- South Korea

- /

- Pharma

- /

- KOSE:A019170

Shinpoong Pharmaceutical Co.,Ltd's (KRX:019170) 30% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

The Shinpoong Pharmaceutical Co.,Ltd (KRX:019170) share price has softened a substantial 30% over the previous 30 days, handing back much of the gains the stock has made lately. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 25% in that time.

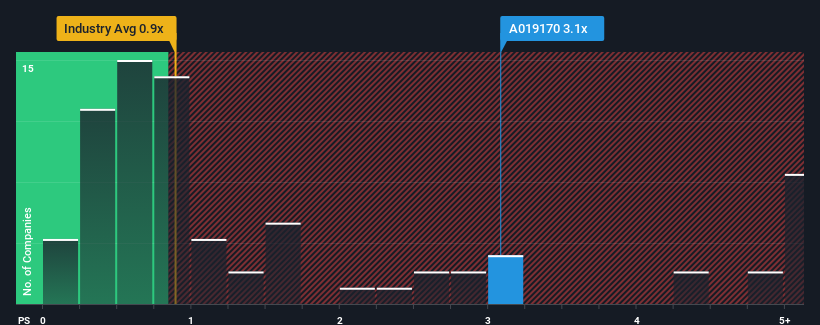

In spite of the heavy fall in price, given around half the companies in Korea's Pharmaceuticals industry have price-to-sales ratios (or "P/S") below 0.9x, you may still consider Shinpoong PharmaceuticalLtd as a stock to avoid entirely with its 3.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Shinpoong PharmaceuticalLtd

How Has Shinpoong PharmaceuticalLtd Performed Recently?

For example, consider that Shinpoong PharmaceuticalLtd's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Shinpoong PharmaceuticalLtd's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

Shinpoong PharmaceuticalLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.3%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 11% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 58% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in mind, we find it worrying that Shinpoong PharmaceuticalLtd's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What Does Shinpoong PharmaceuticalLtd's P/S Mean For Investors?

A significant share price dive has done very little to deflate Shinpoong PharmaceuticalLtd's very lofty P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

The fact that Shinpoong PharmaceuticalLtd currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Shinpoong PharmaceuticalLtd you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A019170

Shinpoong PharmaceuticalLtd

Manufactures and sells pharmaceutical products in South Korea.

Flawless balance sheet minimal.