- South Korea

- /

- Specialty Stores

- /

- KOSDAQ:A067990

What Kind Of Shareholders Hold The Majority In Deutsch Motors Inc.'s (KOSDAQ:067990) Shares?

A look at the shareholders of Deutsch Motors Inc. (KOSDAQ:067990) can tell us which group is most powerful. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones. I generally like to see some degree of insider ownership, even if only a little. As Nassim Nicholas Taleb said, 'Don’t tell me what you think, tell me what you have in your portfolio.

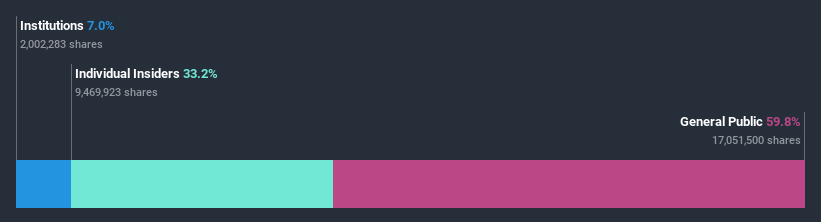

With a market capitalization of ₩185b, Deutsch Motors is a small cap stock, so it might not be well known by many institutional investors. In the chart below, we can see that institutions own shares in the company. We can zoom in on the different ownership groups, to learn more about Deutsch Motors.

See our latest analysis for Deutsch Motors

What Does The Institutional Ownership Tell Us About Deutsch Motors?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

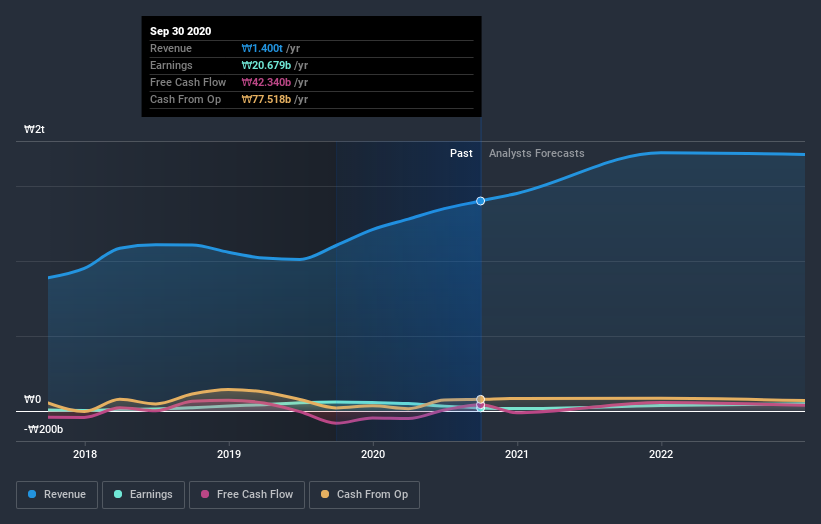

Deutsch Motors already has institutions on the share registry. Indeed, they own a respectable stake in the company. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Deutsch Motors' historic earnings and revenue below, but keep in mind there's always more to the story.

Deutsch Motors is not owned by hedge funds. With a 33% stake, CEO Oh-Soo Kwon is the largest shareholder. For context, the second largest shareholder holds about 4.9% of the shares outstanding, followed by an ownership of 1.6% by the third-largest shareholder.

Our studies suggest that the top 8 shareholders collectively control less than half of the company's shares, meaning that the company's shares are widely disseminated and there is no dominant shareholder.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of Deutsch Motors

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our information suggests that insiders maintain a significant holding in Deutsch Motors Inc.. Insiders own ₩62b worth of shares in the ₩185b company. I would say this shows alignment with shareholders, but it is worth noting that the company is still quite small; some insiders may have founded the business. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public, who are mostly retail investors, collectively hold 60% of Deutsch Motors shares. This level of ownership gives retail investors the power to sway key policy decisions such as board composition, executive compensation, and the dividend payout ratio.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Be aware that Deutsch Motors is showing 2 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

When trading Deutsch Motors or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A067990

Deutsch Motors

Engages in the BMW authorized dealer business in South Korea.

Good value slight.