- South Korea

- /

- Pharma

- /

- KOSE:A009420

Risks Still Elevated At These Prices As Hanall Biopharma Co., Ltd. (KRX:009420) Shares Dive 30%

Hanall Biopharma Co., Ltd. (KRX:009420) shares have had a horrible month, losing 30% after a relatively good period beforehand. Longer-term shareholders would now have taken a real hit with the stock declining 5.4% in the last year.

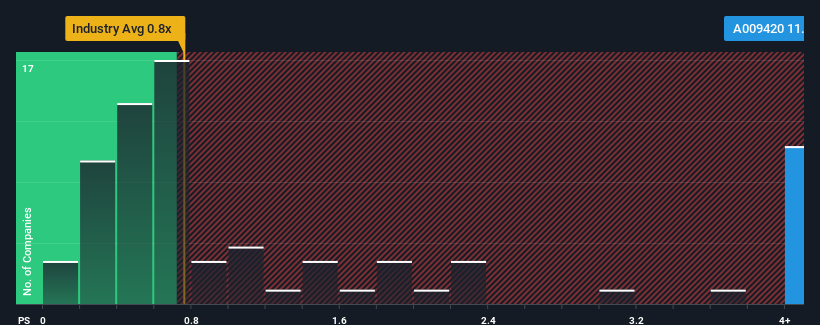

Even after such a large drop in price, given around half the companies in Korea's Pharmaceuticals industry have price-to-sales ratios (or "P/S") below 0.8x, you may still consider Hanall Biopharma as a stock to avoid entirely with its 11.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Hanall Biopharma

How Has Hanall Biopharma Performed Recently?

Hanall Biopharma could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Hanall Biopharma's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

Hanall Biopharma's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Although pleasingly revenue has lifted 36% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Turning to the outlook, the next three years should generate growth of 21% per year as estimated by the seven analysts watching the company. With the industry predicted to deliver 22% growth per annum, the company is positioned for a comparable revenue result.

In light of this, it's curious that Hanall Biopharma's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What We Can Learn From Hanall Biopharma's P/S?

Even after such a strong price drop, Hanall Biopharma's P/S still exceeds the industry median significantly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Hanall Biopharma currently trades on a higher than expected P/S. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

It is also worth noting that we have found 1 warning sign for Hanall Biopharma that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Hanall Biopharma, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hanall Biopharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A009420

Hanall Biopharma

A pharmaceutical company, manufactures and sells pharmaceutical products in South Korea and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives