- China

- /

- Hospitality

- /

- SHSE:605108

Asian Growth Stocks With Strong Insider Ownership Lead The Pack

Reviewed by Simply Wall St

Amid heightened global trade tensions and economic uncertainty, Asian markets have experienced significant volatility, with many indices reflecting the impact of recent tariff announcements. In this challenging environment, growth companies in Asia with strong insider ownership can offer a unique advantage as they often demonstrate resilience and alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Jiayou International LogisticsLtd (SHSE:603871) | 19.3% | 27.3% |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 24.7% |

| AcrelLtd (SZSE:300286) | 40% | 32% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.7% | 24.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 39.9% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Synspective (TSE:290A) | 13.2% | 44.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 74.7% |

Let's uncover some gems from our specialized screener.

Dong-A Socio Holdings (KOSE:A000640)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dong-A Socio Holdings Co., Ltd. operates in the pharmaceutical industry in South Korea through its subsidiaries and has a market capitalization of approximately ₩635.45 billion.

Operations: Dong-A Socio Holdings Co., Ltd., through its subsidiaries, focuses on the pharmaceutical sector in South Korea.

Insider Ownership: 29.8%

Dong-A Socio Holdings shows potential as a growth company with significant insider ownership. Its earnings are forecast to grow significantly at 36% annually, outpacing the KR market. The company's Price-To-Earnings ratio of 11x is attractive compared to the industry average, suggesting good relative value. However, revenue growth is slower than desired at 8.5% annually and debt coverage by operating cash flow remains a concern. Recent earnings showed stable net income despite increased sales to KRW 507 billion for 2024.

- Delve into the full analysis future growth report here for a deeper understanding of Dong-A Socio Holdings.

- The analysis detailed in our Dong-A Socio Holdings valuation report hints at an deflated share price compared to its estimated value.

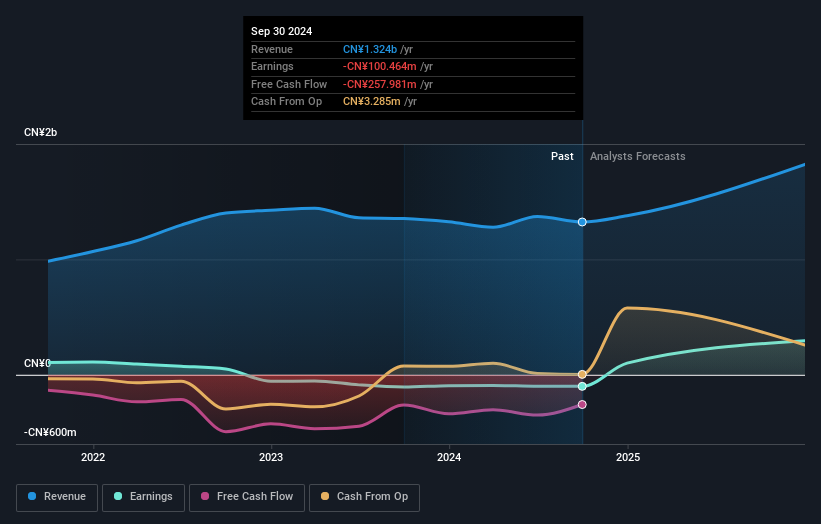

Tianyang New Materials (Shanghai) Technology (SHSE:603330)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Tianyang New Materials (Shanghai) Technology Co., Ltd. operates in the materials technology sector and has a market cap of CN¥3.49 billion.

Operations: Tianyang New Materials (Shanghai) Technology Co., Ltd. does not have specific revenue segment data available in the provided text.

Insider Ownership: 35.9%

Tianyang New Materials (Shanghai) Technology is poised for substantial growth, with revenue expected to increase by 27.4% annually, surpassing the CN market average. Earnings are forecast to grow significantly at 170.04% per year, indicating a shift towards profitability within three years. Despite this promising outlook, dividend sustainability remains questionable due to insufficient earnings coverage. No recent insider trading activity was reported over the past three months, and an extraordinary shareholders meeting is scheduled for March 2025.

- Click here to discover the nuances of Tianyang New Materials (Shanghai) Technology with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Tianyang New Materials (Shanghai) Technology's share price might be too optimistic.

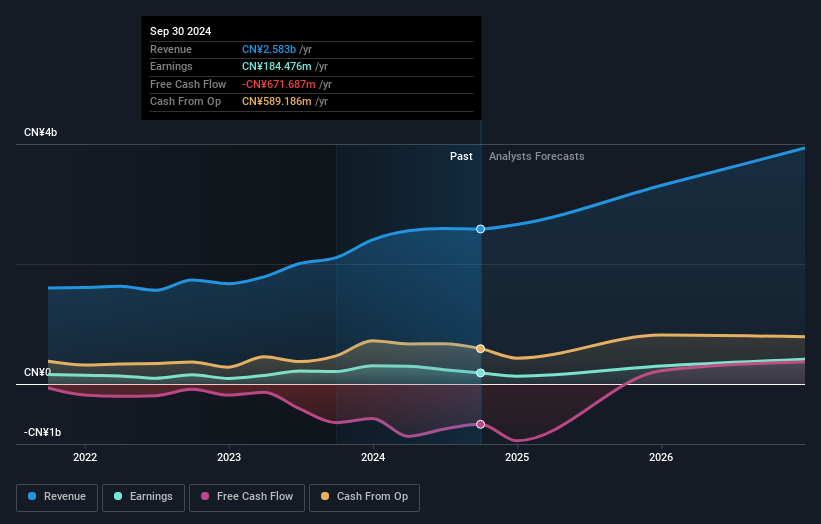

Tongqinglou Catering (SHSE:605108)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tongqinglou Catering Co., Ltd. provides catering services in China and has a market cap of CN¥5.29 billion.

Operations: Tongqinglou Catering Co., Ltd.'s revenue is primarily derived from its catering services in China.

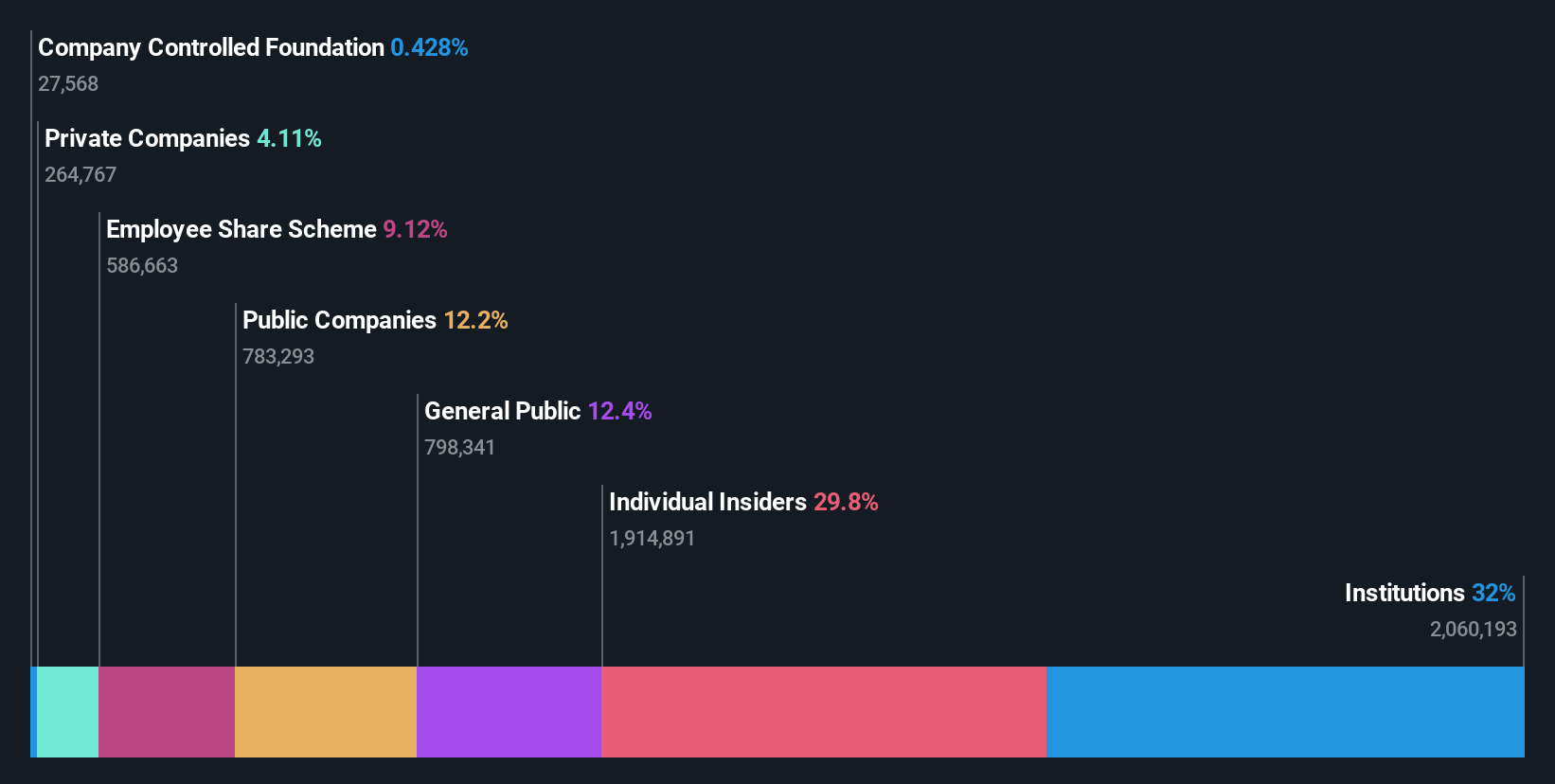

Insider Ownership: 24.5%

Tongqinglou Catering is positioned for robust growth, with earnings projected to rise 44.9% annually, outpacing the CN market's 23.9%. Despite high debt levels and a dividend yield of 2.01% not well covered by cash flows, the stock trades at a significant discount to its estimated fair value. Analysts anticipate a price increase of 27.1%, though return on equity is expected to be modest at 13.9%. No insider trading activity reported recently; an extraordinary shareholders meeting is scheduled for March 2025.

- Click here and access our complete growth analysis report to understand the dynamics of Tongqinglou Catering.

- Our comprehensive valuation report raises the possibility that Tongqinglou Catering is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Embark on your investment journey to our 657 Fast Growing Asian Companies With High Insider Ownership selection here.

- Searching for a Fresh Perspective? These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Tongqinglou Catering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605108

Good value with reasonable growth potential.

Market Insights

Community Narratives