- South Korea

- /

- Real Estate

- /

- KOSE:A210980

3 High Yielding Dividend Stocks On KRX With Up To 8.6% Yield

Reviewed by Simply Wall St

The South Korean market has shown a modest uptick, rising 3.3% in the past week, though it has remained largely unchanged over the past year with earnings expected to grow by 29% annually. In this context, high-yielding dividend stocks can be particularly appealing for investors looking for stable returns in a steady market.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 4.62% | ★★★★★★ |

| NH Investment & Securities (KOSE:A005940) | 6.65% | ★★★★★☆ |

| Shinhan Financial Group (KOSE:A055550) | 4.46% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 7.22% | ★★★★★☆ |

| KT (KOSE:A030200) | 5.38% | ★★★★★☆ |

| LOTTE Fine Chemical (KOSE:A004000) | 4.22% | ★★★★★☆ |

| KB Financial Group (KOSE:A105560) | 3.84% | ★★★★★☆ |

| Cheil Worldwide (KOSE:A030000) | 5.89% | ★★★★☆☆ |

| Snt DynamicsLtd (KOSE:A003570) | 3.70% | ★★★★☆☆ |

| Samyang (KOSE:A145990) | 3.49% | ★★★★☆☆ |

Click here to see the full list of 72 stocks from our Top KRX Dividend Stocks screener.

We'll examine a selection from our screener results.

TYM (KOSE:A002900)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TYM Corporation, with a market cap of approximately ₩194.03 billion, engages in the manufacturing and sale of agricultural machinery and cigarette filters, operating both in South Korea and internationally.

Operations: TYM Corporation generates its revenue primarily from the sale of agricultural machinery and cigarette filters.

Dividend Yield: 3.5%

TYM Corporation, a South Korean firm, reported a significant drop in sales and net income for 2023, with revenues falling to KRW 836.48 billion from KRW 1.17 billion the previous year and net income decreasing to KRW 60.43 million from KRW 98.19 million. Despite this downturn, TYM has maintained its dividend payments supported by a low cash payout ratio of 33% and an earnings coverage ratio of 15.7%, indicating financial prudence in maintaining shareholder returns amidst revenue challenges. The company’s dividend history is relatively short and has shown volatility over the past five years, raising concerns about the stability of future dividends.

- Navigate through the intricacies of TYM with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, TYM's share price might be too pessimistic.

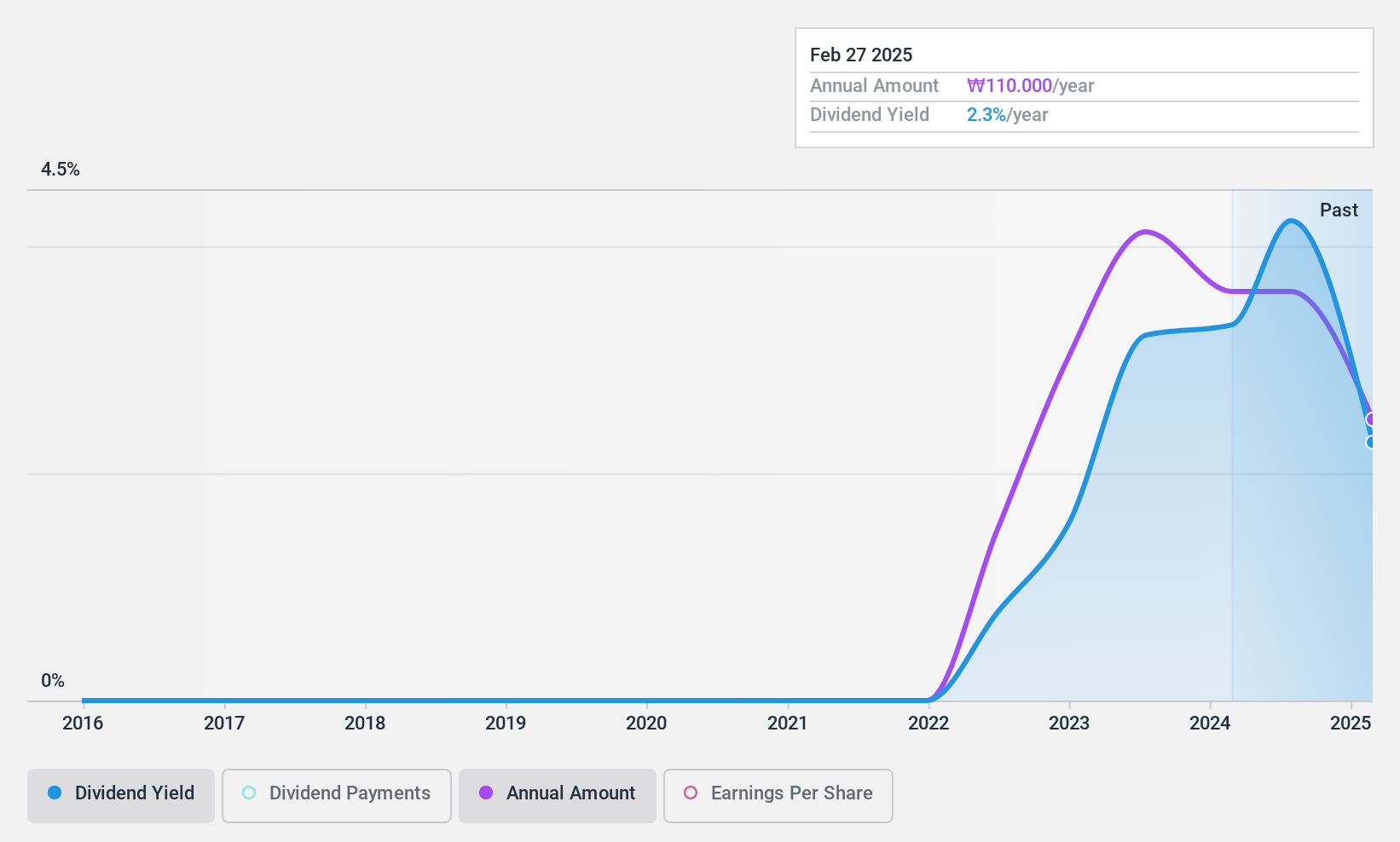

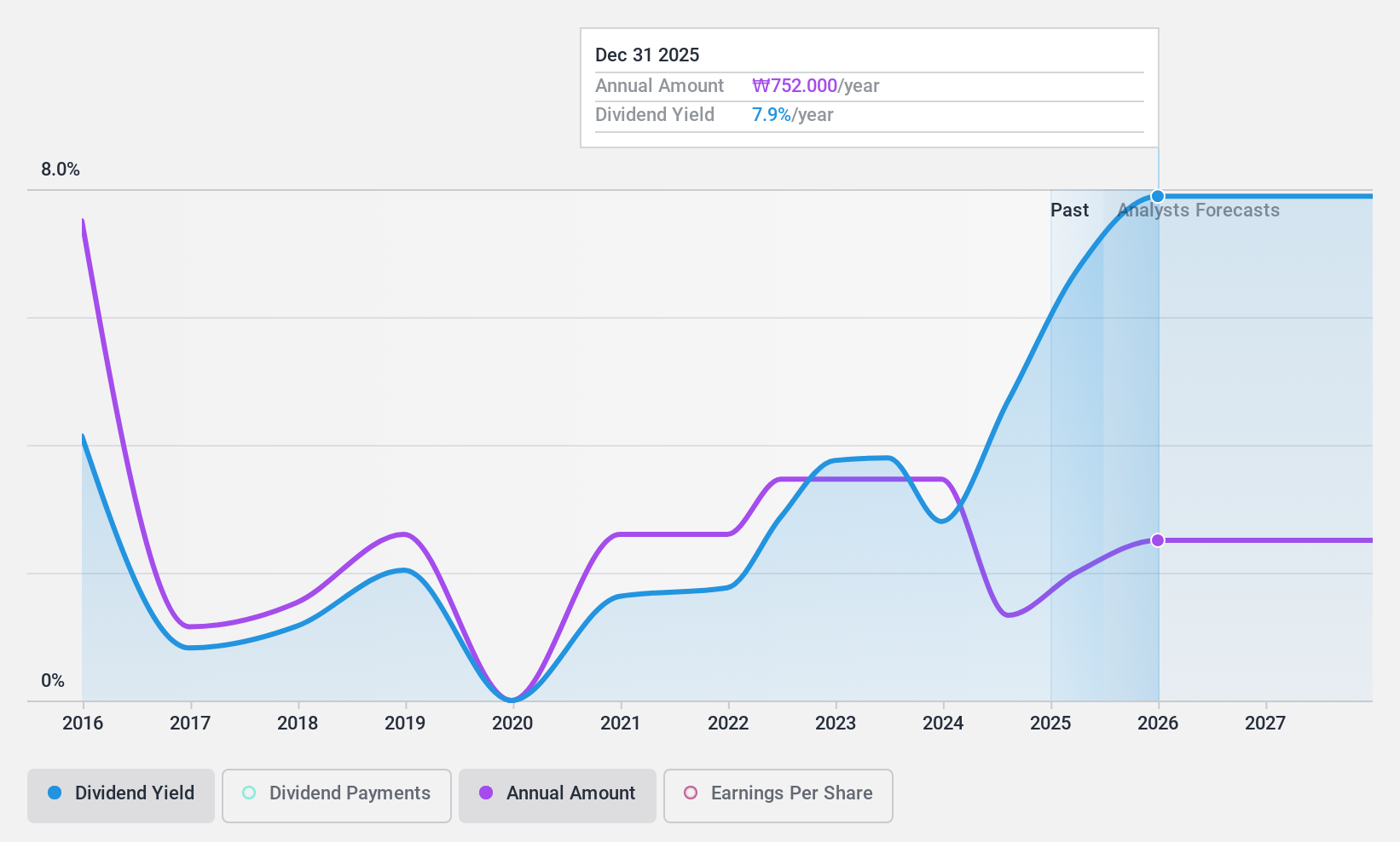

SK D&D (KOSE:A210980)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SK D&D Co. Ltd. is a South Korean company that specializes in the development, marketing, and management of real estate properties, with a market capitalization of approximately ₩228.17 billion.

Operations: SK D&D Co. Ltd. generates revenue primarily through the development, marketing, and management of real estate properties in South Korea.

Dividend Yield: 8.7%

SK D&D, despite a high current dividend yield of 8.69%, displays a shaky dividend history with payments showing significant volatility over its 9-year dividend-paying period. The dividends, although covered by earnings and cash flows with payout ratios of 22.1% and 65.2% respectively, face sustainability issues amid forecasts of an average annual earnings decline of 36.7% over the next three years. Additionally, recent strategic alliances like the partnership with Habyt aim to bolster its residential solutions business, potentially impacting future financial flexibility and performance.

- Dive into the specifics of SK D&D here with our thorough dividend report.

- The analysis detailed in our SK D&D valuation report hints at an deflated share price compared to its estimated value.

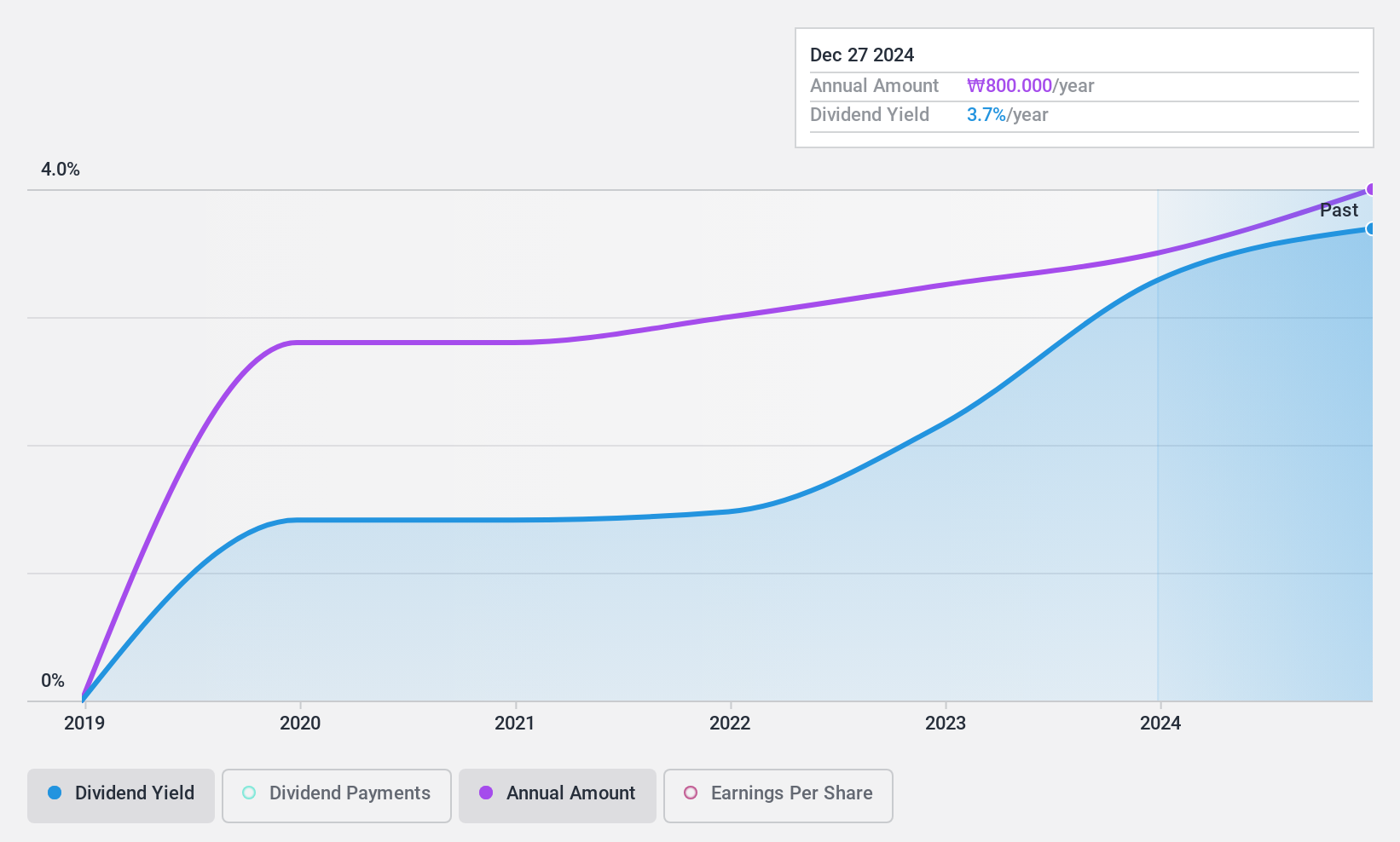

CUCKOO Homesys (KOSE:A284740)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CUCKOO Homesys Co., Ltd. is a South Korean company specializing in the manufacture, sale, and rental of household appliances, with a market capitalization of approximately ₩0.49 billion.

Operations: CUCKOO Homesys Co., Ltd. generates its revenue primarily through the manufacture, sale, and rental of household appliances.

Dividend Yield: 3.7%

CUCKOO Homesys Co., Ltd, with a Price-To-Earnings ratio of 4.4x, stands below the South Korean market average of 12.7x, indicating potential value. Its dividend yield at 3.69% ranks in the top quartile of Korean dividend payers. The company's dividends are well-supported by both earnings and cash flows, with payout ratios at 16.2% and 23.1%, respectively, suggesting sustainability despite its relatively short history of less than ten years in dividend payments. However, recent financials show a slight dip in net income from KRW 29,892.97 million to KRW 28,951.79 million year-over-year as of Q1 2024.

- Take a closer look at CUCKOO Homesys' potential here in our dividend report.

- Our expertly prepared valuation report CUCKOO Homesys implies its share price may be too high.

Taking Advantage

- Unlock our comprehensive list of 72 Top KRX Dividend Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A210980

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026