- South Korea

- /

- Pharma

- /

- KOSE:A009290

Did Business Growth Power Kwang Dong Pharmaceutical's (KRX:009290) Share Price Gain of 117%?

While Kwang Dong Pharmaceutical Co., Ltd. (KRX:009290) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 16% in the last quarter. But that doesn't detract from the splendid returns of the last year. We're very pleased to report the share price shot up 117% in that time. So it is important to view the recent reduction in price through that lense. More important, going forward, is how the business itself is going.

View our latest analysis for Kwang Dong Pharmaceutical

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

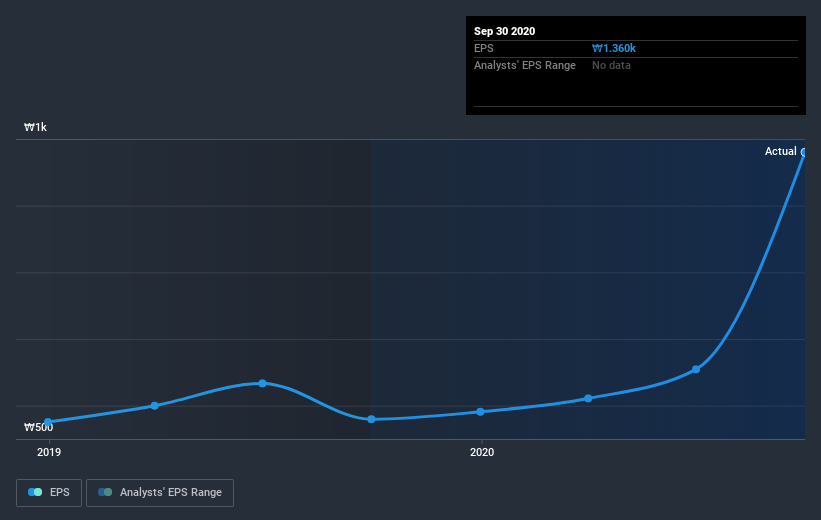

During the last year Kwang Dong Pharmaceutical grew its earnings per share (EPS) by 143%. This EPS growth is significantly higher than the 117% increase in the share price. Therefore, it seems the market isn't as excited about Kwang Dong Pharmaceutical as it was before. This could be an opportunity. This cautious sentiment is reflected in its (fairly low) P/E ratio of 6.29.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Kwang Dong Pharmaceutical's TSR for the last year was 119%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that Kwang Dong Pharmaceutical shareholders have received a total shareholder return of 119% over the last year. That's including the dividend. That certainly beats the loss of about 4% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Kwang Dong Pharmaceutical better, we need to consider many other factors. For instance, we've identified 4 warning signs for Kwang Dong Pharmaceutical (1 is significant) that you should be aware of.

Of course Kwang Dong Pharmaceutical may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade Kwang Dong Pharmaceutical, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Kwang Dong Pharmaceutical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kwang Dong Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A009290

Kwang Dong Pharmaceutical

Operates as a human healthcare provider in South Korea.

Adequate balance sheet and slightly overvalued.