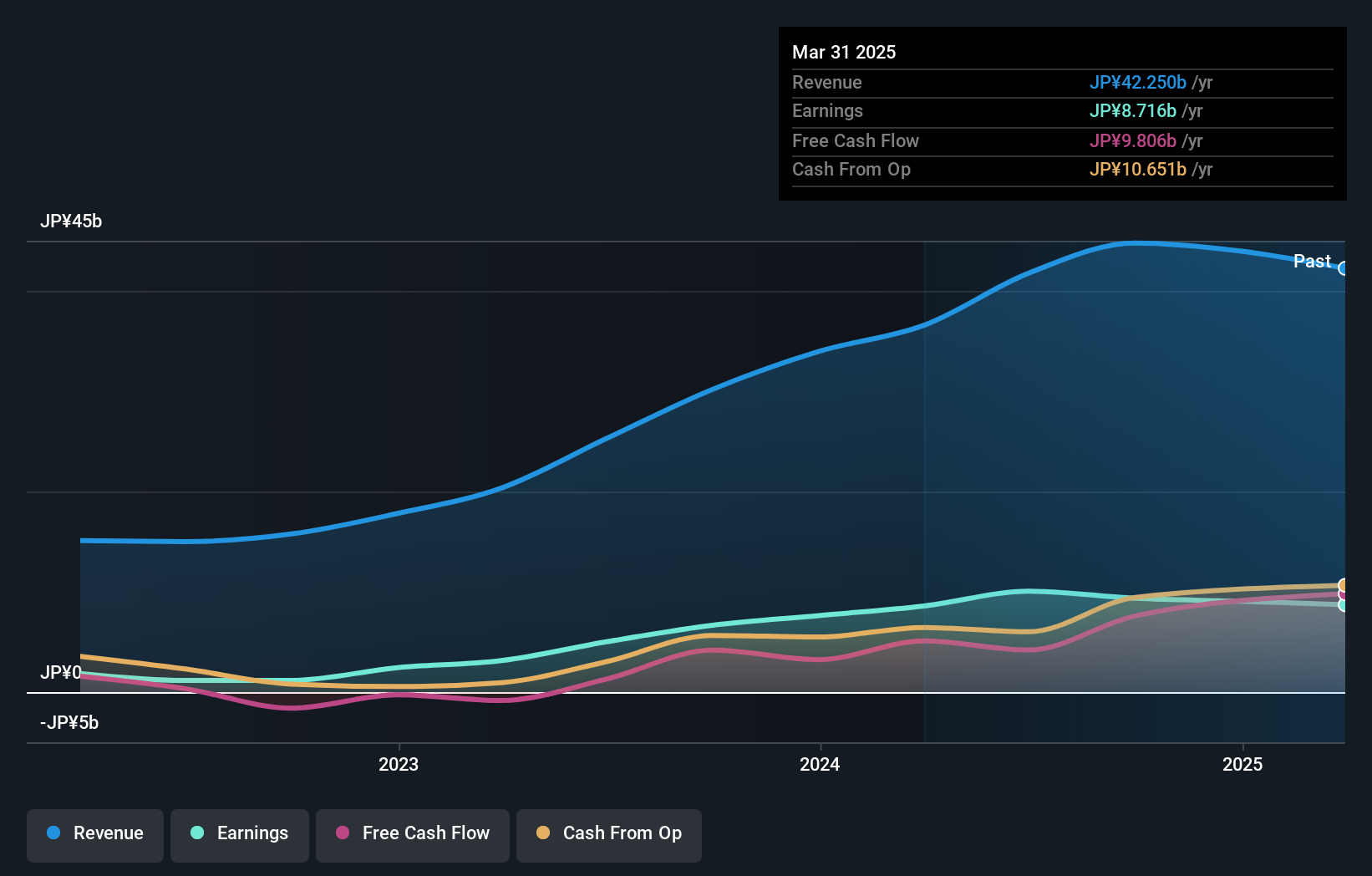

Mars Group Holdings, a nimble player in its sector, has demonstrated impressive financial health by remaining debt-free for the past five years. Its earnings surged by 40% last year, outpacing the industry average of 0.5%, showcasing robust growth potential. Trading at a significant discount of 82% below estimated fair value suggests potential undervaluation. Recently, Mars projected net sales of ¥41.8 billion and an operating profit of ¥12.2 billion for fiscal year ending March 2025, with dividends doubling to ¥120 per share from last year’s ¥60 per share, indicating confidence in its financial trajectory and shareholder returns.

Key Takeaways

- Discover the full array of 4662 Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6419

Mars Group Holdings

Engages in amusement, automatic recognition system, and hotel and restaurant related businesses in Japan.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives