- South Korea

- /

- Building

- /

- KOSE:A009450

Uncovering Hidden South Korean Gems And 2 Other Promising Small Caps With Strong Potential

Reviewed by Simply Wall St

The South Korean market has climbed 4.0% in the last 7 days, though it remained flat over the past year. With earnings forecasted to grow by 28% annually, identifying promising small-cap stocks with strong potential can be a strategic move for investors looking to capitalize on this growth trajectory.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Korea Airport ServiceLtd | NA | 0.40% | 27.17% | ★★★★★★ |

| NOROO PAINT & COATINGS | 17.16% | 5.11% | 6.31% | ★★★★★★ |

| Korea Cast Iron Pipe Ind | NA | 2.58% | 14.14% | ★★★★★★ |

| Woori Technology Investment | NA | 22.60% | -1.67% | ★★★★★★ |

| Kyungdong Invest | 8.15% | 3.08% | 15.07% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 59.19% | 3.54% | 5.92% | ★★★★★★ |

| SELVAS Healthcare | 13.58% | 10.16% | 77.14% | ★★★★★★ |

| Hansae Yes24 Holdings | 97.82% | 2.74% | 18.89% | ★★★★★☆ |

| KG Chemical | 43.62% | 33.46% | 8.39% | ★★★★★☆ |

| Ubiquoss Holdings | 2.69% | 9.93% | 14.22% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Creative & Innovative System (KOSDAQ:A222080)

Simply Wall St Value Rating: ★★★★★☆

Overview: Creative & Innovative System Corporation manufactures and sells equipment for lithium-ion batteries used in IT instruments, EV lithium-ion batteries, fuel cells, solar cells, and displays with a market cap of ₩758.18 billion.

Operations: Creative & Innovative System Corporation generates revenue primarily from the sale of machinery and industrial equipment, totaling ₩378.93 billion. The company has a market cap of ₩758.18 billion.

Creative & Innovative System has shown impressive growth, with earnings surging 417.1% over the past year, outpacing the Machinery industry's -3.5%. The company’s debt to equity ratio improved significantly from 49% to 6.6% over five years. Interest payments on its debt are well covered by EBIT at a staggering 1153.9x coverage, indicating strong financial health. However, shareholder dilution occurred in the past year, which might be a point of concern for potential investors.

Daewoong (KOSE:A003090)

Simply Wall St Value Rating: ★★★★★★

Overview: Daewoong Co., Ltd., together with its subsidiaries, engages in the manufacture and sale of pharmaceuticals in South Korea and has a market cap of ₩936.40 billion.

Operations: Revenue primarily comes from pharmaceutical manufacturing and sales, generating ₩1.98 trillion, followed by service provision at ₩120.70 billion and real estate rental at ₩11.88 billion.

Daewoong, a promising player in the South Korean market, has shown impressive earnings growth of 23.6% annually over the past five years. The company's debt to equity ratio improved from 39.7% to 32.2%, reflecting better financial health. Recent announcements revealed first-quarter sales at KRW 7,781 million compared to KRW 4,986 million last year; however, net income decreased to KRW 21,104 million from KRW 38,430 million previously.

- Get an in-depth perspective on Daewoong's performance by reading our health report here.

Review our historical performance report to gain insights into Daewoong's's past performance.

Kyung Dong Navien (KOSE:A009450)

Simply Wall St Value Rating: ★★★★★★

Overview: Kyung Dong Navien Co., Ltd. manufactures and sells machinery and heat combustion equipment in South Korea, with a market cap of ₩966.90 billion.

Operations: Kyung Dong Navien generates revenue primarily from the sale of machinery and heat combustion equipment. The company has a market cap of ₩966.90 billion.

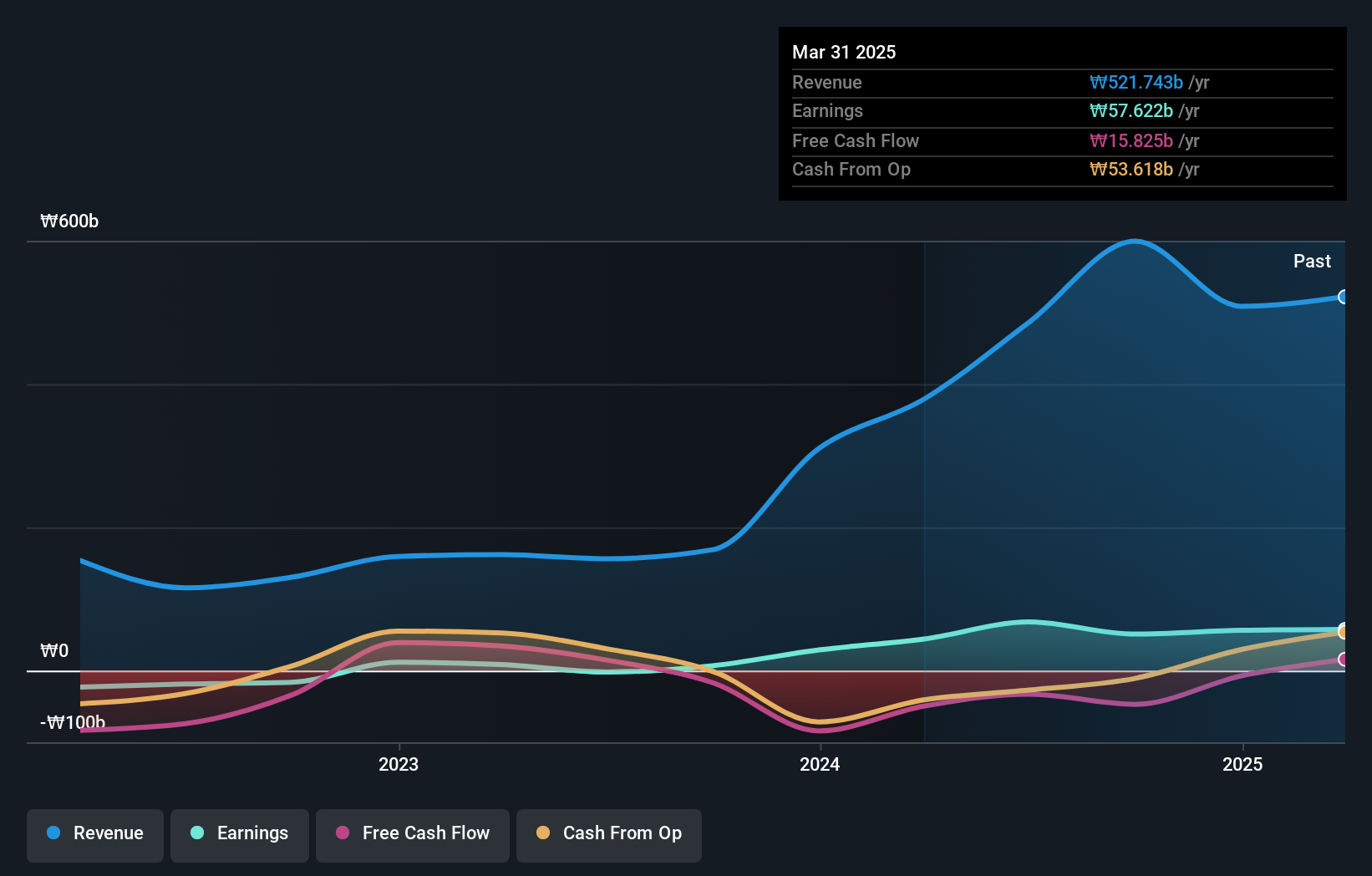

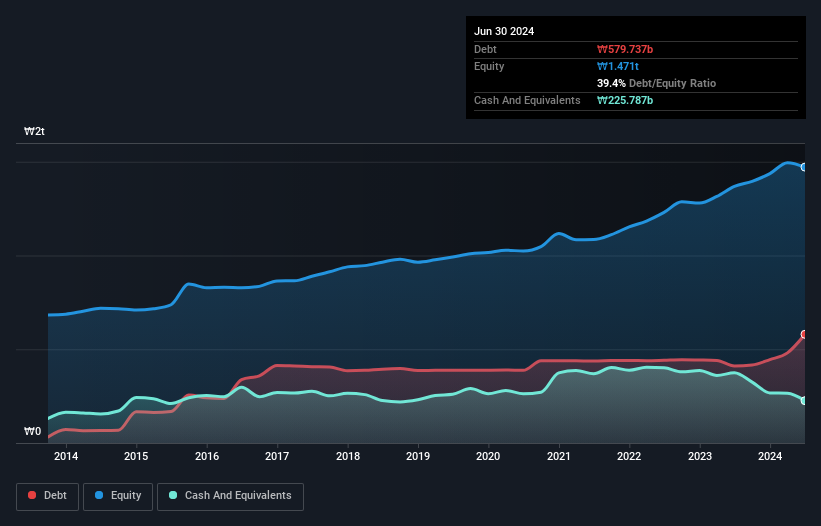

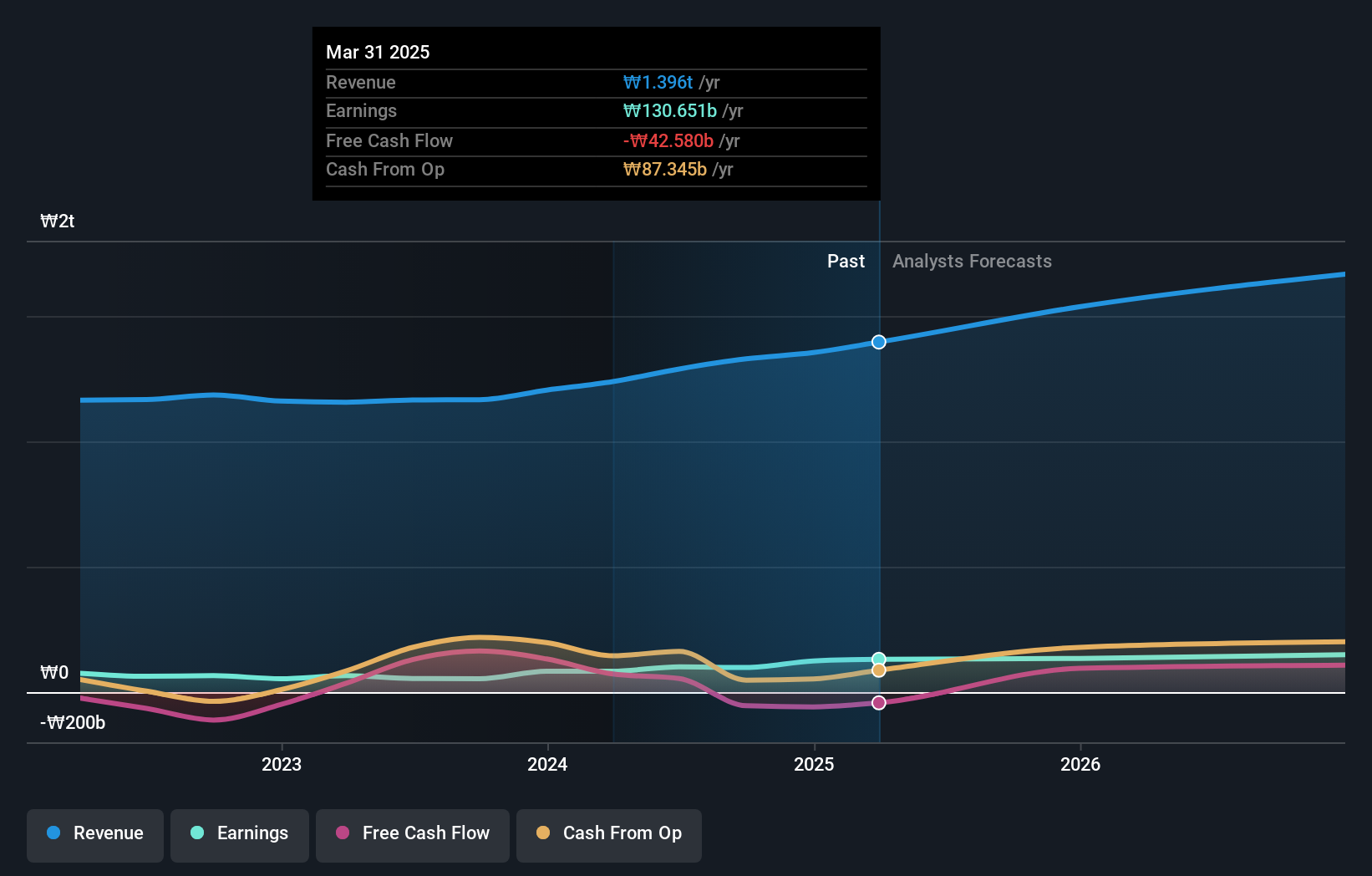

Kyung Dong Navien, a standout in South Korea's heating solutions market, has seen its earnings grow by 27.8% over the past year, outpacing the industry average of 16.2%. The company's debt to equity ratio improved from 41.6% to 27% over five years, demonstrating prudent financial management. With a price-to-earnings ratio of 11.6x compared to the KR market's 11.7x and net debt to equity at a satisfactory 1.9%, Kyung Dong Navien appears well-positioned for continued stability and growth.

- Take a closer look at Kyung Dong Navien's potential here in our health report.

Gain insights into Kyung Dong Navien's past trends and performance with our Past report.

Seize The Opportunity

- Get an in-depth perspective on all 202 KRX Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyung Dong Navien might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A009450

Kyung Dong Navien

Manufactures and sells machinery and heat combustion equipment in South Korea.

Flawless balance sheet with proven track record.