- South Korea

- /

- General Merchandise and Department Stores

- /

- KOSE:A004170

SHINSEGAE Inc. (KRX:004170) Screens Well But There Might Be A Catch

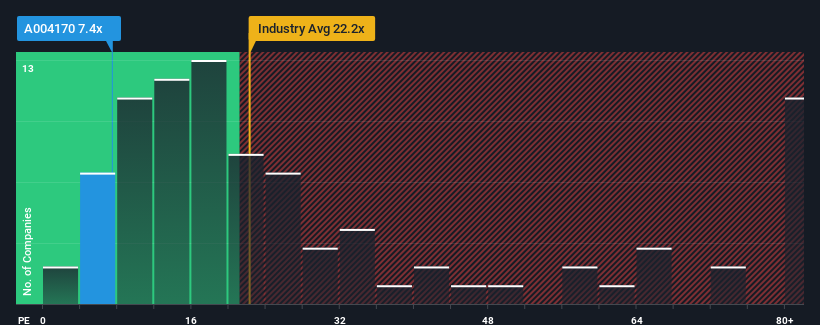

With a price-to-earnings (or "P/E") ratio of 7.4x SHINSEGAE Inc. (KRX:004170) may be sending bullish signals at the moment, given that almost half of all companies in Korea have P/E ratios greater than 12x and even P/E's higher than 23x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

While the market has experienced earnings growth lately, SHINSEGAE's earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for SHINSEGAE

Does Growth Match The Low P/E?

In order to justify its P/E ratio, SHINSEGAE would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 47%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 167% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 21% each year as estimated by the analysts watching the company. That's shaping up to be similar to the 20% per year growth forecast for the broader market.

With this information, we find it odd that SHINSEGAE is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From SHINSEGAE's P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of SHINSEGAE's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with SHINSEGAE (at least 1 which shouldn't be ignored), and understanding these should be part of your investment process.

You might be able to find a better investment than SHINSEGAE. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A004170

Good value slight.

Market Insights

Community Narratives