- South Korea

- /

- Pharma

- /

- KOSE:A000100

Yuhan Corporation's (KRX:000100) P/E Is Still On The Mark Following 26% Share Price Bounce

The Yuhan Corporation (KRX:000100) share price has done very well over the last month, posting an excellent gain of 26%. Looking back a bit further, it's encouraging to see the stock is up 59% in the last year.

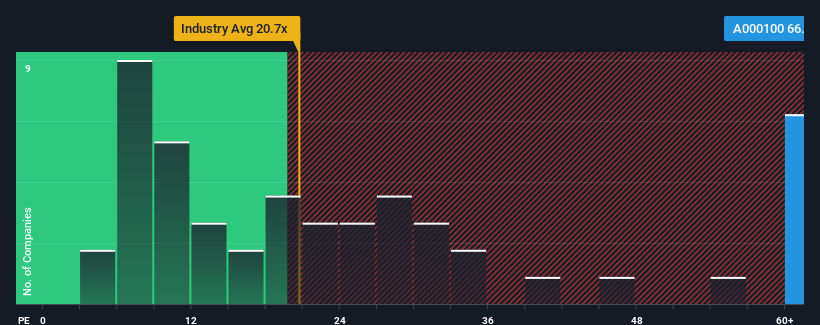

Since its price has surged higher, Yuhan's price-to-earnings (or "P/E") ratio of 66.8x might make it look like a strong sell right now compared to the market in Korea, where around half of the companies have P/E ratios below 14x and even P/E's below 6x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With only a limited decrease in earnings compared to most other companies of late, Yuhan has been doing relatively well. It seems that many are expecting the comparatively superior earnings performance to persist, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price, especially if earnings continue to dissolve.

View our latest analysis for Yuhan

Is There Enough Growth For Yuhan?

Yuhan's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 4.9%. As a result, earnings from three years ago have also fallen 51% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 49% each year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 22% per year, which is noticeably less attractive.

With this information, we can see why Yuhan is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Yuhan's P/E

The strong share price surge has got Yuhan's P/E rushing to great heights as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Yuhan maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Yuhan with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Yuhan, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A000100

Yuhan

Manufactures and sells prescription drugs, over-the-counter drugs, veterinary drugs, and household goods in South Korea and internationally.

Solid track record with excellent balance sheet.