Amidst a backdrop of global market volatility driven by tariff uncertainties and mixed economic indicators, the S&P 500 has shown resilience despite a slight decline. As investors navigate these complex conditions, identifying high growth tech stocks with strong fundamentals and innovative potential becomes crucial for those looking to capitalize on emerging opportunities in this dynamic sector.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1214 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

GC Biopharma (KOSE:A006280)

Simply Wall St Growth Rating: ★★★★☆☆

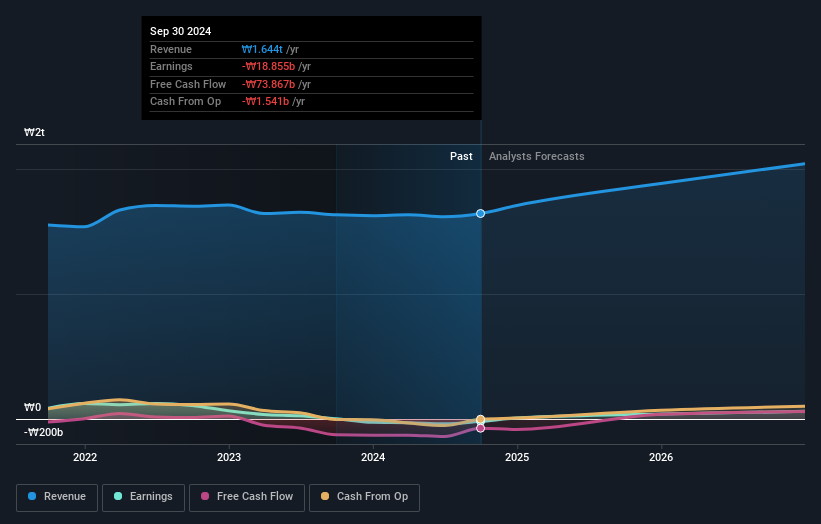

Overview: GC Biopharma Corp. is a biopharmaceutical company engaged in the development and sale of pharmaceutical drugs both in South Korea and internationally, with a market cap of ₩1.56 trillion.

Operations: GC Biopharma focuses on the manufacturing and sales of pharmaceuticals, contributing significantly to its revenue at ₩1.50 trillion. The company also engages in diagnosis and analysis of samples, generating ₩208.75 billion in revenue.

GC Biopharma has recently expanded its market reach with ALYGLO™, now available through Advanced Infusion Care for treating primary immunodeficiency in adults, reflecting a strategic move to enhance patient access and care continuity. Despite a challenging financial landscape marked by unprofitability and revenue growth (9.6% annually) that barely outpaces the market average (9.1%), the company is poised for significant transformations. Notably, its R&D endeavors are robust, as evidenced by the launch of 'GC1130A' in clinical trials for Sanfillippo syndrome—a potential breakthrough therapy underscoring GC Biopharma's commitment to addressing critical unmet medical needs. The firm's forward-looking strategy is further exemplified by an anticipated profit surge, with earnings expected to grow 105.63% annually, positioning it favorably for future profitability and sector leadership in biotechnology innovations.

- Delve into the full analysis health report here for a deeper understanding of GC Biopharma.

Examine GC Biopharma's past performance report to understand how it has performed in the past.

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★★★

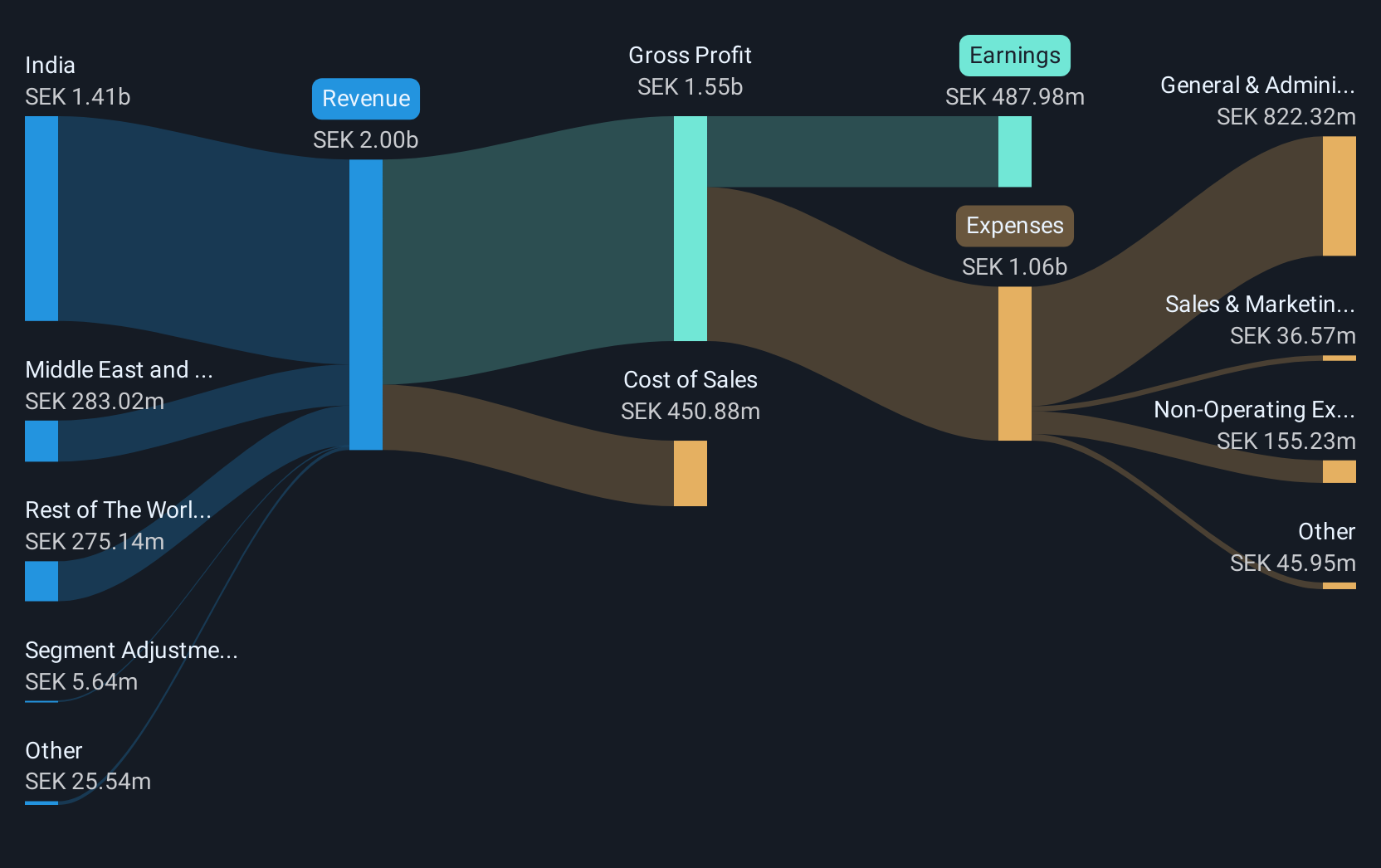

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and internationally, with a market cap of approximately SEK23.60 billion.

Operations: The company generates revenue primarily from its communications software segment, which accounted for SEK1.78 billion. The business focuses on providing mobile caller ID applications to a diverse international market.

Truecaller's recent innovations and strategic partnerships underscore its commitment to enhancing user experience and security in communication. The company has launched a significant update for iPhone users, introducing real-time caller ID and automated spam blocking, leveraging Apple's Live Caller ID Lookup framework with advanced encryption technologies. This move is expected to boost Truecaller's subscription revenues significantly, especially as iOS users represent 7% of its 435 million MAUs. Additionally, Truecaller's collaboration with Nawy aims to improve customer engagement in the real estate sector by ensuring secure and transparent communications through verified business caller IDs. With these advancements, Truecaller not only enhances its service offerings but also solidifies its position in the tech ecosystem by addressing key user concerns around privacy and communication efficiency.

- Dive into the specifics of Truecaller here with our thorough health report.

Gain insights into Truecaller's past trends and performance with our Past report.

ALSO Holding (SWX:ALSN)

Simply Wall St Growth Rating: ★★★★☆☆

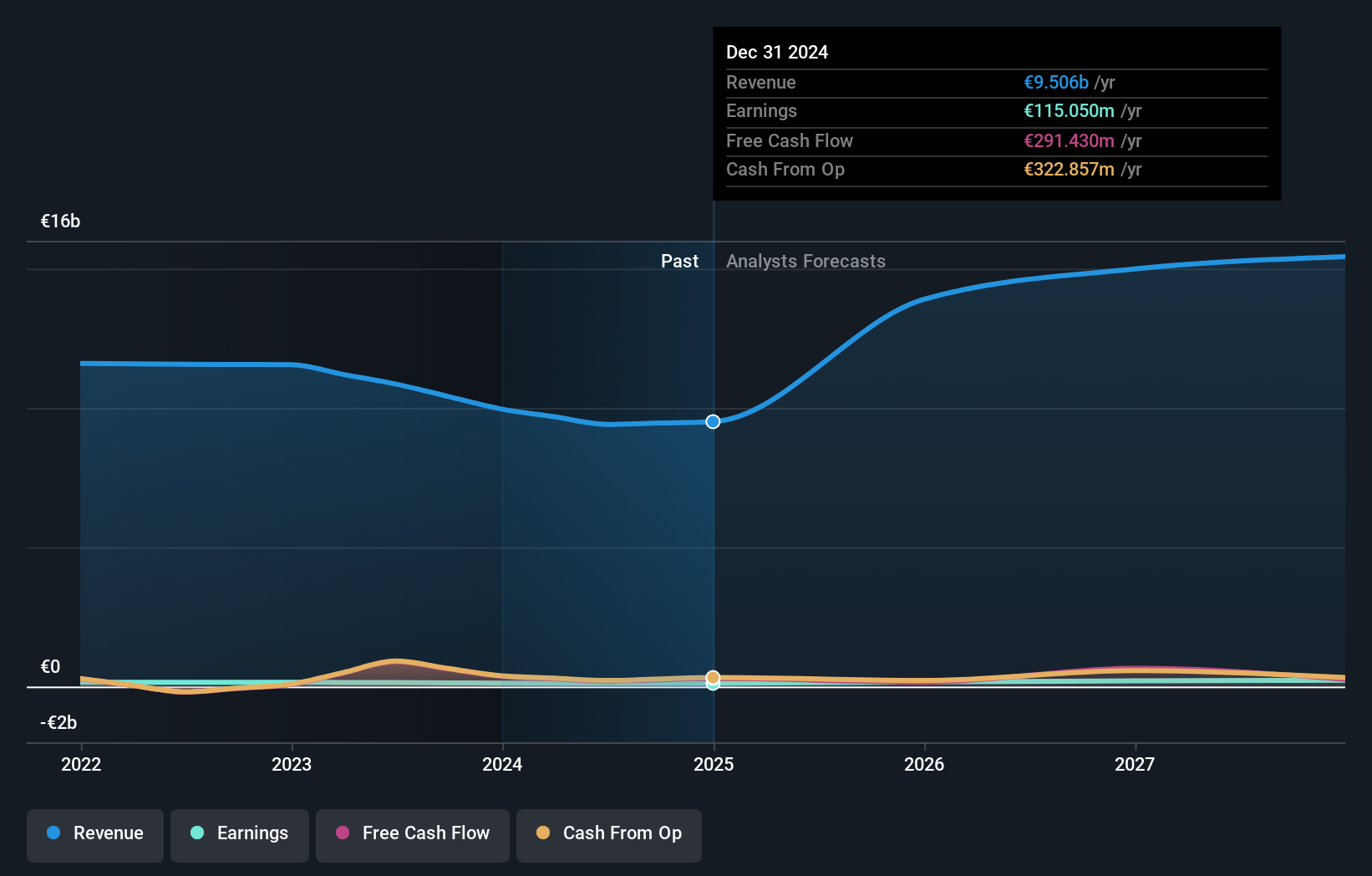

Overview: ALSO Holding AG is a technology services provider for the ICT industry, operating in Switzerland, Germany, the Netherlands, Poland, and internationally with a market cap of CHF3.13 billion.

Operations: The company generates revenue primarily from its operations in Central Europe (€4.62 billion) and Northern/Eastern Europe (€5.24 billion). The business focuses on providing technology services within the ICT industry across multiple regions, leveraging a diverse geographical presence to drive its income streams.

ALSO Holding's strategic focus on enhancing operational efficiency through IT investments has resulted in a robust system landscape, marked by the implementation of 35 SAP R/3 systems and the ongoing transition to SAP S/4HANA. This shift not only promises scalability and improved automation but also supports ALSO's revenue growth, expected at 10% annually, outpacing the Swiss market's 4.3%. Moreover, ALSO's earnings are projected to surge by 26.4% yearly, significantly above the market average of 11.6%. The integration of AI and advanced analytics into its operations further positions ALSO to optimize sales processes and enhance productivity across its expansive network, ensuring it remains competitive in a rapidly evolving tech landscape.

- Get an in-depth perspective on ALSO Holding's performance by reading our health report here.

Review our historical performance report to gain insights into ALSO Holding's's past performance.

Make It Happen

- Get an in-depth perspective on all 1214 High Growth Tech and AI Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Truecaller might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TRUE B

Truecaller

Develops and publishes mobile caller ID applications for individuals and business in India, the Middle East, Africa, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives