- South Korea

- /

- Semiconductors

- /

- KOSE:A000660

KRX And 2 Other Stocks Possibly Trading Below Estimated Fair Value

Reviewed by Simply Wall St

The South Korean market has remained flat over the last week but is up 9.5% over the past year, with earnings forecasted to grow by 30% annually. In this context, identifying stocks that are potentially trading below their estimated fair value can be a strategic approach for investors seeking opportunities in a market poised for growth.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| PharmaResearch (KOSDAQ:A214450) | ₩233000.00 | ₩423449.70 | 45% |

| T'Way Air (KOSE:A091810) | ₩3320.00 | ₩5621.65 | 40.9% |

| TSE (KOSDAQ:A131290) | ₩53100.00 | ₩99412.98 | 46.6% |

| Wonik Ips (KOSDAQ:A240810) | ₩28050.00 | ₩48611.08 | 42.3% |

| Lutronic (KOSDAQ:A085370) | ₩36700.00 | ₩63217.94 | 41.9% |

| Intellian Technologies (KOSDAQ:A189300) | ₩49700.00 | ₩90398.93 | 45% |

| Shinsung E&GLtd (KOSE:A011930) | ₩1467.00 | ₩2856.16 | 48.6% |

| ADTechnologyLtd (KOSDAQ:A200710) | ₩14650.00 | ₩24721.87 | 40.7% |

| Global Tax Free (KOSDAQ:A204620) | ₩3950.00 | ₩6438.93 | 38.7% |

| Hotel ShillaLtd (KOSE:A008770) | ₩43500.00 | ₩81110.30 | 46.4% |

Here we highlight a subset of our preferred stocks from the screener.

TSE (KOSDAQ:A131290)

Overview: TSE Co., Ltd offers semiconductor test solutions both in South Korea and internationally, with a market capitalization of approximately ₩567.34 billion.

Operations: The company's revenue segments include ₩112.77 billion from Electronic Product Inspection, ₩13.67 billion from Semiconductor, Etc. Inspection Service, ₩160.25 billion from Semiconductor Light Inspection Equipment, and ₩21.04 billion from Semiconductors, Etc. Production Line.

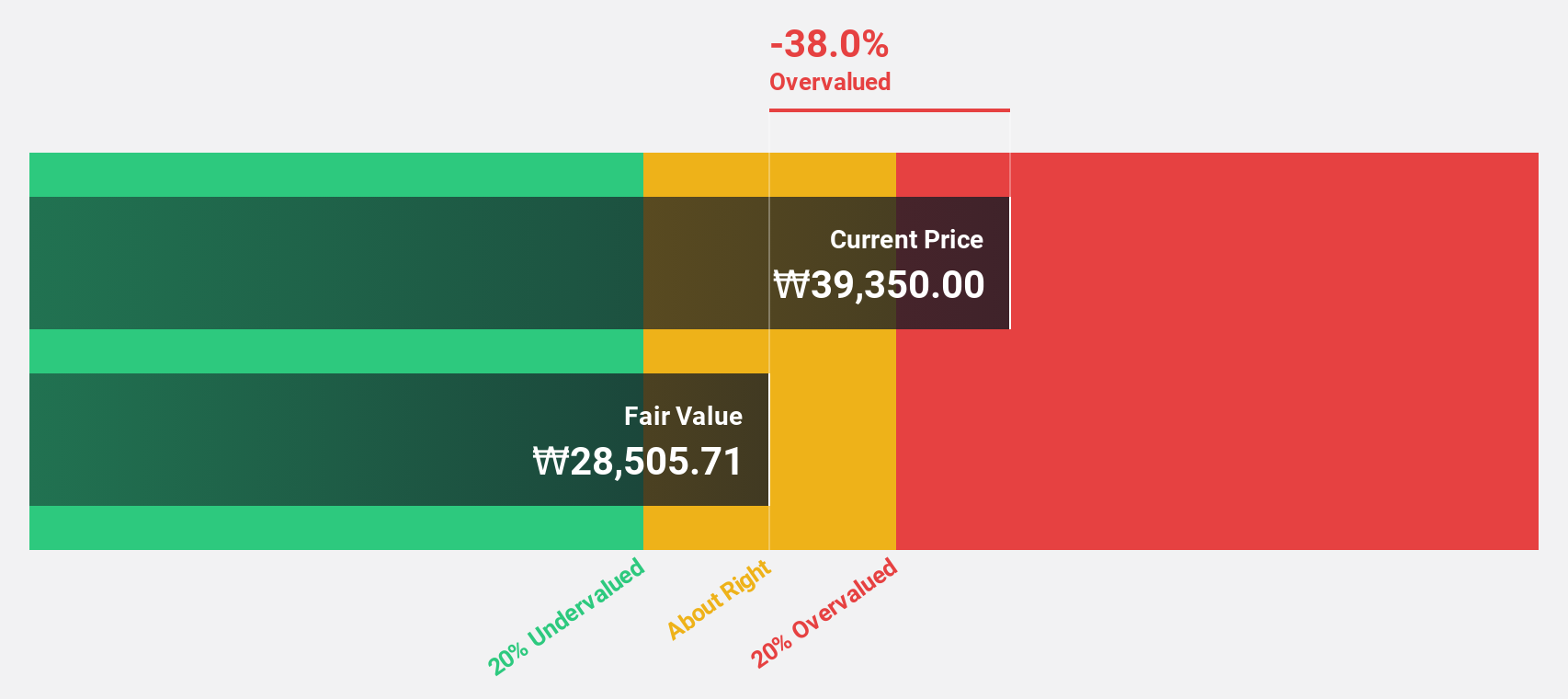

Estimated Discount To Fair Value: 46.6%

TSE is trading at ₩53,100, significantly below its estimated fair value of ₩99,412.98. Despite recent share price volatility, the stock appears undervalued based on discounted cash flow analysis. Earnings are projected to grow 48.5% annually over the next three years, outpacing the South Korean market's 29.6%. Revenue growth is expected at 13.5% per year, faster than the market average of 10.3%, although return on equity may remain low at 13.7%.

- Our earnings growth report unveils the potential for significant increases in TSE's future results.

- Click to explore a detailed breakdown of our findings in TSE's balance sheet health report.

SK hynix (KOSE:A000660)

Overview: SK hynix Inc., along with its subsidiaries, manufactures, distributes, and sells semiconductor products across Korea, China, the rest of Asia, the United States, and Europe with a market cap of approximately ₩134.97 trillion.

Operations: The company's revenue from the manufacture and sale of semiconductor products amounts to approximately ₩49.22 billion.

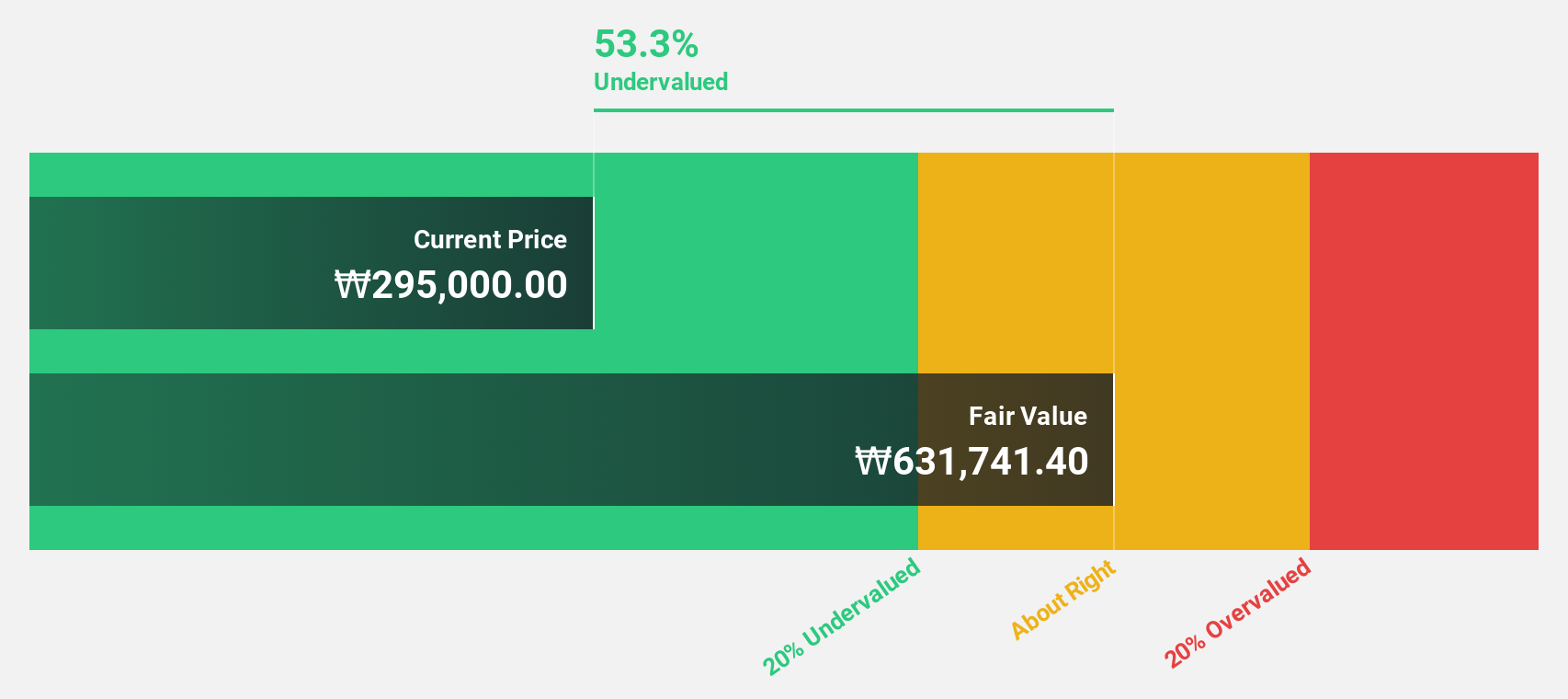

Estimated Discount To Fair Value: 10.6%

SK hynix is trading at ₩196,000, slightly below its estimated fair value of ₩219,118.51. The company has recently turned profitable and earnings are forecast to grow significantly over the next three years at 41.5% annually, surpassing the South Korean market's 29.6%. Revenue growth is projected at 22.4% per year, also exceeding market expectations of 10.3%. However, return on equity may remain modest at 18.9%.

- In light of our recent growth report, it seems possible that SK hynix's financial performance will exceed current levels.

- Click here to discover the nuances of SK hynix with our detailed financial health report.

Hotel ShillaLtd (KOSE:A008770)

Overview: Hotel Shilla Co., Ltd is a hospitality company operating in South Korea and internationally, with a market cap of ₩1.64 trillion.

Operations: The company's revenue is primarily derived from the Travel Retail segment, which accounts for ₩3.31 trillion, and the Hotel & Leisure Sector, Etc., contributing ₩701.77 billion.

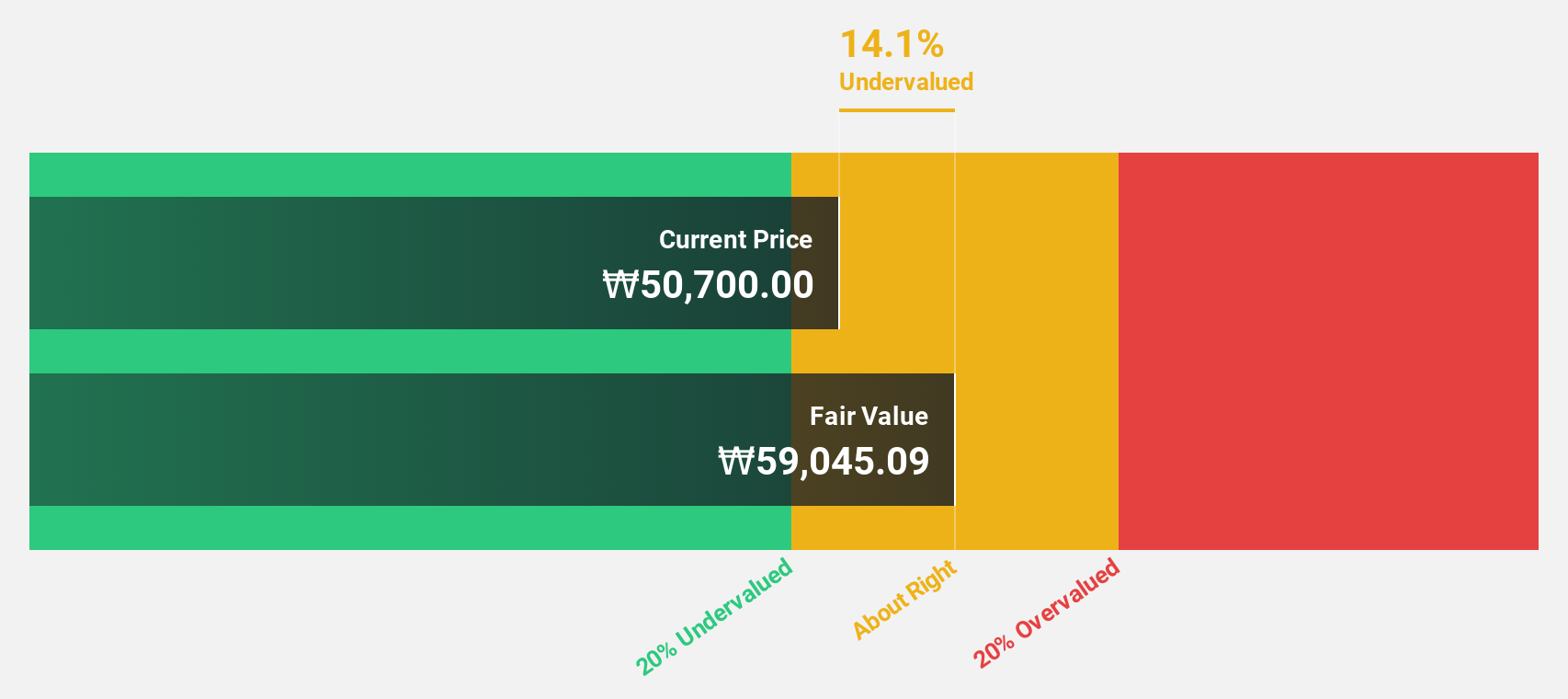

Estimated Discount To Fair Value: 46.4%

Hotel Shilla Ltd. is trading at ₩43,500, significantly below its estimated fair value of ₩81,110.3, indicating it may be undervalued based on cash flows. The company is expected to become profitable over the next three years with earnings growing 70.82% annually, exceeding market averages. However, interest payments are not well covered by earnings and return on equity is forecast to remain low at 16.5%. Revenue growth is projected at 11.3% per year.

- According our earnings growth report, there's an indication that Hotel ShillaLtd might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Hotel ShillaLtd.

Seize The Opportunity

- Embark on your investment journey to our 32 Undervalued KRX Stocks Based On Cash Flows selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000660

SK hynix

Engages in the manufacture, distribution, and sale of semiconductor products in Korea, China, rest of Asia, the United States, and Europe.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives