- South Korea

- /

- Pharma

- /

- KOSE:A019170

Shinpoong Pharmaceutical Co.,Ltd (KRX:019170) Shares May Have Slumped 26% But Getting In Cheap Is Still Unlikely

Shinpoong Pharmaceutical Co.,Ltd (KRX:019170) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 25% in that time.

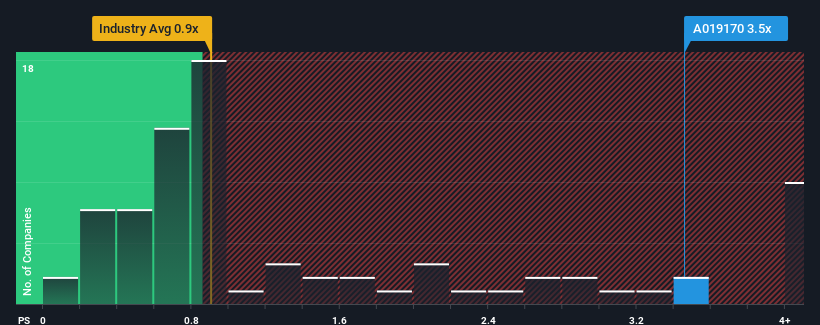

Although its price has dipped substantially, when almost half of the companies in Korea's Pharmaceuticals industry have price-to-sales ratios (or "P/S") below 0.9x, you may still consider Shinpoong PharmaceuticalLtd as a stock not worth researching with its 3.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Shinpoong PharmaceuticalLtd

What Does Shinpoong PharmaceuticalLtd's Recent Performance Look Like?

For example, consider that Shinpoong PharmaceuticalLtd's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Shinpoong PharmaceuticalLtd's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Shinpoong PharmaceuticalLtd?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Shinpoong PharmaceuticalLtd's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.3%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

This is in contrast to the rest of the industry, which is expected to grow by 47% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that Shinpoong PharmaceuticalLtd is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does Shinpoong PharmaceuticalLtd's P/S Mean For Investors?

Even after such a strong price drop, Shinpoong PharmaceuticalLtd's P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Shinpoong PharmaceuticalLtd revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Shinpoong PharmaceuticalLtd (1 shouldn't be ignored!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A019170

Shinpoong PharmaceuticalLtd

Manufactures and sells pharmaceutical products in South Korea.

Flawless balance sheet minimal.

Market Insights

Community Narratives