- South Korea

- /

- Entertainment

- /

- KOSDAQ:A035760

Are CJ ENM's (KOSDAQ:035760) Statutory Earnings A Good Reflection Of Its Earnings Potential?

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. Today we'll focus on whether this year's statutory profits are a good guide to understanding CJ ENM (KOSDAQ:035760).

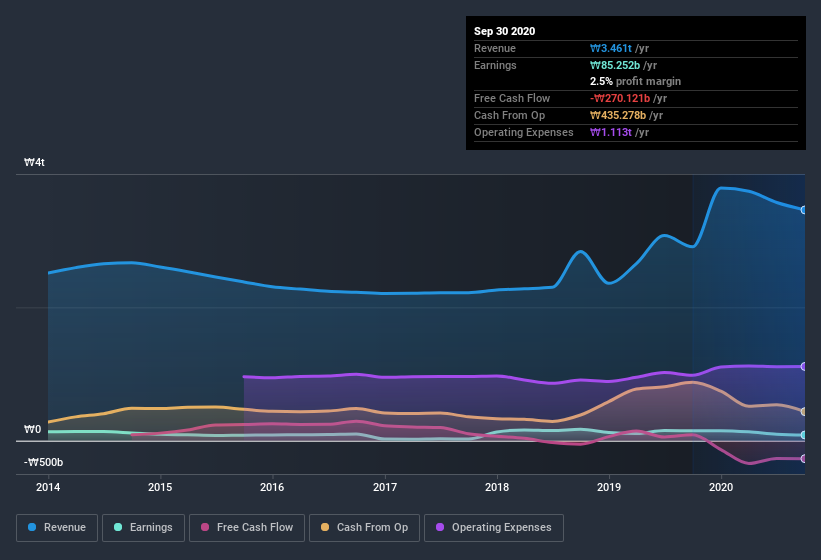

While CJ ENM was able to generate revenue of ₩3.46t in the last twelve months, we think its profit result of ₩85.3b was more important. Happily, it has grown both its profit and revenue over the last three years (though we note its profit is down over the last year).

See our latest analysis for CJ ENM

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. This article will focus on the impact unusual items have had on CJ ENM's statutory earnings. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Impact Of Unusual Items On Profit

Importantly, our data indicates that CJ ENM's profit was reduced by ₩62b, due to unusual items, over the last year. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual expenses don't come up again, we'd therefore expect CJ ENM to produce a higher profit next year, all else being equal.

Our Take On CJ ENM's Profit Performance

Unusual items (expenses) detracted from CJ ENM's earnings over the last year, but we might see an improvement next year. Because of this, we think CJ ENM's earnings potential is at least as good as it seems, and maybe even better! Unfortunately, though, its earnings per share actually fell back over the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. At Simply Wall St, we found 3 warning signs for CJ ENM and we think they deserve your attention.

This note has only looked at a single factor that sheds light on the nature of CJ ENM's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you’re looking to trade CJ ENM, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A035760

CJ ENM

Engages in media platform, film/drama, music, and commerce businesses in South Korea.

Fair value with questionable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026