- South Korea

- /

- Pharma

- /

- KOSE:A009420

Hanall Biopharma Co., Ltd. (KRX:009420) Stocks Pounded By 25% But Not Lagging Industry On Growth Or Pricing

Hanall Biopharma Co., Ltd. (KRX:009420) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 23% share price drop.

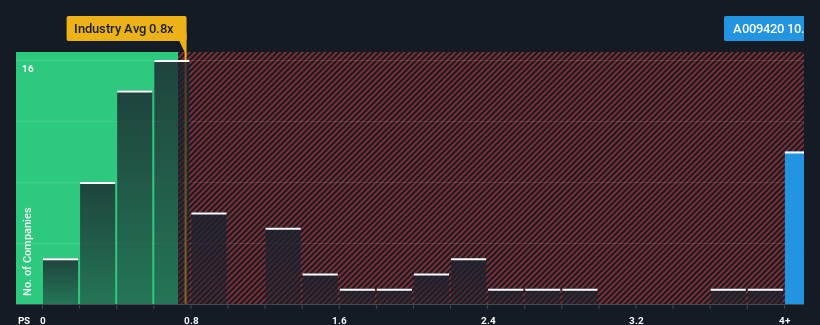

Even after such a large drop in price, when almost half of the companies in Korea's Pharmaceuticals industry have price-to-sales ratios (or "P/S") below 0.8x, you may still consider Hanall Biopharma as a stock not worth researching with its 10.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Hanall Biopharma

What Does Hanall Biopharma's P/S Mean For Shareholders?

Recent times haven't been great for Hanall Biopharma as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Hanall Biopharma's future stacks up against the industry? In that case, our free report is a great place to start.How Is Hanall Biopharma's Revenue Growth Trending?

In order to justify its P/S ratio, Hanall Biopharma would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 3.0%. This was backed up an excellent period prior to see revenue up by 37% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 22% per annum during the coming three years according to the seven analysts following the company. That's shaping up to be materially higher than the 18% per year growth forecast for the broader industry.

In light of this, it's understandable that Hanall Biopharma's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Hanall Biopharma's P/S

Even after such a strong price drop, Hanall Biopharma's P/S still exceeds the industry median significantly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Hanall Biopharma's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 1 warning sign for Hanall Biopharma that we have uncovered.

If these risks are making you reconsider your opinion on Hanall Biopharma, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hanall Biopharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A009420

Hanall Biopharma

A pharmaceutical company, manufactures and sells pharmaceutical products in South Korea and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives