- South Korea

- /

- Real Estate

- /

- KOSE:A210980

Subdued Growth No Barrier To SK D&D Co. Ltd. (KRX:210980) With Shares Advancing 26%

The SK D&D Co. Ltd. (KRX:210980) share price has done very well over the last month, posting an excellent gain of 26%. Looking back a bit further, it's encouraging to see the stock is up 48% in the last year.

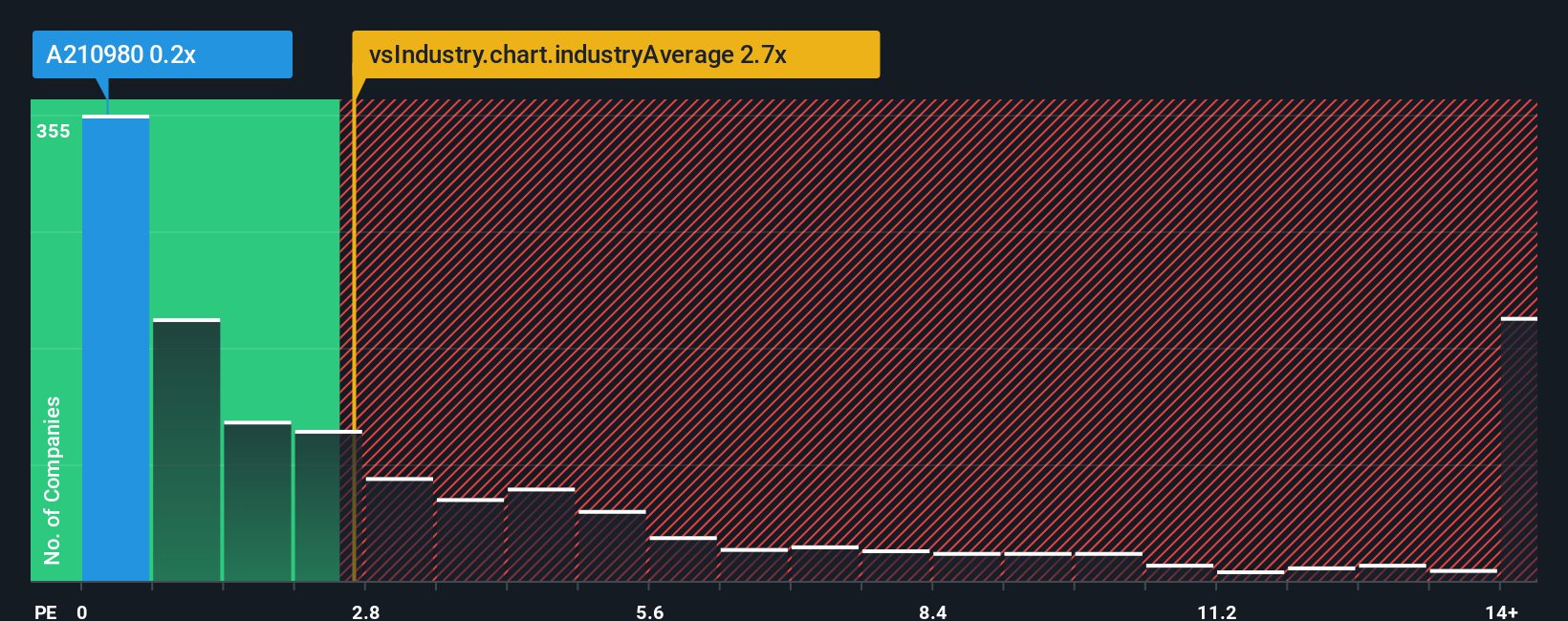

Although its price has surged higher, it's still not a stretch to say that SK D&D's price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Real Estate industry in Korea, seeing as it matches the P/S ratio of the wider industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for SK D&D

What Does SK D&D's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, SK D&D has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on SK D&D will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

SK D&D's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Thanks to this gigantic uplift, it also grew revenue by 19% in total over the last three years. So while the recent revenue growth has been good for the company, we do note that it does tend to experience some large revenue swings, particularly over the last 12 months.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue growth is heading into negative territory, declining 23% per year over the next three years. With the industry predicted to deliver 5.5% growth per annum, that's a disappointing outcome.

With this information, we find it concerning that SK D&D is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Final Word

SK D&D's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

While SK D&D's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with SK D&D, and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A210980

Excellent balance sheet average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026