- South Korea

- /

- Biotech

- /

- KOSDAQ:A314130

Investors Still Aren't Entirely Convinced By Genome & Company's (KOSDAQ:314130) Revenues Despite 49% Price Jump

Genome & Company (KOSDAQ:314130) shares have had a really impressive month, gaining 49% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 46% over that time.

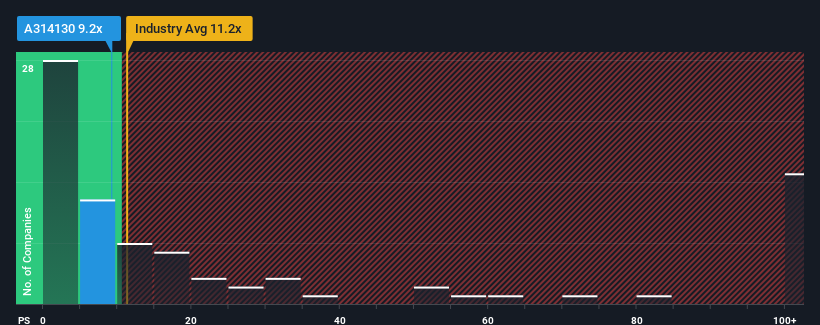

In spite of the firm bounce in price, there still wouldn't be many who think Genome's price-to-sales (or "P/S") ratio of 9.2x is worth a mention when the median P/S in Korea's Biotechs industry is similar at about 11.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Genome

How Genome Has Been Performing

Revenue has risen firmly for Genome recently, which is pleasing to see. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. Those who are bullish on Genome will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Genome will help you shine a light on its historical performance.How Is Genome's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Genome's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 15% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Comparing that to the industry, which is only predicted to deliver 33% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's curious that Genome's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What Does Genome's P/S Mean For Investors?

Genome's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Genome currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

You should always think about risks. Case in point, we've spotted 2 warning signs for Genome you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A314130

Genome

A clinical stage biotechnology company, researches and develops novel-targeted immuno-oncology therapeutics in the field of immuno-oncology, skin diseases, and autism in South Korea.

Excellent balance sheet low.