- South Korea

- /

- Biotech

- /

- KOSDAQ:A314130

Positive Sentiment Still Eludes Genome & Company (KOSDAQ:314130) Following 31% Share Price Slump

The Genome & Company (KOSDAQ:314130) share price has fared very poorly over the last month, falling by a substantial 31%. For any long-term shareholders, the last month ends a year to forget by locking in a 54% share price decline.

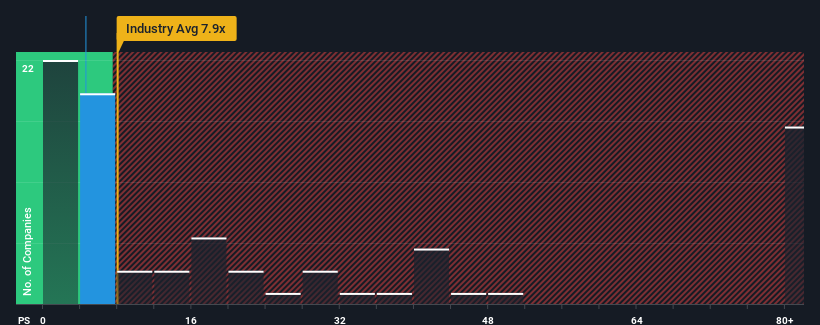

After such a large drop in price, Genome may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 4.6x, considering almost half of all companies in the Biotechs industry in Korea have P/S ratios greater than 7.9x and even P/S higher than 43x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Genome

What Does Genome's P/S Mean For Shareholders?

Genome certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Genome will help you shine a light on its historical performance.How Is Genome's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Genome's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 60%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 41%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's peculiar that Genome's P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On Genome's P/S

Genome's P/S has taken a dip along with its share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We're very surprised to see Genome currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Before you take the next step, you should know about the 3 warning signs for Genome that we have uncovered.

If you're unsure about the strength of Genome's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A314130

Genome

A clinical stage biotechnology company, researches and develops novel-targeted immuno-oncology therapeutics in the field of immuno-oncology, skin diseases, and autism in South Korea.

Excellent balance sheet low.