- South Korea

- /

- Biotech

- /

- KOSDAQ:A314130

Positive Sentiment Still Eludes Genome & Company (KOSDAQ:314130) Following 25% Share Price Slump

Unfortunately for some shareholders, the Genome & Company (KOSDAQ:314130) share price has dived 25% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 74% loss during that time.

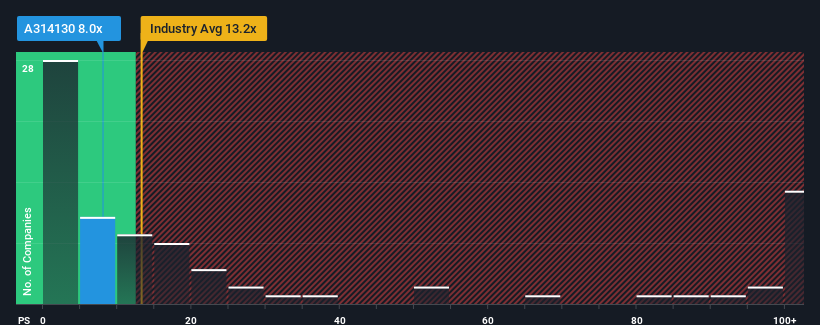

Following the heavy fall in price, Genome may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 8x, since almost half of all companies in the Biotechs industry in Korea have P/S ratios greater than 13.2x and even P/S higher than 50x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Genome

What Does Genome's P/S Mean For Shareholders?

We'd have to say that with no tangible growth over the last year, Genome's revenue has been unimpressive. Perhaps the market believes the recent lacklustre revenue performance is a sign of future underperformance relative to industry peers, hurting the P/S. Those who are bullish on Genome will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Genome, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Genome's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Genome's to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, even though the last 12 months were nothing to write home about. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

This is in contrast to the rest of the industry, which is expected to grow by 33% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Genome is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Genome's recently weak share price has pulled its P/S back below other Biotechs companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We're very surprised to see Genome currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Genome that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Genome, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A314130

Genome

A clinical stage biotechnology company, researches and develops novel-targeted immuno-oncology therapeutics in the field of immuno-oncology, skin diseases, and autism in South Korea.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives