David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Ilyang Pharmaceutical Co.,Ltd (KRX:007570) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Ilyang PharmaceuticalLtd

What Is Ilyang PharmaceuticalLtd's Net Debt?

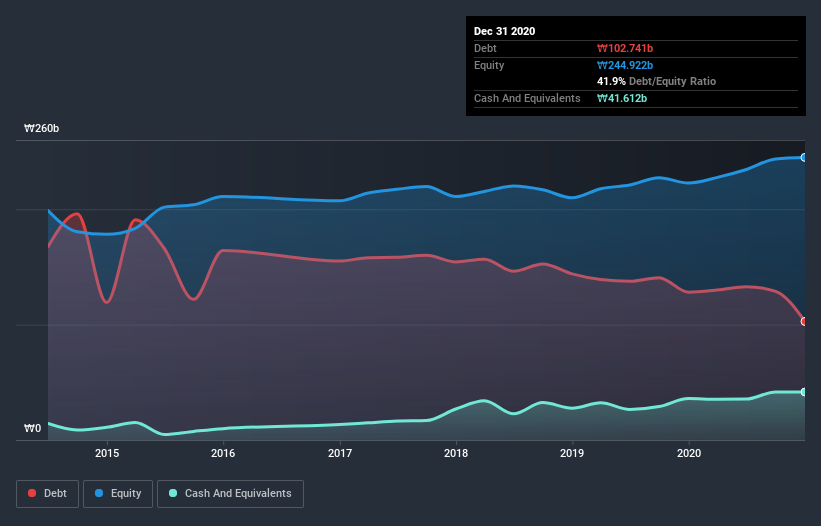

As you can see below, Ilyang PharmaceuticalLtd had ₩102.7b of debt at December 2020, down from ₩128.1b a year prior. However, it does have ₩41.6b in cash offsetting this, leading to net debt of about ₩61.1b.

How Healthy Is Ilyang PharmaceuticalLtd's Balance Sheet?

We can see from the most recent balance sheet that Ilyang PharmaceuticalLtd had liabilities of ₩177.1b falling due within a year, and liabilities of ₩17.0b due beyond that. On the other hand, it had cash of ₩41.6b and ₩64.9b worth of receivables due within a year. So its liabilities total ₩87.6b more than the combination of its cash and short-term receivables.

Of course, Ilyang PharmaceuticalLtd has a market capitalization of ₩599.9b, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Ilyang PharmaceuticalLtd has a low net debt to EBITDA ratio of only 1.3. And its EBIT covers its interest expense a whopping 13.6 times over. So we're pretty relaxed about its super-conservative use of debt. The good news is that Ilyang PharmaceuticalLtd has increased its EBIT by 5.0% over twelve months, which should ease any concerns about debt repayment. When analysing debt levels, the balance sheet is the obvious place to start. But it is Ilyang PharmaceuticalLtd's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Ilyang PharmaceuticalLtd generated free cash flow amounting to a very robust 88% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Our View

The good news is that Ilyang PharmaceuticalLtd's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. And that's just the beginning of the good news since its conversion of EBIT to free cash flow is also very heartening. Looking at the bigger picture, we think Ilyang PharmaceuticalLtd's use of debt seems quite reasonable and we're not concerned about it. After all, sensible leverage can boost returns on equity. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Be aware that Ilyang PharmaceuticalLtd is showing 2 warning signs in our investment analysis , you should know about...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade Ilyang PharmaceuticalLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A007570

Ilyang PharmaceuticalLtd

Operates as a pharmaceutical company primarily in South Korea.

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives