- South Korea

- /

- Pharma

- /

- KOSE:A000520

Should You Be Concerned About Samil Pharmaceutical Co.,Ltd's (KRX:000520) ROE?

One of the best investments we can make is in our own knowledge and skill set. With that in mind, this article will work through how we can use Return On Equity (ROE) to better understand a business. By way of learning-by-doing, we'll look at ROE to gain a better understanding of Samil Pharmaceutical Co.,Ltd (KRX:000520).

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for Samil PharmaceuticalLtd

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Samil PharmaceuticalLtd is:

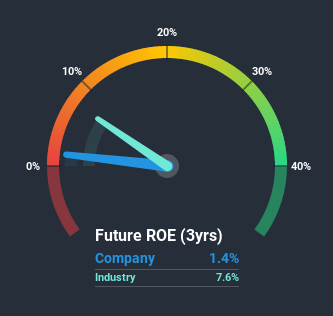

1.4% = ₩940m ÷ ₩66b (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. So, this means that for every ₩1 of its shareholder's investments, the company generates a profit of ₩0.01.

Does Samil PharmaceuticalLtd Have A Good Return On Equity?

Arguably the easiest way to assess company's ROE is to compare it with the average in its industry. However, this method is only useful as a rough check, because companies do differ quite a bit within the same industry classification. As is clear from the image below, Samil PharmaceuticalLtd has a lower ROE than the average (7.6%) in the Pharmaceuticals industry.

Unfortunately, that's sub-optimal. However, a low ROE is not always bad. If the company's debt levels are moderate to low, then there's still a chance that returns can be improved via the use of financial leverage. A company with high debt levels and low ROE is a combination we like to avoid given the risk involved. You can see the 2 risks we have identified for Samil PharmaceuticalLtd by visiting our risks dashboard for free on our platform here.

How Does Debt Impact Return On Equity?

Most companies need money -- from somewhere -- to grow their profits. The cash for investment can come from prior year profits (retained earnings), issuing new shares, or borrowing. In the first and second cases, the ROE will reflect this use of cash for investment in the business. In the latter case, the debt required for growth will boost returns, but will not impact the shareholders' equity. Thus the use of debt can improve ROE, albeit along with extra risk in the case of stormy weather, metaphorically speaking.

Combining Samil PharmaceuticalLtd's Debt And Its 1.4% Return On Equity

Samil PharmaceuticalLtd clearly uses a high amount of debt to boost returns, as it has a debt to equity ratio of 1.41. The combination of a rather low ROE and significant use of debt is not particularly appealing. Debt does bring extra risk, so it's only really worthwhile when a company generates some decent returns from it.

Conclusion

Return on equity is one way we can compare its business quality of different companies. In our books, the highest quality companies have high return on equity, despite low debt. All else being equal, a higher ROE is better.

But ROE is just one piece of a bigger puzzle, since high quality businesses often trade on high multiples of earnings. The rate at which profits are likely to grow, relative to the expectations of profit growth reflected in the current price, must be considered, too. Check the past profit growth by Samil PharmaceuticalLtd by looking at this visualization of past earnings, revenue and cash flow.

Of course Samil PharmaceuticalLtd may not be the best stock to buy. So you may wish to see this free collection of other companies that have high ROE and low debt.

When trading Samil PharmaceuticalLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A000520

Samil PharmaceuticalLtd

Engages in the manufacture and sale of indispensable medicines in South Korea.

Mediocre balance sheet low.

Market Insights

Community Narratives