- South Korea

- /

- Pharma

- /

- KOSE:A128940

Investors in Hanmi Pharm (KRX:128940) have unfortunately lost 22% over the last year

The simplest way to benefit from a rising market is to buy an index fund. But if you buy individual stocks, you can do both better or worse than that. Unfortunately the Hanmi Pharm. Co., Ltd. (KRX:128940) share price slid 22% over twelve months. That contrasts poorly with the market decline of 0.003%. On the other hand, the stock is actually up 3.6% over three years. The share price has dropped 23% in three months.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they've been consistent with returns.

View our latest analysis for Hanmi Pharm

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate twelve months during which the Hanmi Pharm share price fell, it actually saw its earnings per share (EPS) improve by 22%. Of course, the situation might betray previous over-optimism about growth.

It's surprising to see the share price fall so much, despite the improved EPS. So it's well worth checking out some other metrics, too.

With a low yield of 0.2% we doubt that the dividend influences the share price much. Hanmi Pharm's revenue is actually up 10% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

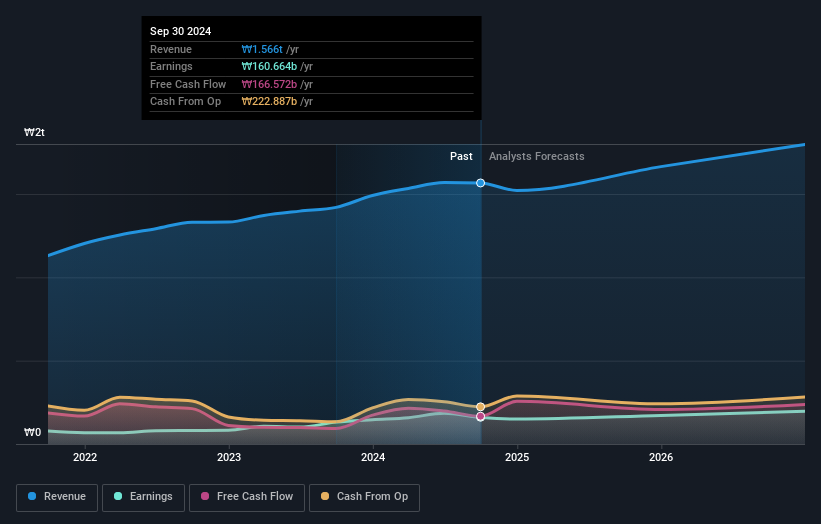

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Hanmi Pharm is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Hanmi Pharm in this interactive graph of future profit estimates.

A Different Perspective

We regret to report that Hanmi Pharm shareholders are down 22% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 0.003%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 1.1% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. Before forming an opinion on Hanmi Pharm you might want to consider these 3 valuation metrics.

We will like Hanmi Pharm better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hanmi Pharm might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A128940

Hanmi Pharm

A biopharmaceutical company, engages in the manufacture and sale of pharmaceutical products in South Korea, China, Japan, the United States, and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives